Region:Asia

Author(s):Geetanshi

Product Code:KRAB3376

Pages:83

Published On:October 2025

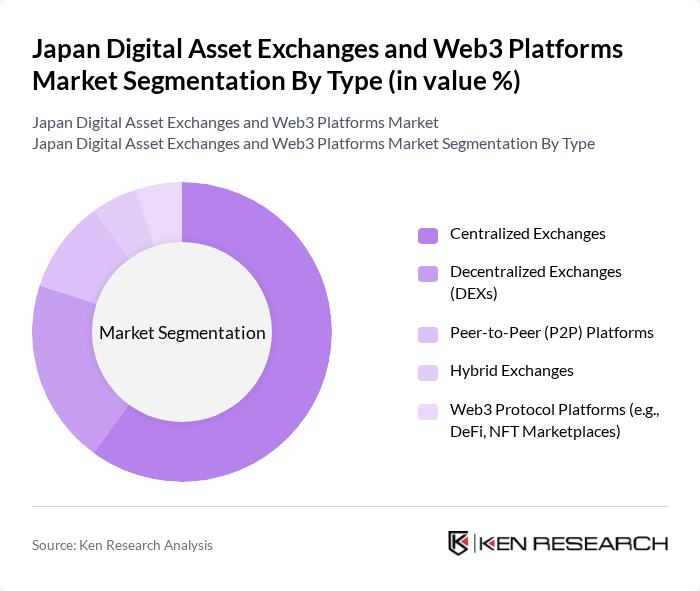

By Type:The market is segmented into various types of exchanges and platforms that cater to different trading needs and preferences. Centralized exchanges dominate due to their user-friendly interfaces, high liquidity, and regulatory compliance. Decentralized exchanges (DEXs) are gaining traction for their privacy, security, and user control over funds. Peer-to-peer (P2P) platforms facilitate direct transactions between users, appealing to those seeking privacy and lower fees. Hybrid exchanges combine features of both centralized and decentralized models, offering flexibility and enhanced security. Web3 protocol platforms, including DeFi and NFT marketplaces, are emerging as significant players, driven by the growing interest in decentralized applications and tokenization of assets .

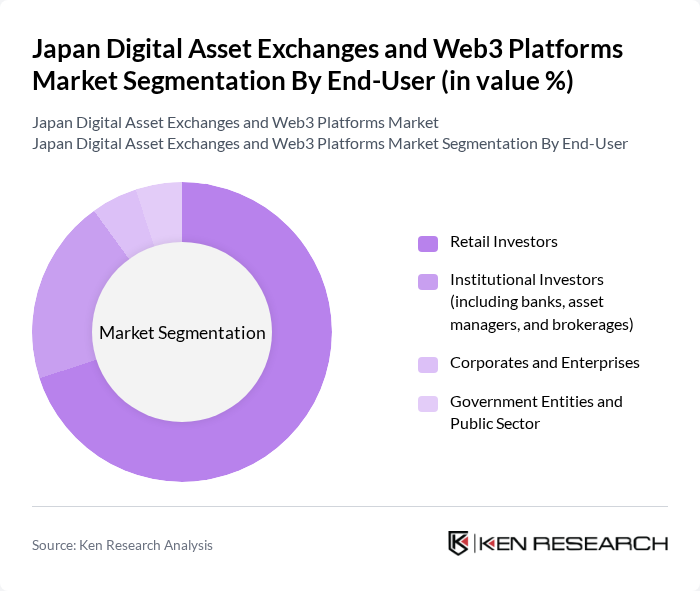

By End-User:The end-user segmentation includes retail investors, institutional investors, corporates, and government entities. Retail investors are the largest segment, driven by the increasing accessibility of digital assets, the rise of mobile trading applications, and a growing interest in wealth management among younger demographics. Institutional investors are also becoming significant players, as they seek to diversify portfolios and capitalize on the growing digital asset market, supported by evolving regulatory clarity. Corporates are exploring blockchain for operational efficiencies, payments, and supply chain transparency, while government entities are focusing on regulatory compliance, digital yen pilots, and public sector applications .

The Japan Digital Asset Exchanges and Web3 Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as bitFlyer, Coincheck, Binance Japan, GMO Coin, DMM Bitcoin, Liquid by FTX Japan, Huobi Japan, OKCoin Japan, Rakuten Wallet, Fisco Cryptocurrency Exchange, Zaif, Bitbank, SBI VC Trade, JPYC Inc., Nomura Holdings / Laser Digital contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's digital asset exchanges and Web3 platforms is poised for transformative growth, driven by technological advancements and increasing consumer engagement. As institutional investment continues to rise, with over ¥1 trillion invested in digital assets, the market is likely to see enhanced liquidity and innovation. Furthermore, the integration of AI technologies in trading platforms is expected to optimize trading strategies, making them more efficient and user-friendly, thereby attracting a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Centralized Exchanges Decentralized Exchanges (DEXs) Peer-to-Peer (P2P) Platforms Hybrid Exchanges Web3 Protocol Platforms (e.g., DeFi, NFT Marketplaces) |

| By End-User | Retail Investors Institutional Investors (including banks, asset managers, and brokerages) Corporates and Enterprises Government Entities and Public Sector |

| By Trading Volume | High Volume Traders (e.g., whales, institutional desks) Medium Volume Traders Low Volume Traders |

| By Asset Class | Cryptocurrencies (e.g., BTC, ETH, XRP) Stablecoins (e.g., JPYC, USDC, USDT) Utility and Security Tokens Non-Fungible Tokens (NFTs) and Other Digital Assets |

| By Payment Method | Bank Transfers (including domestic and international wires) Credit/Debit Cards Digital Wallets (including e-money, prepaid cards) Crypto-to-Crypto Transfers |

| By Geographic Presence | Urban Areas (Tokyo, Osaka, etc.) Rural Areas International Markets (cross-border operations) |

| By Regulatory Compliance | Fully Compliant Exchanges (FSA-licensed) Partially Compliant Exchanges Non-Compliant/Unlicensed Exchanges |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Asset Exchange Users | 120 | Retail Investors, Crypto Traders |

| Web3 Platform Developers | 90 | Software Engineers, Product Managers |

| Institutional Investors in Crypto | 60 | Portfolio Managers, Financial Analysts |

| Regulatory Bodies and Compliance Officers | 40 | Legal Advisors, Compliance Managers |

| Blockchain Technology Experts | 70 | Research Analysts, Technology Consultants |

The Japan Digital Asset Exchanges and Web3 Platforms Market is valued at approximately USD 2.7 billion, reflecting significant growth driven by increased cryptocurrency adoption, advancements in blockchain technology, and rising interest in decentralized finance (DeFi) solutions.