Region:Asia

Author(s):Geetanshi

Product Code:KRAD0024

Pages:86

Published On:August 2025

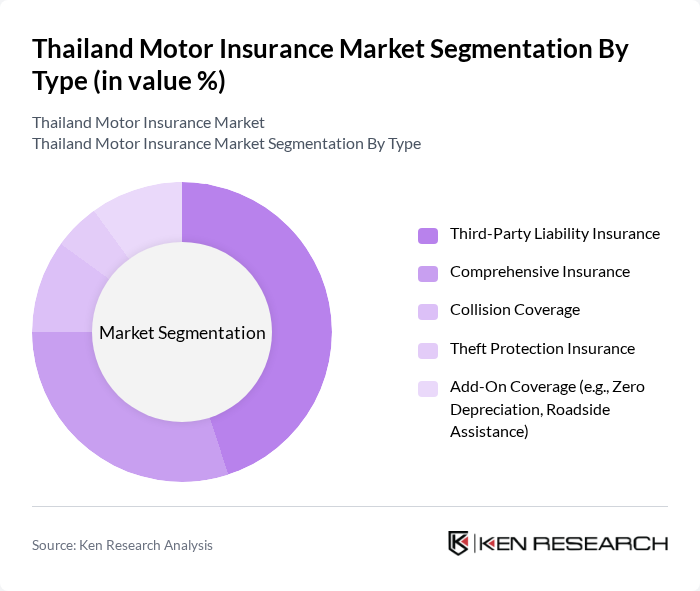

By Type:The market is segmented into various types of motor insurance products, including Third-Party Liability Insurance, Comprehensive Insurance, Collision Coverage, Theft Protection Insurance, and Add-On Coverage (e.g., Zero Depreciation, Roadside Assistance). Among these, Third-Party Liability Insurance is the most dominant segment due to the legal requirement for vehicle owners to have this coverage. Comprehensive Insurance is also gaining traction as consumers seek more extensive protection for their vehicles. The adoption of digital and online channels is facilitating the purchase and management of these products, with bundled and personalized offerings becoming more popular .

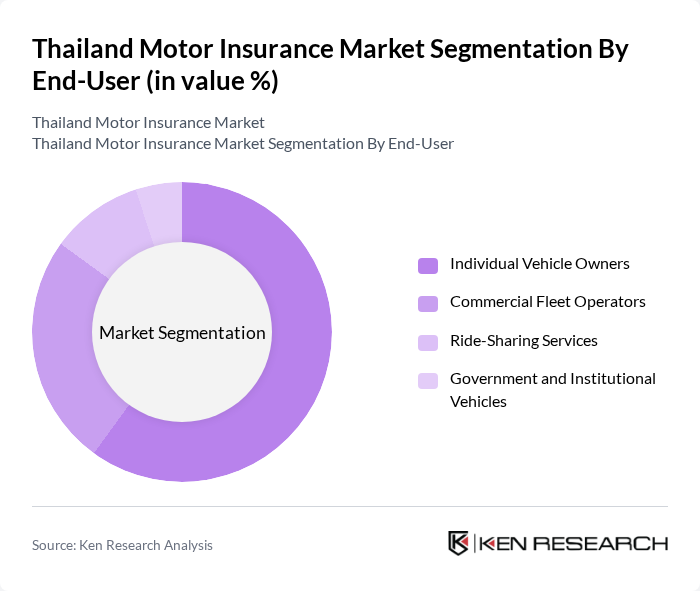

By End-User:The end-user segmentation includes Individual Vehicle Owners, Commercial Fleet Operators, Ride-Sharing Services, and Government and Institutional Vehicles. Individual Vehicle Owners represent the largest segment, driven by the increasing number of personal vehicles and the growing awareness of insurance benefits. Commercial Fleet Operators are also significant, as businesses seek to protect their assets and comply with legal requirements. The rise of ride-sharing services and institutional fleets is contributing to diversification in demand for tailored insurance solutions .

The Thailand Motor Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Viriyah Insurance Public Company Limited, Dhipaya Insurance Public Company Limited, Bangkok Insurance Public Company Limited, Muang Thai Insurance Public Company Limited, Allianz Ayudhya Assurance Public Company Limited, Sompo Insurance (Thailand) Public Company Limited, Chubb Samaggi Insurance Public Company Limited, AXA Insurance Public Company Limited, Tokio Marine Safety Insurance (Thailand) Public Company Limited, Generali Insurance (Thailand) Public Company Limited, FWD General Insurance Public Company Limited, Roojai Company Limited, The Falcon Insurance Public Company Limited, Thaivivat Insurance Public Company Limited, MSIG Insurance (Thailand) Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand motor insurance market is poised for transformative growth driven by technological advancements and evolving consumer preferences. The integration of digital platforms is expected to enhance customer engagement and streamline policy management. Additionally, the increasing adoption of usage-based insurance models will cater to the demand for personalized coverage. As insurers adapt to these trends, they will likely focus on improving customer experience and leveraging data analytics to optimize their offerings, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Liability Insurance Comprehensive Insurance Collision Coverage Theft Protection Insurance Add-On Coverage (e.g., Zero Depreciation, Roadside Assistance) |

| By End-User | Individual Vehicle Owners Commercial Fleet Operators Ride-Sharing Services Government and Institutional Vehicles |

| By Vehicle Type | Private Vehicles (Passenger Cars) Motorcycles Commercial Vehicles Electric Vehicles |

| By Distribution Channel | Agents Brokers Banks and Financial Institutions Online Platforms Direct Sales |

| By Region | Bangkok Central Thailand Northern Thailand Southern Thailand Eastern Thailand |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private Car Insurance | 100 | Insurance Agents, Policyholders |

| Motorcycle Insurance | 60 | Insurance Brokers, Motorcycle Owners |

| Commercial Vehicle Insurance | 40 | Fleet Managers, Business Owners |

| Claims Processing Insights | 50 | Claims Adjusters, Customer Service Representatives |

| Consumer Preferences in Motor Insurance | 80 | General Consumers, Insurance Policyholders |

The Thailand Motor Insurance Market is valued at approximately USD 4.8 billion, reflecting a steady growth driven by increasing vehicle ownership, consumer awareness, and regulatory mandates for insurance coverage.