Region:Europe

Author(s):Dev

Product Code:KRAB4293

Pages:88

Published On:October 2025

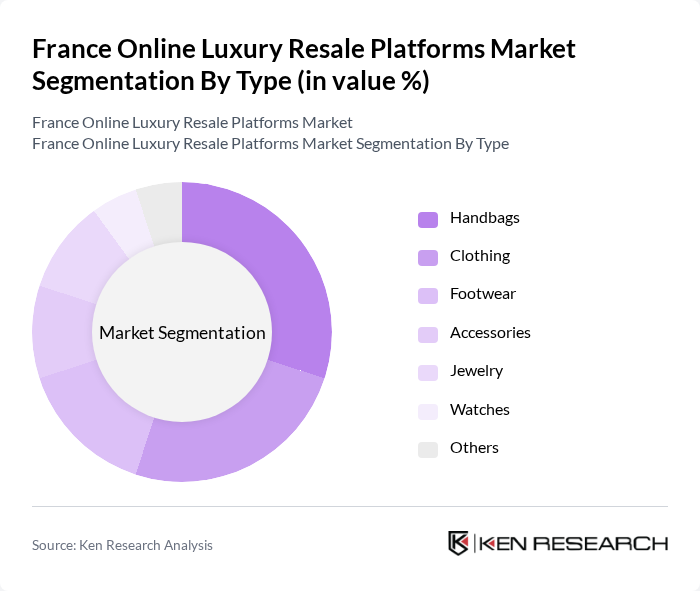

By Type:The market is segmented into various types, including Handbags, Clothing, Footwear, Accessories, Jewelry, Watches, and Others. Among these, Handbags and Clothing are the most popular categories, driven by consumer demand for high-quality, branded items at a lower price point compared to new products. The trend towards sustainable fashion has also led to increased interest in pre-owned items, particularly in these segments.

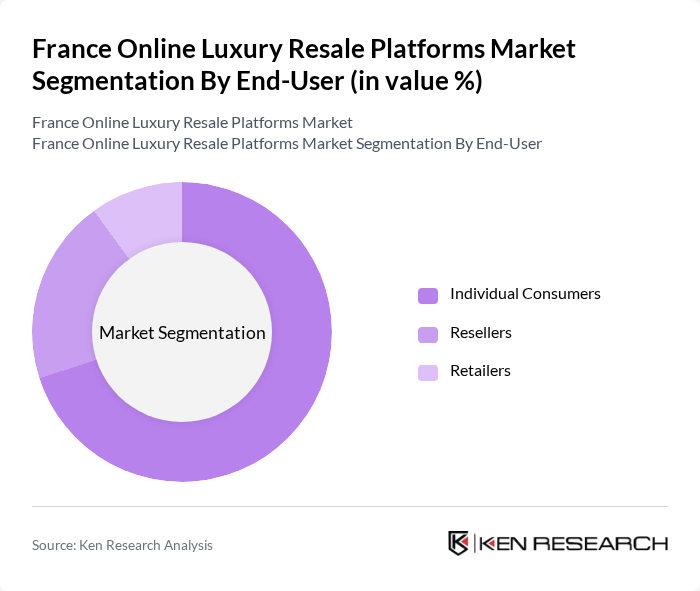

By End-User:The market is segmented into Individual Consumers, Resellers, and Retailers. Individual Consumers dominate the market, as they are increasingly turning to online platforms to purchase luxury items at more affordable prices. The trend of personalizing luxury purchases and the desire for unique items have led to a surge in individual consumer participation in the resale market.

The France Online Luxury Resale Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vestiaire Collective, The RealReal, Poshmark, Depop, Grailed, Rebag, Farfetch, eBay, Luxury Garage Sale, ThredUp, 1stdibs, Tradesy, Catawiki, Chrono24, and StockX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online luxury resale market in France appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, platforms that emphasize eco-friendly practices are likely to thrive. Additionally, the integration of advanced technologies, such as AI for personalized shopping experiences, will enhance customer engagement. The market is expected to adapt to these trends, fostering innovation and collaboration with luxury brands to meet the growing demand for pre-owned goods.

| Segment | Sub-Segments |

|---|---|

| By Type | Handbags Clothing Footwear Accessories Jewelry Watches Others |

| By End-User | Individual Consumers Resellers Retailers |

| By Sales Channel | Online Marketplaces Brand-owned Websites Social Media Platforms |

| By Price Range | Under €500 €500 - €1000 €1000 - €2000 Above €2000 |

| By Condition | New Like New Used |

| By Brand | Luxury Brands Designer Brands High-Street Brands |

| By Region | Île-de-France Provence-Alpes-Côte d'Azur Auvergne-Rhône-Alpes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Resale | 150 | Fashion Enthusiasts, Online Shoppers |

| Designer Handbags Market | 100 | Luxury Brand Consumers, Resale Platform Users |

| High-End Footwear Resale | 80 | Shoe Collectors, Fashion Influencers |

| Luxury Accessories Segment | 70 | Accessory Buyers, Trend Analysts |

| Consumer Attitudes Towards Resale | 120 | General Consumers, Sustainability Advocates |

The France Online Luxury Resale Platforms Market is valued at approximately EUR 1.5 billion, reflecting a significant growth trend driven by consumer preferences for sustainable fashion and the increasing acceptance of pre-owned luxury goods.