Region:Asia

Author(s):Dev

Product Code:KRAC0401

Pages:81

Published On:August 2025

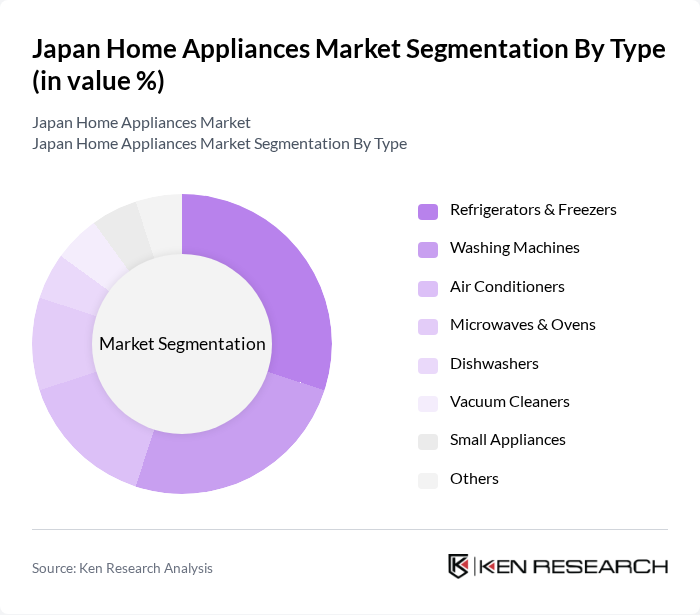

By Type:The market is segmented into various types of home appliances, including refrigerators & freezers, washing machines, air conditioners, microwaves & ovens, dishwashers, vacuum cleaners, small appliances (such as coffee/tea makers, rice cookers, food processors, toasters), and others. Among these, refrigerators & freezers and washing machines are the leading segments due to their essential role in daily household activities. The increasing focus on energy efficiency and smart technology integration is driving innovation in these categories.

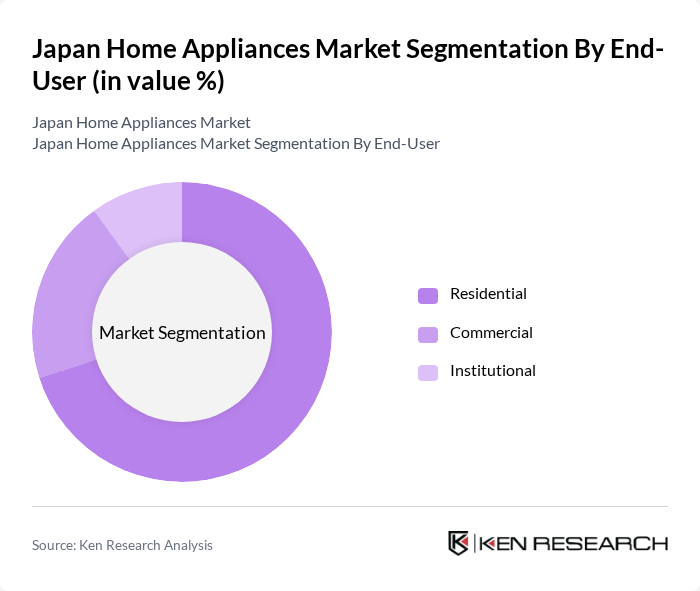

By End-User:The end-user segmentation includes residential, commercial (hospitality, offices, retail), and institutional (healthcare, education) categories. The residential segment dominates the market, driven by the increasing number of households and the growing trend of home automation. Consumers are increasingly investing in modern appliances that enhance convenience and energy efficiency, leading to a robust demand in this segment.

The Japan Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Corporation, Sharp Corporation, Hitachi Global Life Solutions, Inc., Toshiba Lifestyle Products & Services Corporation, Mitsubishi Electric Corporation, Daikin Industries, Ltd., Fujitsu General Limited, Hisense Japan, Haier Japan (AQUA), BSH Hausgeräte GmbH (Bosch, Siemens) – Japan, Miele Japan Corp., Dyson Japan, Electrolux Japan Ltd., LG Electronics Japan Inc., Samsung Electronics Japan Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Japan home appliances market is poised for significant transformation driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for smart and energy-efficient appliances is expected to rise. Additionally, the integration of AI and IoT technologies will enhance user experiences, making appliances more intuitive. Companies that adapt to these trends and focus on sustainability will likely capture a larger market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators & Freezers Washing Machines Air Conditioners Microwaves & Ovens Dishwashers Vacuum Cleaners Small Appliances (Coffee/Tea Makers, Rice Cookers, Food Processors, Toasters) Others |

| By End-User | Residential Commercial (Hospitality, Offices, Retail) Institutional (Healthcare, Education) |

| By Sales Channel | Multi-brand Stores Exclusive/Brand Stores Online Supermarkets/Hypermarkets Others (Distributors, Catalog/TV Shopping) |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand-Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Features | Energy-Efficient Models Smart/Connected Appliances Compact/Space-Saving Designs |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 140 | Store Managers, Sales Executives |

| Home Appliance Manufacturers | 100 | Product Development Managers, Marketing Directors |

| Consumer Insights and Market Research Firms | 80 | Market Analysts, Research Directors |

| Household Consumers | 150 | Homeowners, Renters |

| Retail Supply Chain Managers | 70 | Logistics Coordinators, Inventory Managers |

The Japan Home Appliances Market is valued at approximately USD 26.5 billion, reflecting a robust growth driven by technological advancements and increasing consumer demand for energy-efficient and smart home solutions.