Region:Europe

Author(s):Rebecca

Product Code:KRAB6400

Pages:98

Published On:October 2025

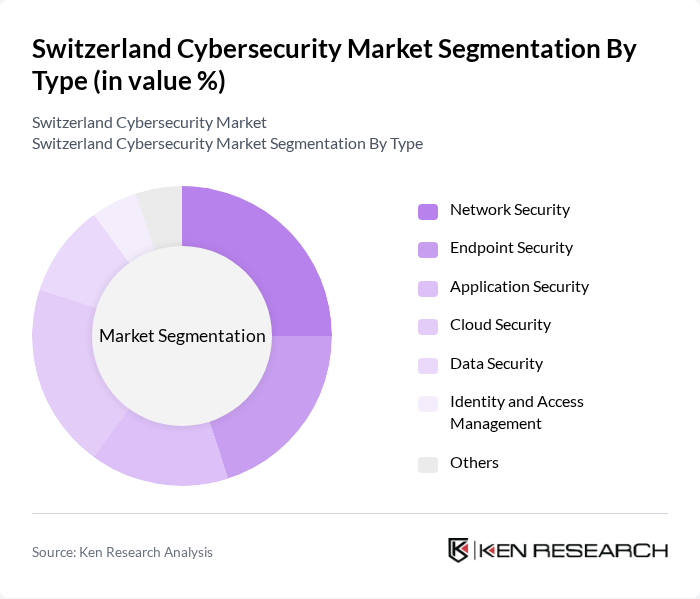

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these segments plays a crucial role in addressing specific security challenges faced by organizations.

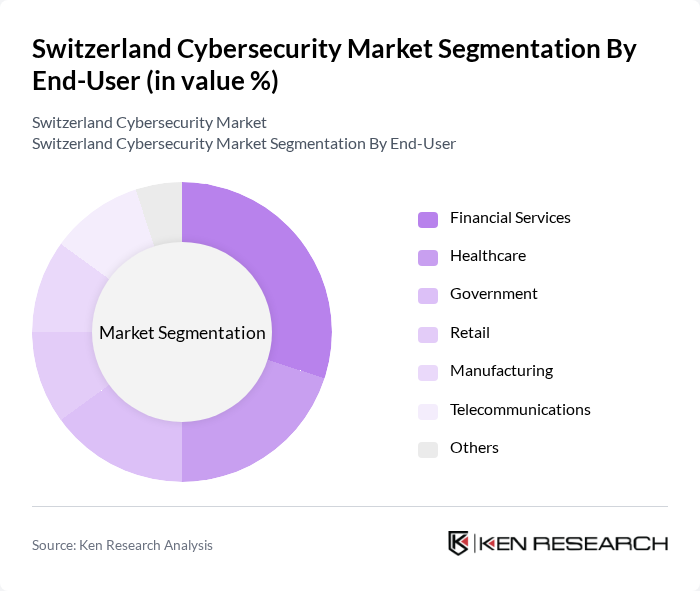

By End-User:The end-user segmentation includes Financial Services, Healthcare, Government, Retail, Manufacturing, Telecommunications, and Others. Each sector has unique cybersecurity needs driven by regulatory requirements and the sensitivity of the data they handle.

The Switzerland Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swiss Cyber Security, Kudelski Security, Securosys, Swisscom, PwC Switzerland, Deloitte Switzerland, EY Switzerland, KPMG Switzerland, Infoguard, NEXUS, Sumo Logic, Check Point Software Technologies, Fortinet, Palo Alto Networks, and IBM Security contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Swiss cybersecurity market is poised for significant evolution, driven by technological advancements and increasing awareness of cyber risks. As organizations continue to embrace digital transformation, the demand for innovative security solutions will rise. Additionally, the integration of artificial intelligence and machine learning in cybersecurity practices is expected to enhance threat detection and response capabilities, making systems more resilient against evolving cyber threats. This dynamic environment will foster collaboration between public and private sectors to strengthen national cybersecurity infrastructure.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Financial Services Healthcare Government Retail Manufacturing Telecommunications Others |

| By Industry Vertical | BFSI Energy and Utilities Transportation and Logistics Education Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Services Training and Education Incident Response Services |

| By Region | Zurich Geneva Basel Bern Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 100 | IT Security Managers, Compliance Officers |

| Healthcare Cybersecurity Solutions | 80 | Chief Information Officers, Data Protection Officers |

| Manufacturing Cybersecurity Practices | 70 | Operations Managers, IT Directors |

| Government Cybersecurity Initiatives | 60 | Policy Makers, Cybersecurity Analysts |

| SME Cybersecurity Awareness | 90 | Business Owners, IT Consultants |

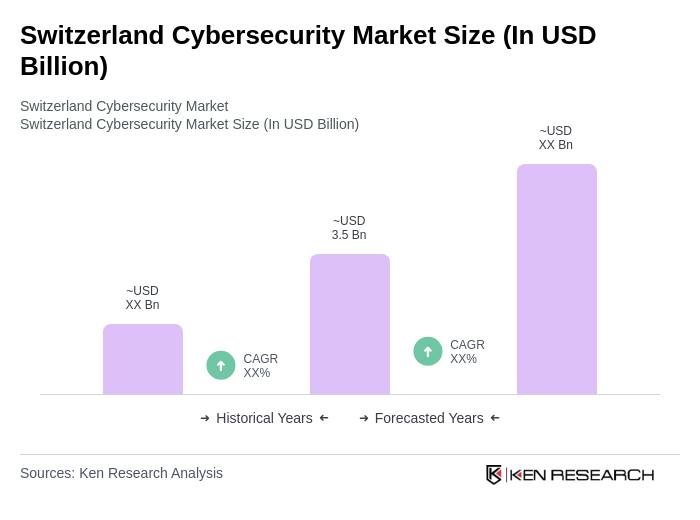

The Switzerland Cybersecurity Market is valued at approximately USD 3.5 billion, reflecting a significant increase driven by rising cyber threats, digital technology adoption, and heightened awareness of data privacy regulations among businesses and consumers.