Italy Online Luxury Resale Platforms Market Overview

- The Italy Online Luxury Resale Platforms Market is valued at approximately USD 2.75 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing consumer preference for sustainable fashion, the rise of digital marketplaces, and the growing acceptance of pre-owned luxury goods among younger demographics. The market has seen a significant shift as consumers seek value, authenticity, and environmental responsibility in luxury purchases. The adoption of online platforms and mobile apps, particularly among Gen Z and millennial consumers, has accelerated the expansion of the market, with authentication and quality assurance processes further boosting consumer confidence .

- Key cities dominating this market include Milan, Rome, and Florence. Milan, as a global fashion capital, attracts a high concentration of luxury consumers and brands, while Rome and Florence contribute with their rich cultural heritage and tourism, enhancing the demand for luxury items. The presence of numerous luxury boutiques, flagship stores, and internationally recognized fashion events in these cities further solidifies their dominance in the online luxury resale market .

- In 2023, the Italian government strengthened consumer protection in online transactions for luxury goods through the implementation of the Legislative Decree No. 26/2023, issued by the Ministry of Enterprises and Made in Italy. This regulation mandates clear information disclosure, authentication procedures, and enhanced measures against counterfeit goods for online sales platforms, ensuring that consumers receive genuine products and reinforcing trust in the online luxury resale market .

Italy Online Luxury Resale Platforms Market Segmentation

By Product Category:The product category segmentation includes various luxury items that are popular in the resale market. The subsegments are Handbags, Clothing, Footwear, Accessories (including belts, scarves, sunglasses), Jewelry, Watches, Small Leather Goods, and Others (e.g., homeware, collectibles). Among these, Handbags and Clothing are the leading subsegments, driven by high consumer demand, brand loyalty, and strong resale value. Handbags, in particular, maintain robust resale prices and are frequently sought after by both collectors and value-conscious buyers .

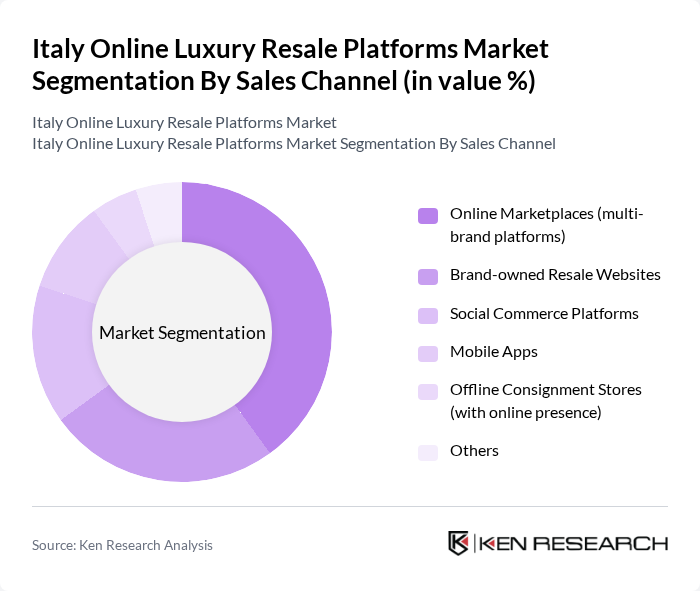

By Sales Channel:The sales channel segmentation includes Online Marketplaces (multi-brand platforms), Brand-owned Resale Websites, Social Commerce Platforms, Mobile Apps, Offline Consignment Stores (with online presence), and Others. Online Marketplaces are the dominant channel, offering a wide assortment of products and attracting a large customer base. Brand-owned resale websites are gaining traction as luxury brands seek to manage their secondary markets and foster customer loyalty. Social commerce and mobile apps are also experiencing strong growth, driven by younger, digitally native consumers .

Italy Online Luxury Resale Platforms Market Competitive Landscape

The Italy Online Luxury Resale Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vestiaire Collective, The RealReal, Rebelle, Lampoo, Depop, eBay, Catawiki, Chrono24, Farfetch Second Life, Vinted, Grailed, Sellier Knightsbridge, StockX, Luxury Garage Sale, 1stDibs contribute to innovation, geographic expansion, and service delivery in this space.

Italy Online Luxury Resale Platforms Market Industry Analysis

Growth Drivers

- Increasing Consumer Interest in Sustainable Fashion:The Italian luxury resale market is experiencing a surge in consumer interest in sustainable fashion, with 75% of consumers indicating a preference for eco-friendly products. According to the Italian National Institute of Statistics, the sustainable fashion sector is projected to grow by €1.8 billion in future. This shift is driven by heightened awareness of environmental issues, prompting consumers to seek out pre-owned luxury items as a more sustainable alternative to fast fashion.

- Rise of Digital Marketplaces:The proliferation of digital marketplaces has significantly transformed the luxury resale landscape in Italy. In future, e-commerce sales in the luxury sector are expected to reach €10 billion, with online platforms accounting for 35% of total luxury sales. This growth is fueled by increased internet penetration, with approximately 90% of Italians now online, facilitating easier access to luxury resale platforms and enhancing consumer engagement through digital channels.

- Growing Acceptance of Pre-Owned Luxury Goods:The acceptance of pre-owned luxury goods is on the rise, with a 65% increase in consumer purchases of second-hand luxury items reported in future. This trend is supported by a shift in consumer attitudes, with 60% of luxury shoppers in Italy now viewing pre-owned items as a viable alternative. The growing acceptance is further bolstered by the increasing availability of authenticated resale platforms, enhancing consumer confidence in purchasing pre-owned luxury goods.

Market Challenges

- Concerns Over Authenticity and Quality:One of the primary challenges facing the Italian online luxury resale market is consumer concerns regarding the authenticity and quality of pre-owned items. A survey conducted by the Italian Chamber of Commerce revealed that 45% of potential buyers hesitate to purchase due to fears of counterfeit products. This skepticism can hinder market growth, as consumers prioritize assurance of authenticity when investing in luxury goods.

- Intense Competition Among Platforms:The online luxury resale market in Italy is characterized by intense competition, with over 60 platforms vying for market share. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. According to industry reports, the top five platforms account for 75% of the market, leaving smaller players struggling to differentiate themselves and attract a loyal customer base.

Italy Online Luxury Resale Platforms Market Future Outlook

The future of the Italian online luxury resale market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, platforms that emphasize eco-friendly practices are likely to thrive. Additionally, the integration of advanced technologies, such as AI for personalized shopping experiences, will enhance customer engagement. The market is expected to adapt to changing regulations and consumer demands, positioning itself for sustained growth in the coming years.

Market Opportunities

- Expansion into Emerging Markets:There is significant potential for Italian luxury resale platforms to expand into emerging markets, particularly in Asia and South America. With a growing middle class and increasing disposable income, these regions present lucrative opportunities for luxury resale. The World Bank projects GDP growth in emerging markets to remain robust, with many Asian and South American economies experiencing growth rates above global averages. This indicates a rising demand for luxury goods, including pre-owned items.

- Collaborations with Luxury Brands:Collaborating with established luxury brands can create new avenues for growth in the resale market. Partnerships can enhance brand credibility and attract a broader customer base. In future, it is estimated that collaborations could increase sales by up to €600 million, as luxury brands seek to tap into the growing demand for sustainable and pre-owned products, aligning with consumer values.