Region:Asia

Author(s):Geetanshi

Product Code:KRAA3229

Pages:83

Published On:September 2025

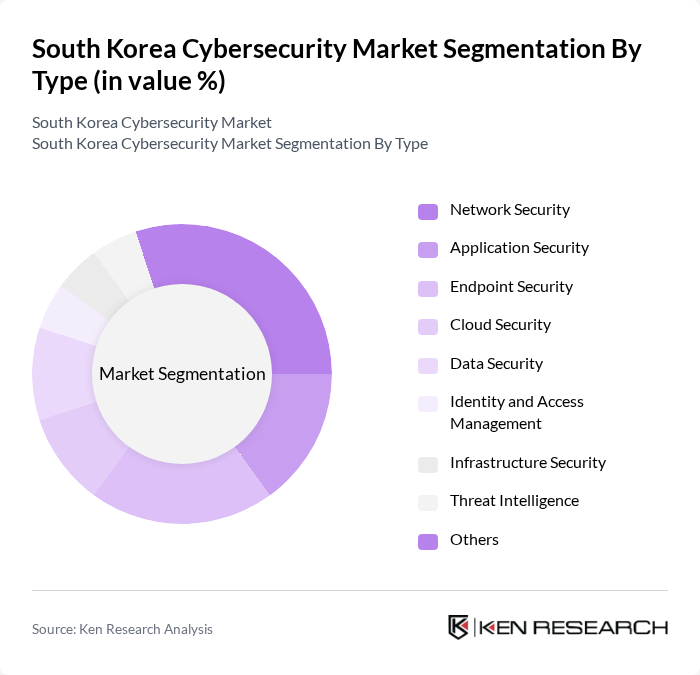

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Security, Threat Intelligence, and Others. Each of these segments plays a crucial role in addressing specific security challenges faced by organizations .

TheNetwork Securitysegment is currently dominating the market due to the increasing number of cyber threats targeting organizational networks. Companies are investing heavily in firewalls, intrusion detection systems, and other network protection technologies to safeguard their data and infrastructure. The rise of remote work, cloud services, and the proliferation of IoT devices has further amplified the need for robust network security solutions, making it a priority for businesses across various sectors .

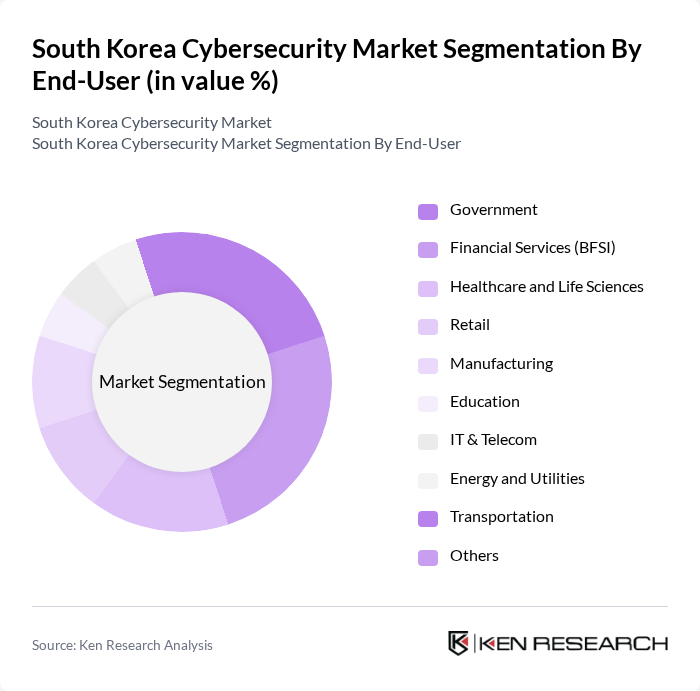

By End-User:The market is segmented by end-users, including Government, Financial Services (BFSI), Healthcare and Life Sciences, Retail, Manufacturing, Education, IT & Telecom, Energy and Utilities, Transportation, and Others. Each sector has unique cybersecurity needs and regulatory requirements that drive the demand for tailored solutions .

TheFinancial Services (BFSI)sector is the leading end-user in the cybersecurity market, driven by the need to protect sensitive financial data and comply with stringent regulations. With the increasing digitization of banking services and the rise of online transactions, financial institutions are prioritizing cybersecurity investments to mitigate risks associated with data breaches and fraud. This sector's high-value transactions and sensitive information make it a prime target for cybercriminals, necessitating advanced security measures .

The South Korea Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDS, SK shieldus (formerly SK Infosec), LG CNS, Hanwha Vision (formerly Hanwha Techwin), AhnLab, Softcamp, Penta Security Systems, Inca Internet, SecuLetter, S-1 Corporation, Duzon Bizon, IBM Korea, KT Corporation, Daou Technology, and Fortinet Korea contribute to innovation, geographic expansion, and service delivery in this space .

The South Korean cybersecurity market is poised for significant evolution, driven by technological advancements and regulatory pressures. The shift towards zero trust security models is expected to redefine security architectures, enhancing protection against sophisticated threats. Additionally, the integration of artificial intelligence in cybersecurity solutions will likely improve threat detection and response times. As organizations prioritize compliance with stringent regulations, the demand for innovative security solutions will continue to grow, fostering a more resilient cybersecurity landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Infrastructure Security Threat Intelligence Others |

| By End-User | Government Financial Services (BFSI) Healthcare and Life Sciences Retail Manufacturing Education IT & Telecom Energy and Utilities Transportation Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Security Services Training and Education Implementation & Integration |

| By Industry Vertical | BFSI Government Healthcare and Life Sciences Aerospace and Defense Manufacturing IT & Telecom Energy and Utilities Transportation Media and Entertainment Others |

| By Security Type | Infrastructure Security Application Security Endpoint Security Cloud Security Data Security Threat Intelligence Incident Response Vulnerability Management |

| By Policy Support | Compliance Solutions Risk Management Frameworks Security Audits |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 100 | IT Security Managers, Compliance Officers |

| Healthcare Cybersecurity Solutions | 60 | Chief Information Officers, Data Protection Officers |

| Manufacturing Cybersecurity Practices | 50 | Operations Managers, IT Directors |

| Government Cybersecurity Initiatives | 40 | Policy Makers, Cybersecurity Analysts |

| SME Cybersecurity Awareness | 70 | Business Owners, IT Consultants |

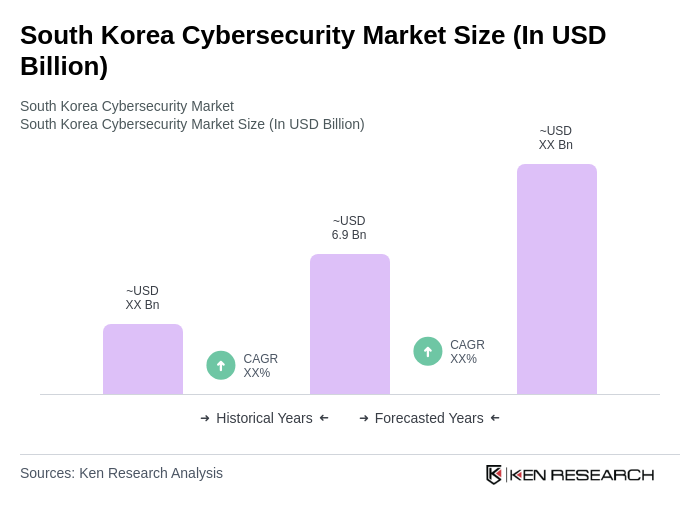

The South Korea Cybersecurity Market is valued at approximately USD 6.9 billion, reflecting significant growth driven by increasing cyber threats, digital transformation, and stringent data privacy regulations.