Region:Asia

Author(s):Dev

Product Code:KRAA5934

Pages:88

Published On:September 2025

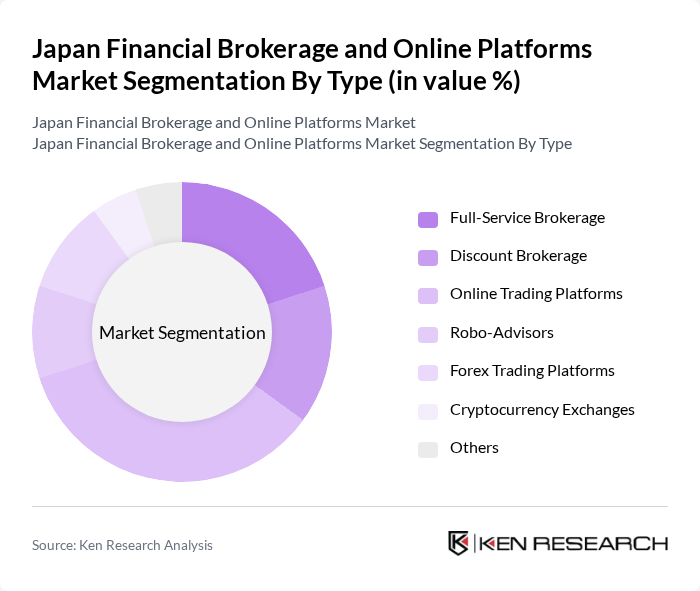

By Type:The market is segmented into various types, including Full-Service Brokerage, Discount Brokerage, Online Trading Platforms, Robo-Advisors, Forex Trading Platforms, Cryptocurrency Exchanges, and Others. Among these, Online Trading Platforms have gained significant traction due to their user-friendly interfaces and lower fees, appealing to a growing number of retail investors seeking cost-effective trading solutions.

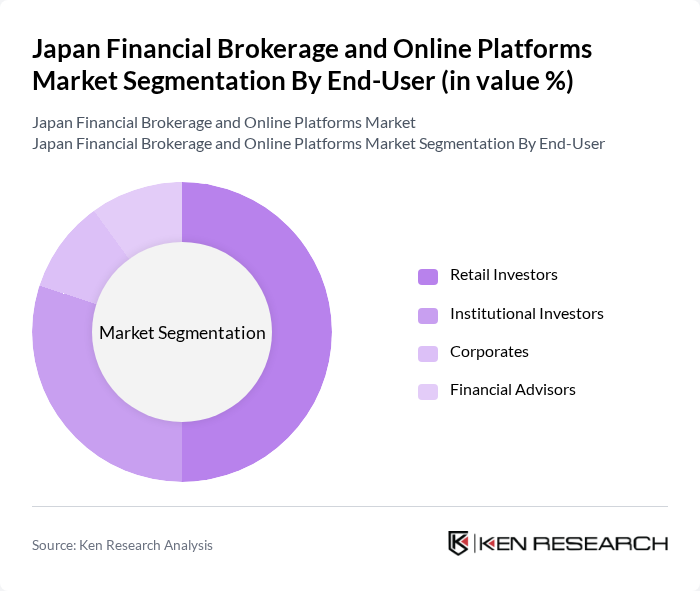

By End-User:The end-user segmentation includes Retail Investors, Institutional Investors, Corporates, and Financial Advisors. Retail Investors dominate the market, driven by the increasing accessibility of online trading platforms and a growing interest in personal finance management among the general public.

The Japan Financial Brokerage and Online Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nomura Securities Co., Ltd., Daiwa Securities Group Inc., SBI Securities Co., Ltd., Rakuten Securities, Inc., Matsui Securities Co., Ltd., Monex Group, Inc., Okasan Securities Group Inc., Tokai Tokyo Financial Holdings, Inc., Japan Securities Finance Co., Ltd., Kabu.com Securities Co., Ltd., Orix Corporation, Aizawa Securities Co., Ltd., Ichiyoshi Securities Co., Ltd., Shinko Securities Co., Ltd., Chuo Mitsui Trust Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan financial brokerage and online platforms market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in trading strategies is expected to enhance decision-making processes, while the rise of mobile trading will cater to the growing demand for convenience. Additionally, as regulatory frameworks evolve, they will likely support innovation, allowing firms to explore new business models and services that align with changing investor needs and market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Online Trading Platforms Robo-Advisors Forex Trading Platforms Cryptocurrency Exchanges Others |

| By End-User | Retail Investors Institutional Investors Corporates Financial Advisors |

| By Investment Type | Equities Bonds Mutual Funds ETFs Derivatives Others |

| By Service Type | Trading Services Advisory Services Research Services Wealth Management Services |

| By Distribution Channel | Direct Sales Online Platforms Financial Advisors Partnerships with Banks |

| By Customer Segment | High Net-Worth Individuals Mass Affluent Retail Customers |

| By Geographic Presence | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Brokerage Services | 150 | Retail Investors, Financial Advisors |

| Online Trading Platforms | 100 | Platform Users, IT Managers |

| Investment Advisory Services | 80 | Investment Advisors, Wealth Managers |

| Market Trends and Insights | 70 | Market Analysts, Financial Researchers |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

The Japan Financial Brokerage and Online Platforms Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by digital trading platform adoption and increased retail investor participation.