Region:Europe

Author(s):Geetanshi

Product Code:KRAB4018

Pages:86

Published On:October 2025

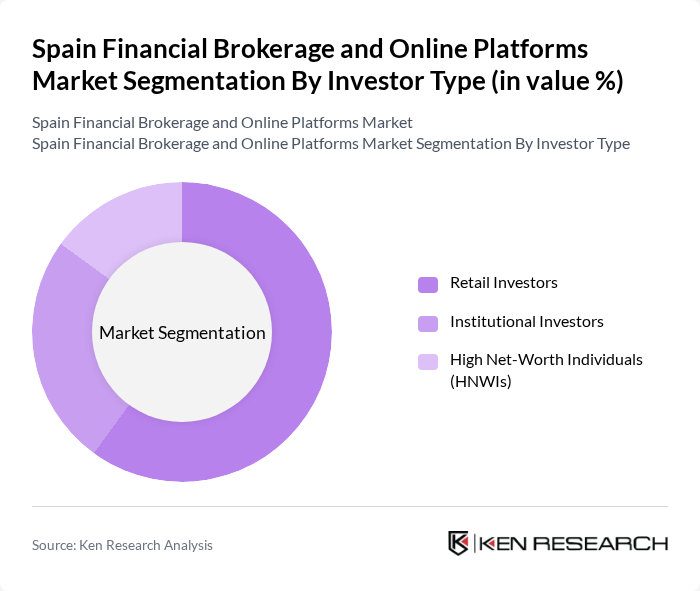

By Investor Type:The investor type segmentation includes Retail Investors, Institutional Investors, and High Net-Worth Individuals (HNWIs). Retail investors dominate the market due to the increasing accessibility of online trading platforms and the growing interest in personal finance management, supported by technological advancements and lower trading costs. Institutional investors, while significant, tend to engage in larger transactions and have a more complex decision-making process, with their participation expected to grow as technology adoption for portfolio management increases. HNWIs are also a crucial segment, as they seek tailored investment solutions and personalized services.

By Operation Type:The operation type segmentation consists of Domestic Operations and Foreign Operations. Domestic operations are the primary focus for most brokerage firms, as they cater to the local investor base and leverage regional market knowledge, with the domestic segment showing greater potential for near-term expansion due to familiarity with regulations and the local investment landscape. Foreign operations, while growing, are often limited by regulatory complexities and the need for local partnerships, but provide opportunities for diversification and access to international markets, with accelerated growth expected in the longer term as cross-border investment technologies advance.

The Spain Financial Brokerage and Online Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as BBVA Trader, Bankinter Broker, ING Direct, Renta 4 Banco, DEGIRO, Interactive Brokers, eToro, XTB, IC Markets, AVA Trade, FP Markets, Tastyworks, Pepperstone, Self Bank, Clicktrade contribute to innovation, geographic expansion, and service delivery in this space.

The future of the financial brokerage and online platforms market in Spain appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in trading strategies is expected to enhance decision-making processes, while the growing emphasis on sustainable investing will likely lead to the emergence of new platforms focused on ESG criteria. Additionally, as mobile trading continues to gain traction, firms that prioritize user experience and innovative features will be well-positioned to capture market share.

| Segment | Sub-Segments |

|---|---|

| By Investor Type | Retail Investors Institutional Investors High Net-Worth Individuals (HNWIs) |

| By Operation Type | Domestic Operations Foreign Operations |

| By Order Execution Type | Market Maker Type Brokers Electronic Communication Network (ECN) Brokers |

| By Product Type | Equities Bonds ETFs Derivatives (Futures, Options) Forex Cryptocurrencies |

| By Platform Type | Traditional Online Brokers Discount Brokers Robo-Advisors Mobile-First Platforms |

| By Service Model | Full-Service Brokerage Self-Directed Trading Hybrid Advisory Services |

| By Geographic Coverage | Madrid Metropolitan Area Barcelona Metropolitan Area Other Spanish Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Brokerage Services | 120 | Retail Investors, Financial Advisors |

| Online Trading Platforms | 85 | Platform Users, IT Managers |

| Institutional Brokerage Insights | 65 | Institutional Investors, Portfolio Managers |

| Regulatory Impact Assessment | 45 | Compliance Officers, Legal Advisors |

| Market Trends and Innovations | 75 | Market Analysts, Product Development Managers |

The Spain Financial Brokerage and Online Platforms Market is valued at approximately EUR 2.5 billion, reflecting significant growth driven by digital trading platform adoption and increased retail investor participation.