Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0030

Pages:96

Published On:August 2025

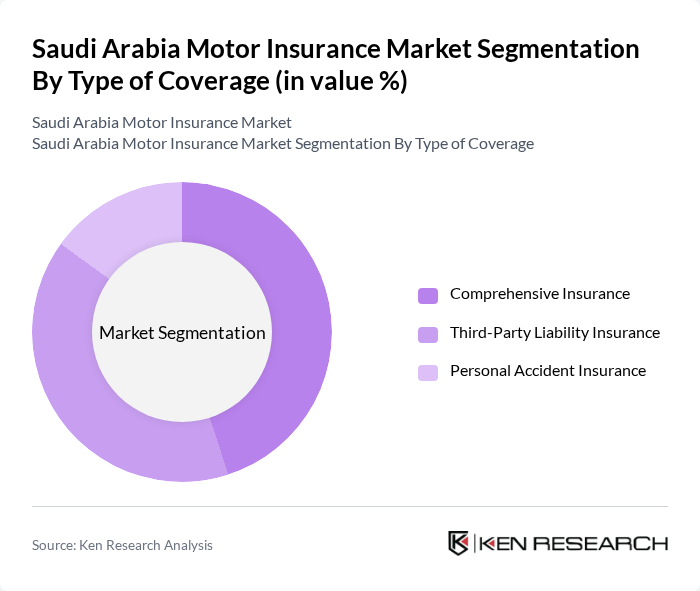

By Type of Coverage:The market is segmented into three main types of coverage: Comprehensive Insurance, Third-Party Liability Insurance, and Personal Accident Insurance. Comprehensive Insurance is widely preferred by consumers seeking extensive protection for their vehicles against both own damage and third-party liabilities. Third-Party Liability Insurance is mandated by law, making it the most essential segment for regulatory compliance. Personal Accident Insurance is gaining traction as consumers become more aware of the need for personal safety and financial protection in the event of an accident .

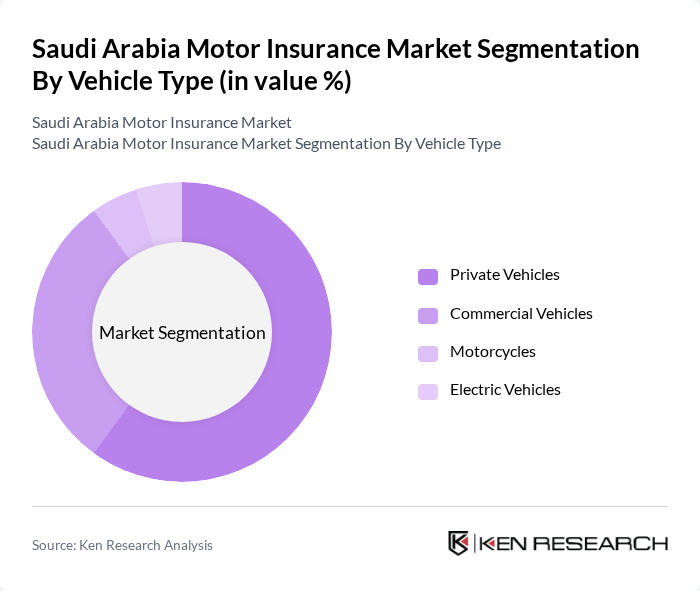

By Vehicle Type:The segmentation by vehicle type includes Private Vehicles, Commercial Vehicles, Motorcycles, and Electric Vehicles. Private Vehicles account for the largest share of the market, reflecting the high rate of individual vehicle ownership in Saudi Arabia. Commercial Vehicles represent a significant segment due to the expanding logistics, delivery, and transportation sectors. Motorcycles and Electric Vehicles are emerging categories, with growth supported by evolving consumer preferences, regulatory incentives for electric mobility, and the increasing adoption of two-wheelers for delivery services .

The Saudi Arabia Motor Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Al Rajhi Takaful, Bupa Arabia, Gulf Insurance Group (GIG Saudi), Allianz Saudi Fransi Cooperative Insurance Company, Arab National Insurance Company (ANB Insurance), United Cooperative Assurance Company (UCA), Saudi Arabian Cooperative Insurance Company (SAICO), Alinma Tokio Marine, MetLife AIG ANB Cooperative Insurance Company, Al-Ahlia Insurance Company, Al-Etihad Cooperative Insurance Co., SABB Takaful, Aljazira Takaful Taawuni Company, and Walaa Cooperative Insurance Co. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia motor insurance market is poised for significant transformation driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in claims processing is expected to enhance efficiency and reduce turnaround times. Additionally, the shift towards usage-based insurance models will cater to the growing demand for personalized coverage. As the market adapts to these trends, insurers will likely focus on improving customer experience and expanding digital platforms to meet the needs of a tech-savvy population.

| Segment | Sub-Segments |

|---|---|

| By Type of Coverage | Comprehensive Insurance Third-Party Liability Insurance Personal Accident Insurance |

| By Vehicle Type | Private Vehicles Commercial Vehicles Motorcycles Electric Vehicles |

| By Distribution Channel | Insurance Agents/Brokers Direct Sales (Online and Call Centers) Automotive Dealerships |

| By End-User | Individual Consumers Small Businesses Corporations Government Entities |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Segment | First-Time Buyers Renewing Customers High-Risk Customers Others |

| By Region | Riyadh Jeddah Dammam Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Insurance | 120 | Insurance Policyholders, Claims Adjusters |

| Commercial Vehicle Insurance | 90 | Fleet Managers, Business Owners |

| Motor Insurance Brokers | 50 | Insurance Brokers, Sales Agents |

| Consumer Preferences in Motor Insurance | 100 | Car Owners, Potential Buyers |

| Regulatory Impact on Insurance Practices | 40 | Regulatory Officials, Industry Experts |

The Saudi Arabia Motor Insurance Market is valued at approximately USD 4.2 billion, reflecting significant growth driven by increasing vehicle ownership, consumer awareness, and regulatory mandates for insurance coverage.