Region:Asia

Author(s):Geetanshi

Product Code:KRAA0087

Pages:98

Published On:August 2025

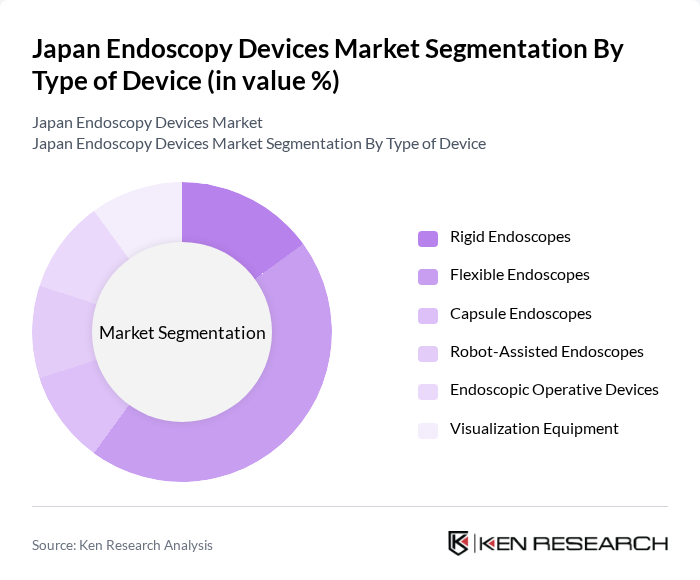

By Type of Device:The endoscopy devices market can be segmented into various types, including rigid endoscopes, flexible endoscopes, capsule endoscopes, robot-assisted endoscopes, endoscopic operative devices, and visualization equipment. Among these, flexible endoscopes are the most dominant due to their versatility and ability to navigate complex anatomical structures, making them essential for a wide range of diagnostic and therapeutic procedures. The adoption of robotic-assisted and capsule endoscopes is also increasing, driven by demand for less invasive and more precise procedures .

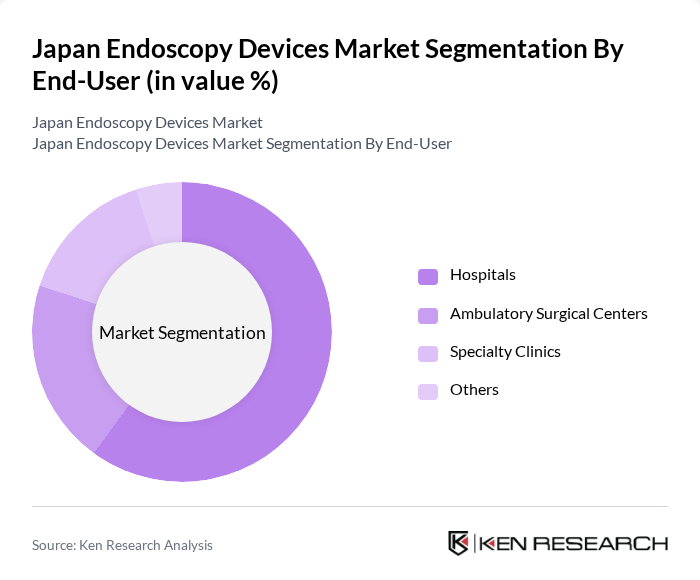

By End-User:The endoscopy devices market is segmented by end-users, including hospitals, ambulatory surgical centers, specialty clinics, and others. Hospitals are the leading end-user segment, driven by the high volume of procedures performed and the availability of advanced medical technologies. The increasing number of surgical interventions and diagnostic procedures in hospitals further solidifies their dominance in the market. Ambulatory surgical centers and specialty clinics are experiencing growth due to the rising demand for outpatient procedures and the adoption of minimally invasive techniques .

The Japan Endoscopy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olympus Corporation, Fujifilm Holdings Corporation, Pentax Medical (HOYA Corporation), Medtronic plc, Boston Scientific Corporation, Stryker Corporation, Karl Storz SE & Co. KG, Conmed Corporation, HOYA Corporation, Richard Wolf GmbH, Cook Medical, Ethicon (Johnson & Johnson), B. Braun Melsungen AG, Medline Industries, LP, Smith & Nephew plc contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan endoscopy devices market appears promising, driven by ongoing technological advancements and a growing emphasis on preventive healthcare. As the healthcare infrastructure expands, particularly in rural areas, access to endoscopic services is expected to improve. Additionally, the integration of artificial intelligence in diagnostic processes is anticipated to enhance accuracy and efficiency, further solidifying the role of endoscopy in modern medical practice. Continuous investment in research and development will also play a crucial role in shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type of Device | Rigid Endoscopes Flexible Endoscopes Capsule Endoscopes Robot-Assisted Endoscopes Endoscopic Operative Devices Visualization Equipment |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Others |

| By Application | Gastroenterology Orthopedic Surgery Cardiology ENT Surgery Gynecology Others |

| By Region | Kanto Kansai Chubu Others |

| By Technology | Video Endoscopy Optical Endoscopy Robotic Endoscopy Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Product Type | Endoscopic Accessories Endoscopic Imaging Systems Endoscopic Surgical Instruments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 60 | Gastroenterologists, Clinic Managers |

| Hospitals with Endoscopy Units | 100 | Surgeons, Nursing Staff, Procurement Officers |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Healthcare Regulatory Bodies | 40 | Regulatory Affairs Managers, Policy Analysts |

| Endoscopy Equipment Manufacturers | 50 | Product Development Managers, Marketing Directors |

The Japan Endoscopy Devices Market is valued at approximately USD 3.6 billion, driven by the increasing prevalence of gastrointestinal diseases and advancements in endoscopic technologies, particularly in high-definition and robotic-assisted devices.