Region:Africa

Author(s):Shubham

Product Code:KRAA5973

Pages:93

Published On:September 2025

By Type:The market is segmented into various types, including Full-Service Brokerage, Discount Brokerage, Robo-Advisory Services, Online Trading Platforms, and Others. Among these, Full-Service Brokerage is currently the leading sub-segment due to its comprehensive service offerings that cater to a wide range of investor needs. This segment appeals to both novice and experienced investors seeking personalized advice and extensive market research. The demand for tailored investment strategies and the growing complexity of financial products have further solidified the position of Full-Service Brokerage in the market.

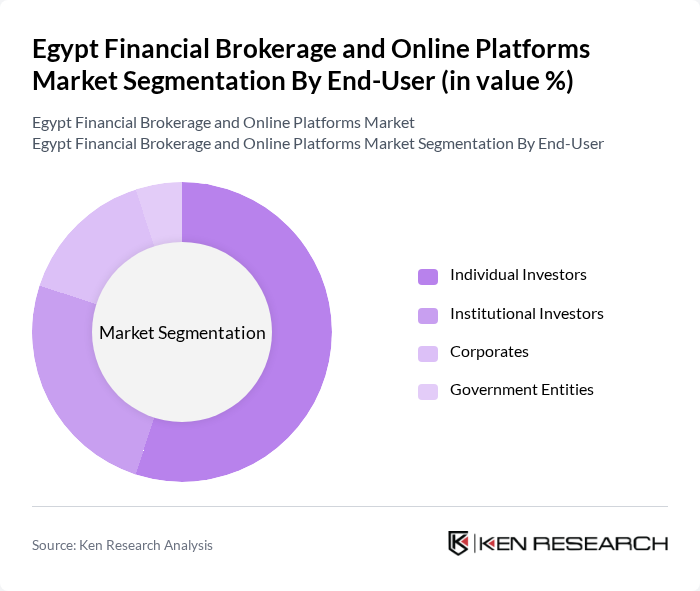

By End-User:The market is segmented by end-user into Individual Investors, Institutional Investors, Corporates, and Government Entities. Individual Investors dominate the market, driven by the increasing accessibility of online trading platforms and a growing interest in personal finance management. The rise of mobile trading applications has made it easier for individuals to engage in trading activities, leading to a surge in retail participation. This trend is further supported by educational initiatives aimed at enhancing financial literacy among the general public.

The Egypt Financial Brokerage and Online Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as EFG Hermes, CI Capital, Pharos Holding, Beltone Financial, Mubasher Financial Services, Arab African International Securities, Prime Holding, Naeem Holding, Pioneers Holding, ASEC Securities, Al Ahly Pharos, Egyptian Arab Land Bank, Al-Masryeen Securities, Al-Ahly Investment and Development, Ahram Securities contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's financial brokerage and online platforms market appears promising, driven by technological innovations and increasing retail investor engagement. As mobile trading applications become more prevalent, they will likely attract a broader audience, particularly younger investors. Additionally, the ongoing regulatory reforms aimed at enhancing investor protection will foster a more secure trading environment, encouraging further participation. These trends suggest a dynamic market landscape that could significantly reshape investment behaviors in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Robo-Advisory Services Online Trading Platforms Others |

| By End-User | Individual Investors Institutional Investors Corporates Government Entities |

| By Investment Type | Equities Bonds Mutual Funds Derivatives Others |

| By Service Channel | Online Platforms Mobile Applications Call Centers Branch Offices |

| By Customer Segment | Retail Investors High Net-Worth Individuals Small and Medium Enterprises Large Corporations |

| By Geographic Presence | Urban Areas Rural Areas Regional Markets International Markets |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Retail Traders |

| Brokerage Firm Operations | 100 | Operations Managers, Compliance Officers |

| Online Trading Platform Users | 120 | Active Traders, Casual Investors |

| Financial Advisors and Analysts | 80 | Financial Advisors, Market Analysts |

| Institutional Investor Perspectives | 70 | Institutional Fund Managers, Investment Analysts |

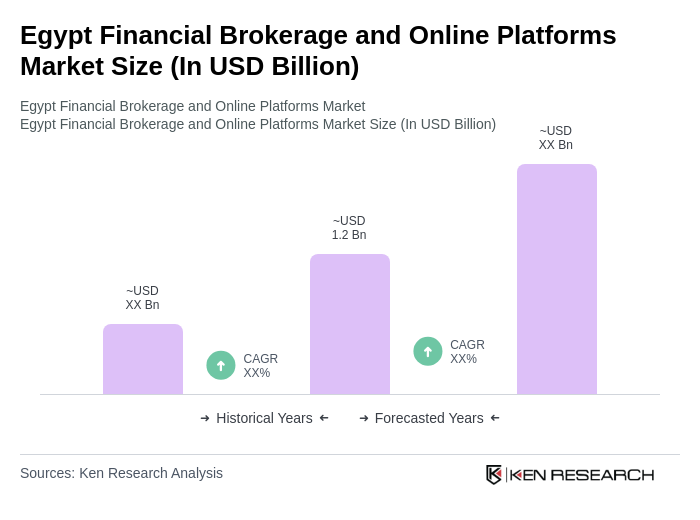

The Egypt Financial Brokerage and Online Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digital trading platform adoption, increased retail investor participation, and favorable regulatory changes enhancing market accessibility.