Region:Asia

Author(s):Rebecca

Product Code:KRAD0294

Pages:98

Published On:August 2025

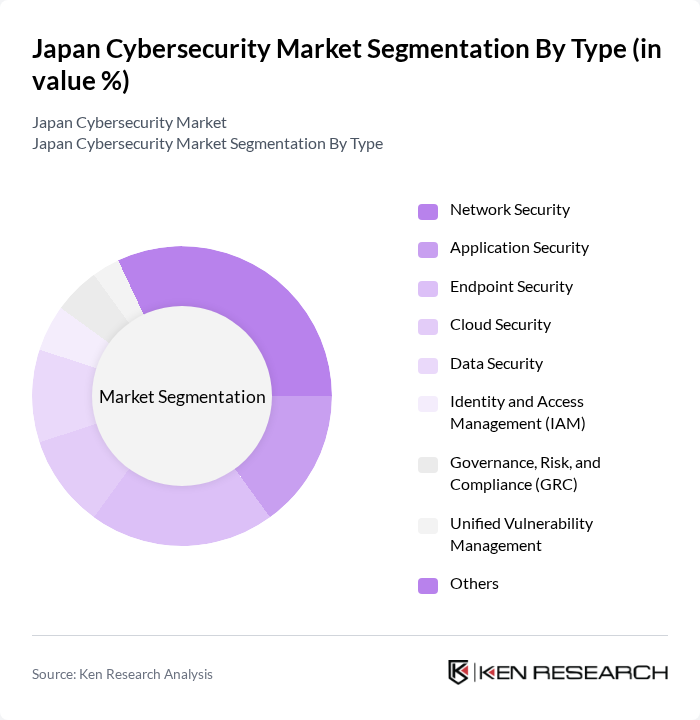

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management (IAM), Governance, Risk, and Compliance (GRC), Unified Vulnerability Management, and Others. Each of these sub-segments plays a crucial role in addressing specific security challenges faced by organizations. Network Security and Endpoint Security remain the largest segments, driven by the need to protect expanding digital infrastructures and the proliferation of connected devices. Cloud Security and IAM are experiencing rapid adoption due to increased cloud migration and the shift toward zero-trust architectures .

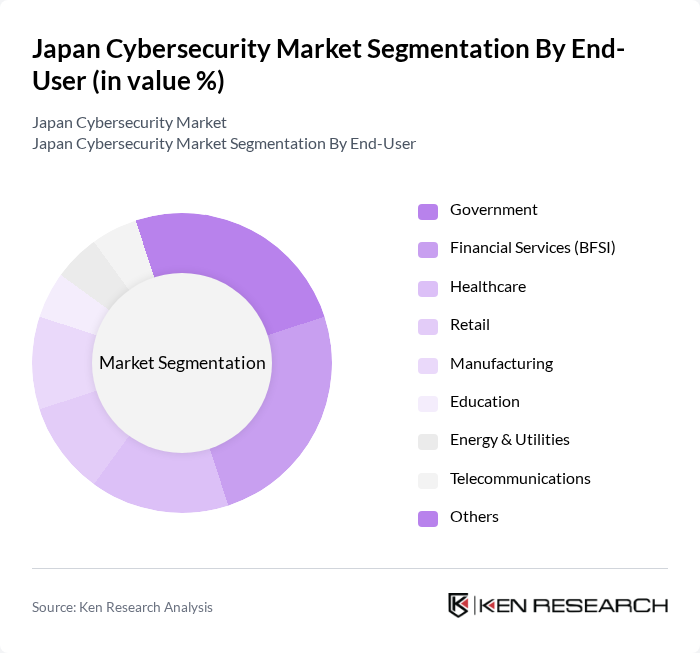

By End-User:The end-user segmentation includes Government, Financial Services (BFSI), Healthcare, Retail, Manufacturing, Education, Energy & Utilities, Telecommunications, and Others. Each sector has unique cybersecurity needs based on the sensitivity of the data they handle and the regulatory requirements they must comply with. The Financial Services and Government sectors are the largest end-users, reflecting stringent compliance mandates and the critical nature of their data. Healthcare and Manufacturing are also rapidly increasing cybersecurity investments due to the rise in targeted attacks and digital transformation initiatives .

The Japan Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as NEC Corporation, Fujitsu Limited, Trend Micro Incorporated, NTT Security Corporation, Hitachi Systems, Ltd., CyberAgent, Inc., SoftBank Corp., Cisco Systems, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., IBM Japan, Ltd., McAfee Corp., Kaspersky Lab, Microsoft Japan Co., Ltd., FFRI Security, Inc., Cyber Security Cloud, Inc., LAC Co., Ltd., SCSK Corporation, IIJ (Internet Initiative Japan Inc.), Digital Arts Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity market in Japan appears promising, driven by increasing investments in technology and a heightened focus on data protection. As organizations adapt to the evolving threat landscape, the integration of artificial intelligence and machine learning into security protocols will become more prevalent. Additionally, the growing emphasis on compliance with international standards will further propel the demand for innovative cybersecurity solutions, ensuring that businesses remain resilient against cyber threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management (IAM) Governance, Risk, and Compliance (GRC) Unified Vulnerability Management Others |

| By End-User | Government Financial Services (BFSI) Healthcare Retail Manufacturing Education Energy & Utilities Telecommunications Others |

| By Industry Vertical | Banking, Financial Services, and Insurance (BFSI) Telecommunications Energy and Utilities Transportation and Logistics Government and Defense Healthcare Manufacturing Retail & E-commerce Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Security Services (MSS) Professional Services (Risk Assessment, Penetration Testing, Compliance Mapping) Training and Education Incident Response & Forensics |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium/Trial-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 100 | IT Security Managers, Compliance Officers |

| Healthcare Cybersecurity Solutions | 60 | Chief Information Officers, Data Protection Officers |

| Manufacturing Cybersecurity Practices | 50 | Operations Managers, IT Directors |

| Government Cybersecurity Initiatives | 40 | Policy Makers, Cybersecurity Analysts |

| Retail Sector Cybersecurity Measures | 70 | Security Analysts, IT Managers |

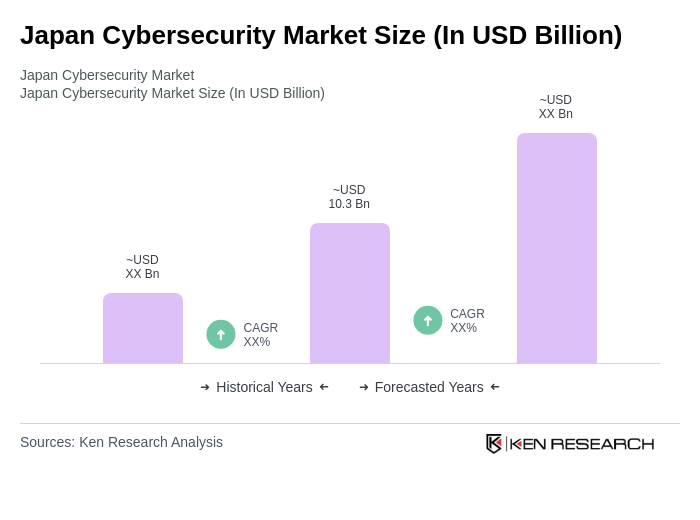

The Japan Cybersecurity Market is valued at approximately USD 10.3 billion, reflecting significant growth driven by increasing cyber threats, digital technology adoption, and heightened data privacy awareness among consumers and businesses.