Region:Asia

Author(s):Rebecca

Product Code:KRAD0301

Pages:93

Published On:August 2025

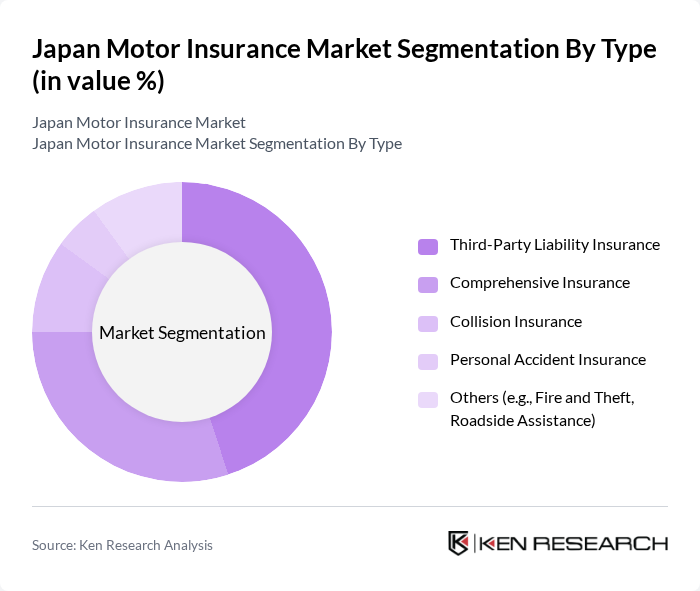

By Type:The market is segmented into various types of motor insurance products, including Third-Party Liability Insurance, Comprehensive Insurance, Collision Insurance, Personal Accident Insurance, and Others (e.g., Fire and Theft, Roadside Assistance). Among these, Third-Party Liability Insurance is the most widely adopted due to its mandatory nature, ensuring that all vehicle owners are covered for damages caused to third parties. Comprehensive Insurance is also gaining traction as consumers seek broader coverage options to protect against various risks. The adoption of telematics and usage-based insurance products is also increasing, particularly among younger and tech-savvy consumers .

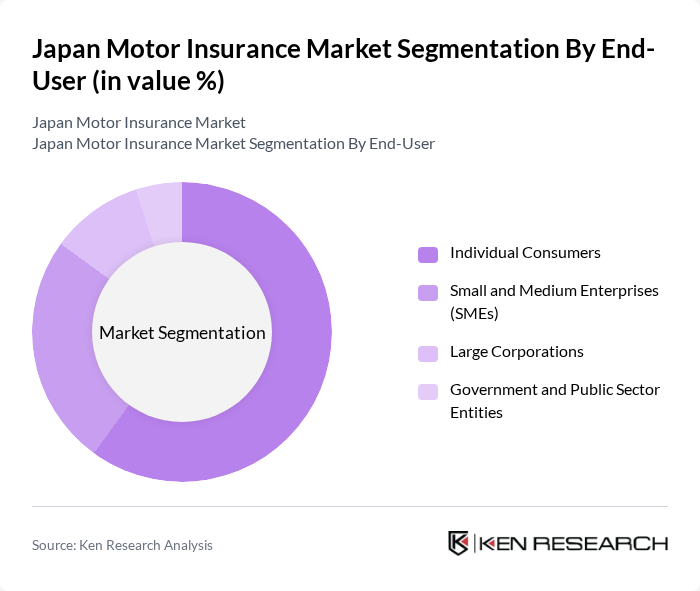

By End-User:The market is further segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government and Public Sector Entities. Individual Consumers dominate the market, driven by the increasing number of personal vehicles and the growing awareness of the need for insurance. SMEs also represent a significant portion of the market as they seek to protect their fleet and business operations from potential liabilities. The rise of corporate fleet insurance and tailored products for business users is also notable .

The Japan Motor Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokio Marine & Nichido Fire Insurance Co., Ltd., MS&AD Insurance Group Holdings, Inc., Sompo Japan Insurance Inc., Aioi Nissay Dowa Insurance Co., Ltd., Mitsui Sumitomo Insurance Co., Ltd., The Kyoei Fire & Marine Insurance Co., Ltd., The Toa Reinsurance Company, Limited, The Fuji Fire and Marine Insurance Co., Ltd., The Daido Fire & Marine Insurance Co., Ltd., AIG General Insurance Company, Ltd., Zurich Insurance Company Ltd (Japan Branch), AXA General Insurance Co., Ltd., Chubb Insurance Japan, SBI Insurance Co., Ltd., Rakuten General Insurance Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan motor insurance market is poised for transformation, driven by technological advancements and evolving consumer preferences. The shift towards digital platforms is expected to streamline operations and enhance customer engagement. Additionally, the increasing adoption of electric vehicles will necessitate new insurance products tailored to these vehicles' unique risks. As insurers adapt to these trends, they will likely focus on innovative solutions that cater to a tech-savvy consumer base, ensuring sustainable growth in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Liability Insurance Comprehensive Insurance Collision Insurance Personal Accident Insurance Others (e.g., Fire and Theft, Roadside Assistance) |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government and Public Sector Entities |

| By Vehicle Type | Passenger Cars Commercial Vehicles Motorcycles Electric and Hybrid Vehicles |

| By Distribution Channel | Agents Brokers Direct Sales Online Platforms Bancassurance |

| By Policy Duration | Short-Term Policies (?1 year) Long-Term Policies (>1 year) |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Segment | First-Time Buyers Repeat/Loyal Customers Price-Sensitive Customers High Net-Worth Individuals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private Vehicle Insurance Holders | 100 | Individual Policyholders, Family Car Owners |

| Commercial Vehicle Insurance Clients | 60 | Fleet Managers, Business Owners |

| Insurance Agents and Brokers | 50 | Insurance Sales Agents, Independent Brokers |

| Claims Adjusters and Underwriters | 40 | Claims Managers, Underwriting Specialists |

| Regulatory and Compliance Experts | 40 | Insurance Regulators, Compliance Officers |

The Japan Motor Insurance Market is valued at approximately USD 54 billion, reflecting a steady growth driven by increasing vehicle ownership, consumer awareness of insurance, and regulatory requirements mandating coverage for motor vehicles.