Region:Asia

Author(s):Dev

Product Code:KRAB3634

Pages:91

Published On:October 2025

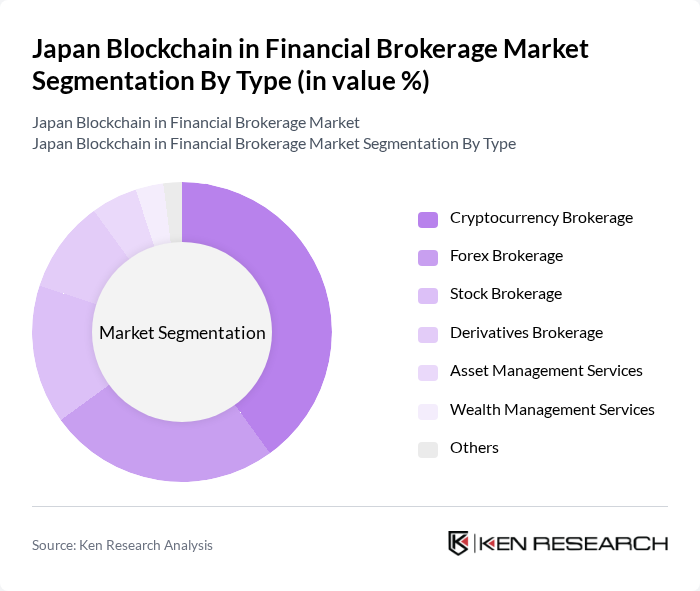

By Type:The market is segmented into various types, including Cryptocurrency Brokerage, Forex Brokerage, Stock Brokerage, Derivatives Brokerage, Asset Management Services, Wealth Management Services, and Others. Among these, Cryptocurrency Brokerage is currently the leading segment, driven by the increasing popularity of digital currencies and the growing number of retail and institutional investors entering the market. The demand for secure and efficient trading platforms has also contributed to the growth of this segment.

By End-User:The end-user segmentation includes Retail Investors, Institutional Investors, Financial Institutions, and Hedge Funds. Retail Investors dominate this segment, driven by the increasing accessibility of trading platforms and the growing interest in cryptocurrencies. The rise of mobile trading applications has made it easier for individual investors to participate in the market, further boosting this segment's growth.

The Japan Blockchain in Financial Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as SBI Holdings, Inc., Rakuten Securities, Inc., Monex Group, Inc., GMO Financial Holdings, Inc., Bitflyer, Inc., DMM Bitcoin, Inc., Coincheck, Inc., Fisco Cryptocurrency Exchange, Liquid Group, Inc., Bittrex Japan, Inc., Huobi Japan, Inc., Zaif Exchange, bitbank, Inc., OKCoin Japan, Crypto Garage, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the blockchain market in Japan's financial brokerage sector appears promising, driven by technological advancements and increasing investor interest. As more financial institutions adopt blockchain solutions, the market is likely to see enhanced operational efficiencies and reduced transaction costs. Additionally, the growing trend of digital asset trading and the development of decentralized finance (DeFi) platforms are expected to create new avenues for growth, attracting both institutional and retail investors to the blockchain ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Cryptocurrency Brokerage Forex Brokerage Stock Brokerage Derivatives Brokerage Asset Management Services Wealth Management Services Others |

| By End-User | Retail Investors Institutional Investors Financial Institutions Hedge Funds |

| By Application | Trading Platforms Payment Solutions Investment Management Compliance and Reporting |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions |

| By Regulatory Compliance | KYC Compliance AML Compliance Data Protection Regulations |

| By Investment Size | Small Investments Medium Investments Large Investments |

| By Policy Support | Government Grants Tax Incentives Regulatory Sandboxes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Brokerage Firms | 100 | CEOs, CTOs, Compliance Officers |

| Blockchain Technology Providers | 80 | Product Managers, Business Development Leads |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Fintech Startups | 70 | Founders, Innovation Officers |

| Investment Analysts | 60 | Market Analysts, Financial Advisors |

The Japan Blockchain in Financial Brokerage Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of blockchain technology in financial services, increased cryptocurrency trading, and demand for innovative financial products.