Italy Online Luxury Bags & Accessories Market Overview

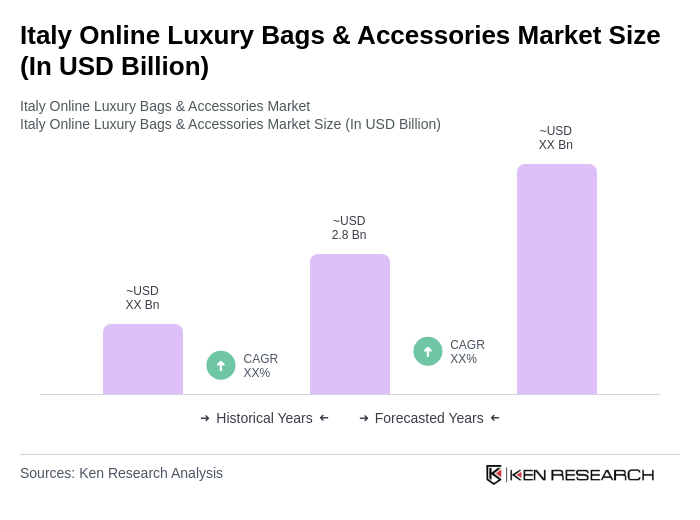

- The Italy Online Luxury Bags & Accessories Market is valued at USD 2.8 billion, based on a five-year historical analysis. This market is supported by rising disposable incomes, a strong cultural affinity for luxury goods, and the rapid expansion of e-commerce platforms that provide consumers with convenient access to high-end products. The sector has experienced a pronounced shift toward online shopping, particularly in the wake of the pandemic, as consumers increasingly prioritize convenience, product variety, and digital engagement. The online retail segment now captures over 30% of luxury handbag sales in Europe, reflecting the growing importance of digital channels in Italy’s luxury sector .

- Key cities such as Milan, Florence, and Rome remain central to the market due to their enduring influence in global fashion and luxury retail. Milan, recognized as Italy’s fashion capital, continues to attract both domestic and international luxury brands. Florence is distinguished for its artisanal leather craftsmanship, while Rome’s rich cultural heritage and luxury shopping districts reinforce its role as a pivotal market hub. These cities collectively shape consumer preferences and drive innovation in the luxury bags and accessories segment .

- The Italian government has enacted sustainability-focused regulations impacting the luxury sector, notably through alignment with the European Union’s Circular Economy Action Plan and the forthcoming Digital Product Passports mandated by the EU’s Ecodesign for Sustainable Products Regulation (ESPR), 2023. These instruments require luxury brands to increase transparency, traceability, and environmental disclosures across their supply chains, encouraging the adoption of eco-friendly materials and sustainable production practices .

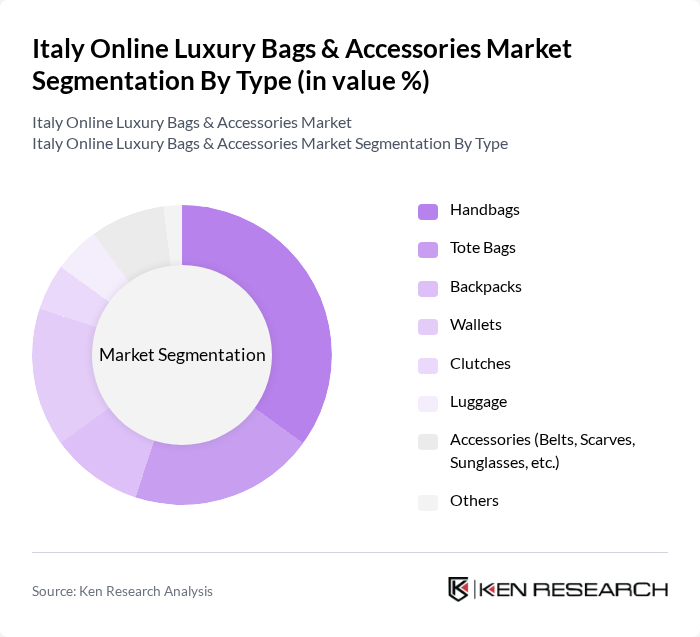

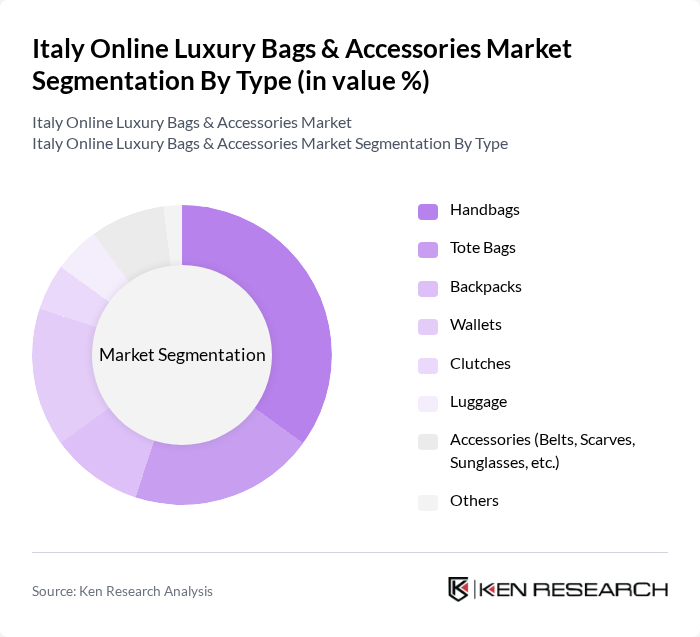

Italy Online Luxury Bags & Accessories Market Segmentation

By Type:The market is segmented into luxury handbags, tote bags, backpacks, wallets, clutches, luggage, and accessories such as belts, scarves, and sunglasses. Handbags and accessories remain the most sought-after categories, prized for their versatility and status appeal. The market is increasingly influenced by demand for premium quality, iconic designer labels, and a marked shift toward sustainable and ethically produced items, as consumers seek transparency and environmental responsibility from luxury brands .

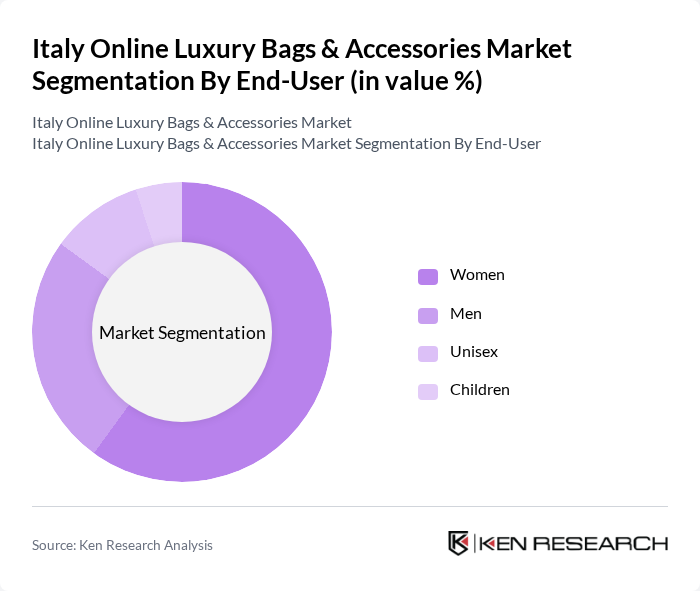

By End-User:The end-user segmentation comprises women, men, unisex, and children. Women constitute the largest segment, reflecting a strong affinity for fashion and luxury items. The men’s segment is expanding, driven by increasing male participation in luxury fashion and the popularity of men’s bags and accessories. Unisex products are gaining momentum, indicative of a broader industry shift toward inclusive and gender-neutral fashion. Children’s luxury accessories remain a niche but emerging category, supported by affluent consumers seeking exclusivity for younger demographics .

Italy Online Luxury Bags & Accessories Market Competitive Landscape

The Italy Online Luxury Bags & Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gucci, Prada, Fendi, Bottega Veneta, Valentino, Dolce & Gabbana, Salvatore Ferragamo, Versace, Tod's, Moschino, Giorgio Armani, Bulgari, Ermenegildo Zegna, Moncler, Missoni, Brioni, Loro Piana, Louis Vuitton, Burberry, Jimmy Choo, Loewe, Celine, Balenciaga contribute to innovation, geographic expansion, and service delivery in this space.

Italy Online Luxury Bags & Accessories Market Industry Analysis

Growth Drivers

- Increasing Disposable Income Among Consumers:The average disposable income in Italy is projected to reach €25,000 per capita in future, reflecting a 3% increase from the previous year. This rise in disposable income enables consumers to allocate more funds towards luxury goods, including high-end bags and accessories. As more Italians enter higher income brackets, the purchasing power for luxury items is expected to grow, driving demand in the online luxury segment significantly.

- Rising Demand for Luxury Fashion Items:The luxury fashion market in Italy is anticipated to grow to €11 billion in future, driven by a cultural shift towards premium products. This demand is fueled by a younger demographic increasingly valuing brand prestige and quality. The trend is evident as luxury brands report a 15% increase in online sales, indicating a robust appetite for high-end fashion items among Italian consumers, particularly in the online space.

- Growth of E-commerce Platforms:E-commerce sales in Italy are expected to reach €38 billion in future, with luxury goods accounting for a significant portion. The convenience of online shopping, coupled with improved logistics and delivery services, has made it easier for consumers to purchase luxury bags and accessories. This shift is supported by a 20% increase in online luxury sales, highlighting the growing importance of digital channels in the luxury market landscape.

Market Challenges

- Intense Competition Among Luxury Brands:The Italian luxury market is characterized by fierce competition, with over 200 established brands vying for market share. This saturation leads to aggressive marketing strategies and price wars, which can erode profit margins. In future, it is estimated that the top five luxury brands will account for 40% of total sales, intensifying the pressure on smaller brands to differentiate themselves in a crowded marketplace.

- Counterfeit Products Affecting Brand Integrity:The counterfeit luxury goods market in Italy is valued at approximately €7 billion, posing a significant threat to brand integrity. Counterfeit products not only undermine consumer trust but also impact legitimate sales. In future, it is projected that 30% of luxury consumers will encounter counterfeit items online, prompting brands to invest heavily in anti-counterfeiting measures and consumer education to protect their reputations.

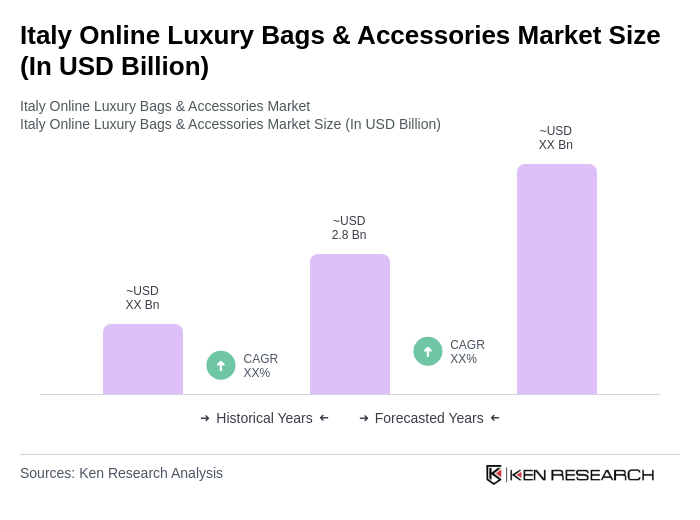

Italy Online Luxury Bags & Accessories Market Future Outlook

The future of the online luxury bags and accessories market in Italy appears promising, driven by evolving consumer preferences and technological advancements. As disposable incomes rise and e-commerce continues to flourish, brands are likely to enhance their online presence. Additionally, the integration of innovative technologies, such as augmented reality, will further enrich the shopping experience. Sustainability will also play a crucial role, as consumers increasingly seek ethically sourced luxury products, shaping the market landscape in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Italian luxury brands have a significant opportunity to expand into emerging markets, particularly in Asia and South America. With a combined population of over 2 billion and a growing middle class, these regions present untapped potential for luxury sales, which could increase revenues by an estimated €3 billion in future.

- Development of Sustainable Luxury Products:The demand for sustainable luxury products is on the rise, with 60% of consumers willing to pay more for eco-friendly items. By investing in sustainable materials and ethical production practices, brands can attract environmentally conscious consumers, potentially increasing market share and enhancing brand loyalty in a competitive landscape.