Region:Middle East

Author(s):Shubham

Product Code:KRAB6275

Pages:90

Published On:October 2025

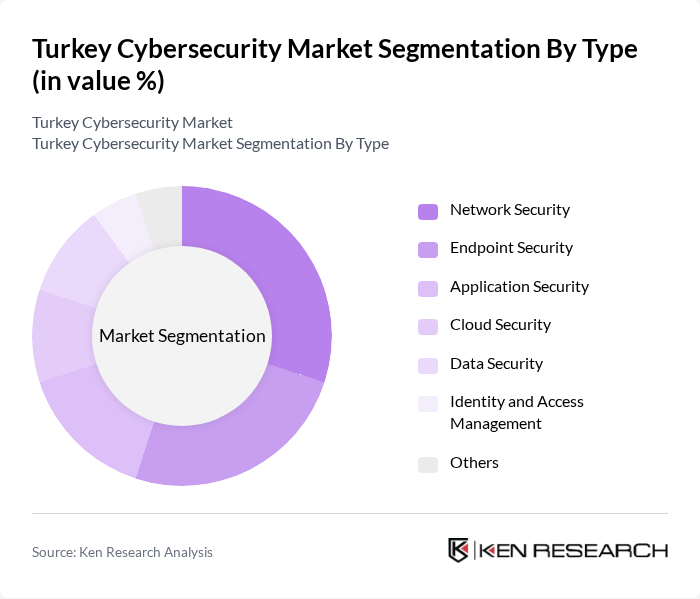

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these segments plays a crucial role in addressing specific security challenges faced by organizations.

The leading subsegment in the Turkey Cybersecurity Market is Network Security, which accounts for 30% of the market share. This dominance is attributed to the increasing number of cyber threats targeting network infrastructures, prompting organizations to invest in advanced network security solutions. The growing trend of remote work and the rise of IoT devices have further amplified the need for robust network security measures to protect sensitive data and maintain operational integrity.

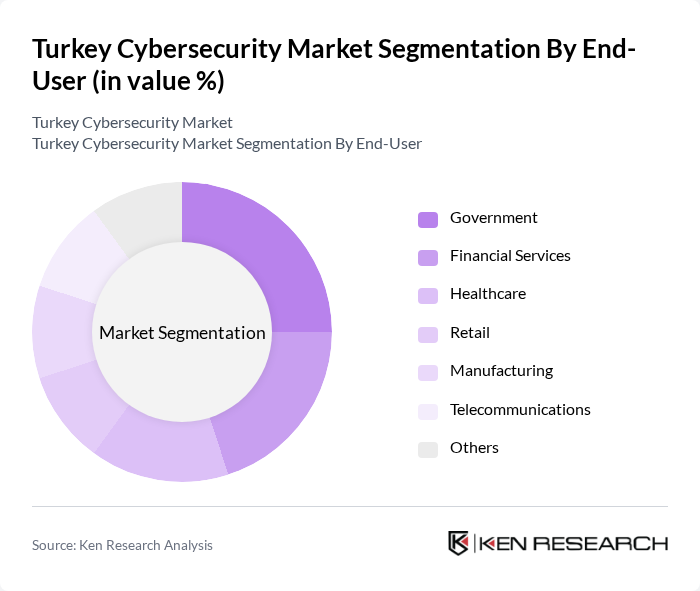

By End-User:The market is segmented by end-users, including Government, Financial Services, Healthcare, Retail, Manufacturing, Telecommunications, and Others. Each sector has unique cybersecurity needs based on the sensitivity of the data they handle and the regulatory requirements they must comply with.

In the end-user segmentation, the Government sector leads with a 25% market share. This is due to the government's critical role in national security and the increasing focus on protecting sensitive data from cyber threats. The implementation of regulations such as the KVKK has further driven government agencies to enhance their cybersecurity frameworks, resulting in significant investments in cybersecurity solutions.

The Turkey Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kaspersky Lab, Trend Micro, Fortinet, Check Point Software Technologies, Palo Alto Networks, Cisco Systems, McAfee, IBM Security, Symantec (Broadcom), ESET, FireEye, Sophos, Trend Micro, Bitdefender, CyberArk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkish cybersecurity market appears promising, driven by increasing investments in technology and a growing emphasis on data protection. As organizations continue to embrace digital transformation, the demand for innovative cybersecurity solutions will likely rise. Furthermore, the integration of artificial intelligence and machine learning into security protocols is expected to enhance threat detection and response capabilities. With government support and a focus on developing a skilled workforce, the market is poised for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Government Financial Services Healthcare Retail Manufacturing Telecommunications Others |

| By Industry Vertical | BFSI Energy and Utilities Education Transportation Government and Defense Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Services Training and Education |

| By Region | Marmara Aegean Central Anatolia Eastern Anatolia Southeastern Anatolia Black Sea |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 100 | IT Security Managers, Risk Assessment Officers |

| Healthcare Data Protection | 80 | Compliance Officers, IT Directors |

| Government Cybersecurity Initiatives | 70 | Policy Makers, Cybersecurity Analysts |

| SME Cybersecurity Solutions | 90 | Business Owners, IT Consultants |

| Telecommunications Security Measures | 60 | Network Security Engineers, Operations Managers |

The Turkey Cybersecurity Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increasing cyber threats, heightened awareness of data protection, and stringent government regulations mandating robust cybersecurity measures across various sectors.