Region:Global

Author(s):Dev

Product Code:KRAA2523

Pages:81

Published On:August 2025

Market.png)

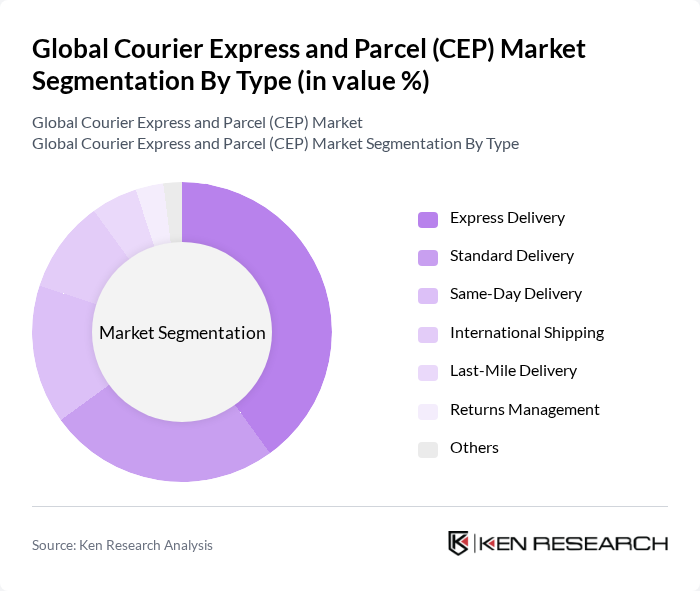

By Type:The market is segmented into Express Delivery, Standard Delivery, Same-Day Delivery, International Shipping, Last-Mile Delivery, Returns Management, and Others. Among these,Express Deliveryremains the leading sub-segment, driven by increasing consumer preference for rapid shipping and guaranteed delivery windows. Urbanization and the expansion of e-commerce platforms have heightened expectations for delivery speed, especially in metropolitan areas. The integration of advanced tracking systems and flexible delivery options further supports the dominance of Express Delivery in the CEP market .

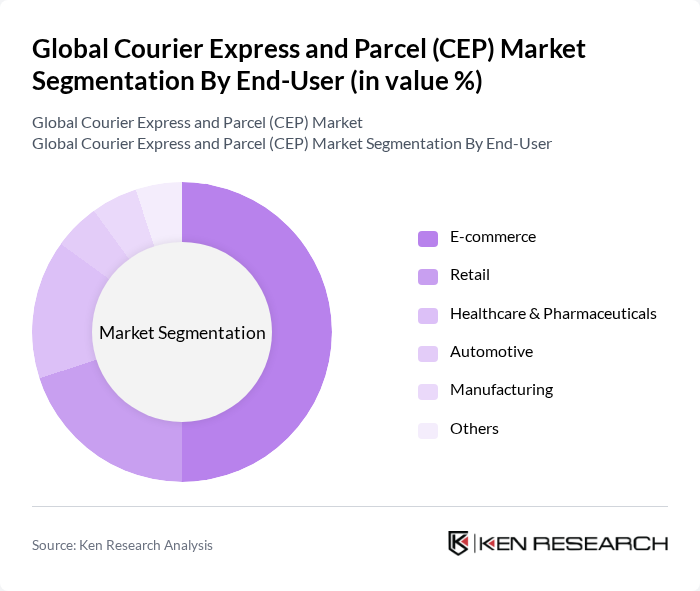

By End-User:The end-user segmentation includes E-commerce, Retail, Healthcare & Pharmaceuticals, Automotive, Manufacturing, and Others. TheE-commercesector is the dominant end-user, as the rapid expansion of online shopping has significantly increased the demand for reliable and efficient courier services. E-commerce platforms require robust delivery networks to meet customer expectations for speed and transparency. Healthcare & Pharmaceuticals is also a rapidly growing segment, driven by the need for temperature-controlled logistics and timely delivery of critical medical supplies .

The Global Courier Express and Parcel (CEP) Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL International GmbH, FedEx Corporation, United Parcel Service, Inc., TNT Express N.V., Aramex International LLC, DB Schenker, XPO Logistics, Inc., DPDgroup, SF Express Co., Ltd., Japan Post Holdings Co., Ltd., Royal Mail Group Ltd., Canada Post Corporation, La Poste, Poste Italiane S.p.A., Singapore Post Limited, Yamato Transport Co., Ltd., Korea Post, India Post, Hermes Europe GmbH, DTDC Express Ltd., Allied Express Transport Pty Ltd., First Flight Courier Ltd., One World Express Inc. Ltd., Nippon Express Holdings, Inc., United States Postal Service contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CEP market is poised for transformation, driven by technological advancements and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly adopt automation and AI to enhance efficiency. Furthermore, sustainability will become a focal point, with companies investing in green logistics solutions to meet regulatory demands and consumer expectations. The integration of smart technologies will redefine delivery processes, ensuring that the industry remains agile and responsive to market changes.

| Segment | Sub-Segments |

|---|---|

| By Type | Express Delivery Standard Delivery Same-Day Delivery International Shipping Last-Mile Delivery Returns Management Others |

| By End-User | E-commerce Retail Healthcare & Pharmaceuticals Automotive Manufacturing Others |

| By Delivery Mode | Road Air Sea Rail Others |

| By Packaging Type | Boxed Palletized Crated Bagged Others |

| By Service Type | Door-to-Door Port-to-Port Terminal-to-Terminal Others |

| By Customer Type | B2B B2C C2C Others |

| By Pricing Model | Flat Rate Variable Rate Subscription-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Express Delivery Services | 100 | Operations Managers, Logistics Coordinators |

| Parcel Delivery in E-commerce | 80 | eCommerce Directors, Supply Chain Analysts |

| International Shipping Solutions | 60 | Export Managers, Compliance Officers |

| Last-Mile Delivery Innovations | 50 | Urban Logistics Planners, Technology Managers |

| Cold Chain Logistics for Perishables | 40 | Supply Chain Managers, Quality Assurance Leads |

The Global Courier Express and Parcel (CEP) Market is valued at approximately USD 456.6 billion, driven by the growth of e-commerce, consumer demand for fast delivery, and advancements in logistics technology.