Region:Middle East

Author(s):Rebecca

Product Code:KRAB5856

Pages:91

Published On:October 2025

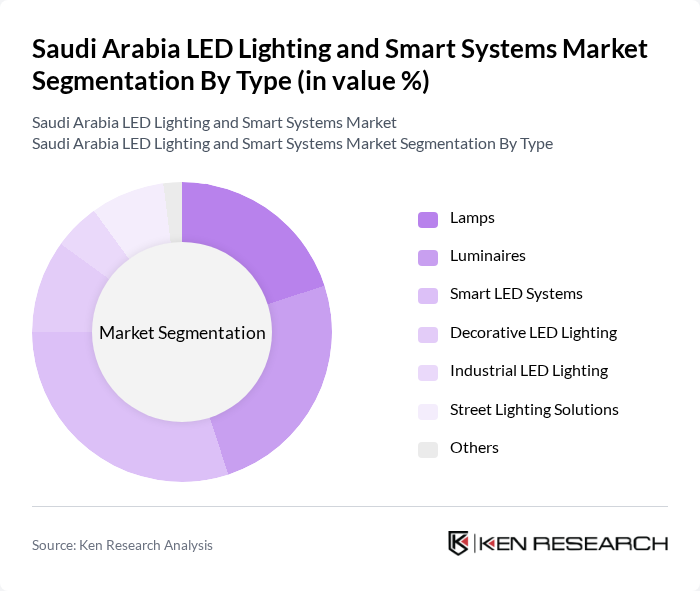

By Type:The market is segmented into various types of lighting solutions, including lamps, luminaires, smart LED systems, decorative LED lighting, industrial LED lighting, street lighting solutions, and others. Among these, smart LED systems are gaining traction due to the increasing integration of IoT technologies in urban infrastructure. The demand for energy-efficient and smart lighting solutions is driving innovation and adoption across commercial, industrial, and residential sectors .

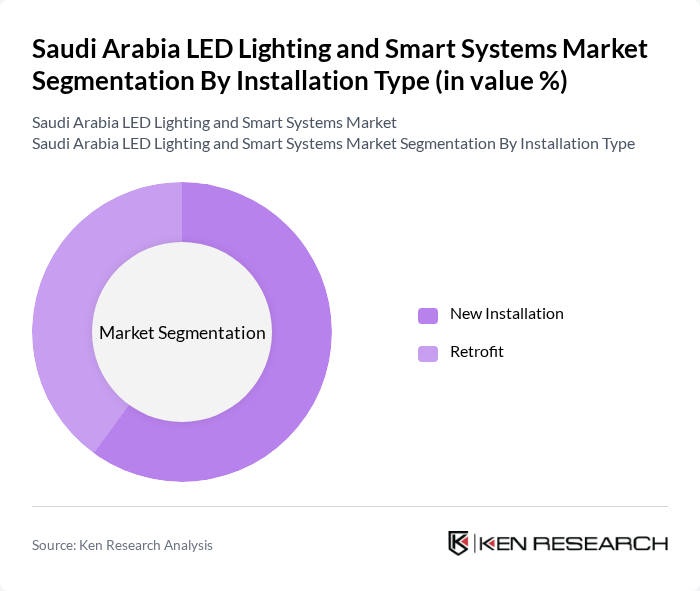

By Installation Type:The market is further segmented into new installations and retrofits. New installations are primarily driven by ongoing urban development projects and the establishment of smart cities, while retrofits are gaining popularity as businesses and municipalities seek to upgrade existing lighting systems to more energy-efficient solutions. The trend towards sustainability and energy savings is propelling both segments forward .

The Saudi Arabia LED Lighting and Smart Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Lighting Company, Alfanar Company, Philips Lighting Saudi Arabia (Signify Saudi Arabia), Osram Middle East, General Electric Company (GE Lighting), Zumtobel Lighting Saudi Arabia, Al Nasser Group, Cinmar Lighting Systems, Huda Lighting, Al AbdulKarim Trading Company, Cooper Lighting Solutions, Cree Lighting, Acuity Brands, Hubbell Lighting, Panasonic Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia LED lighting and smart systems market is poised for significant transformation driven by technological advancements and government initiatives. The integration of IoT and AI in lighting management is expected to enhance operational efficiency and user experience in future. Additionally, the focus on sustainable solutions will likely accelerate the adoption of eco-friendly lighting technologies, aligning with global trends. As urbanization continues, the demand for smart infrastructure will further bolster market growth, creating a dynamic landscape for innovation and investment.

| Segment | Sub-Segments |

|---|---|

| By Type | Lamps Luminaires Smart LED Systems Decorative LED Lighting Industrial LED Lighting Street Lighting Solutions Others |

| By Installation Type | New Installation Retrofit |

| By End-Use Application | Indoor Lighting Outdoor Lighting Smart City Applications Home Automation Commercial Spaces Industrial Facilities Government & Utilities Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Subsidies for LED Adoption Tax Incentives for Smart Systems Grants for Energy Efficiency Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial LED Lighting Adoption | 100 | Facility Managers, Energy Efficiency Consultants |

| Smart Systems Integration in Buildings | 80 | Building Owners, IT Managers |

| Government Energy Efficiency Programs | 60 | Policy Makers, Energy Regulators |

| Residential Smart Lighting Solutions | 90 | Homeowners, Interior Designers |

| Industrial LED Lighting Solutions | 70 | Plant Managers, Operations Directors |

The Saudi Arabia LED Lighting and Smart Systems Market is valued at approximately USD 1.5 billion, driven by the demand for energy-efficient lighting solutions and government initiatives promoting smart city developments.