Region:North America

Author(s):Dev

Product Code:KRAB0588

Pages:87

Published On:August 2025

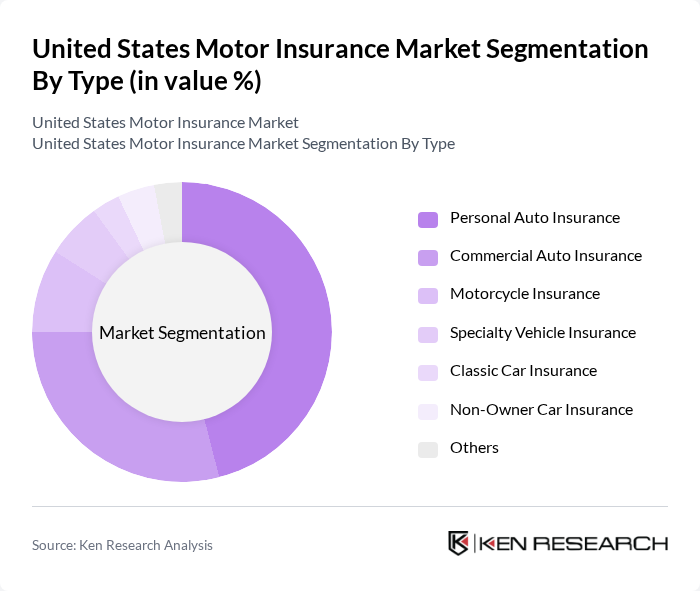

By Type:The motor insurance market is segmented into various types, including personal auto insurance, commercial auto insurance, motorcycle insurance, specialty vehicle insurance, classic car insurance, non-owner car insurance, and others. Personal auto insurance is the most significant segment, driven by the high number of personal vehicles on the road and the increasing need for individual coverage. Commercial auto insurance follows closely, as businesses require coverage for their fleets. The motorcycle insurance segment has also seen growth due to rising motorcycle ownership and usage, while specialty and classic car insurance cater to niche vehicle categories. Non-owner car insurance addresses the needs of drivers who do not own vehicles but require liability coverage .

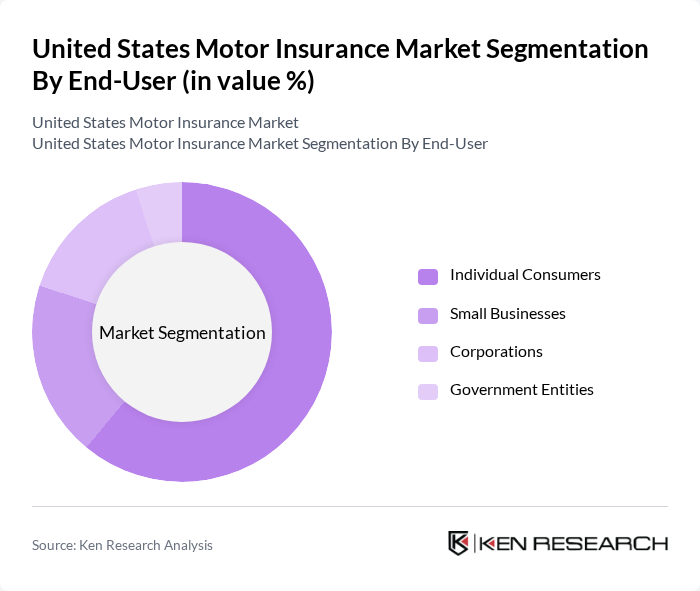

By End-User:The end-user segmentation includes individual consumers, small businesses, corporations, and government entities. Individual consumers represent the largest segment, as personal vehicle ownership is widespread across the United States. Small businesses also contribute significantly, as they require insurance for their vehicles used in operations. Corporations and government entities follow, with specific needs for fleet insurance and compliance with regulations. The rise in telematics adoption and digital platforms has further expanded access and tailored solutions for each end-user group .

The United States Motor Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as State Farm Mutual Automobile Insurance Company, GEICO (Government Employees Insurance Company), The Progressive Corporation, Allstate Insurance Company, USAA (United Services Automobile Association), Farmers Insurance Group, Liberty Mutual Insurance Company, Nationwide Mutual Insurance Company, American Family Insurance, The Travelers Companies, Inc., The Hartford Financial Services Group, Inc., MetLife, Inc., Chubb Limited, Erie Insurance Group, The Hanover Insurance Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the United States motor insurance market appears promising, driven by technological innovations and evolving consumer preferences. As digital solutions become more prevalent, insurers are likely to enhance customer engagement through personalized services. Additionally, the growing emphasis on sustainability may lead to the development of eco-friendly insurance products. These trends indicate a shift towards more adaptive and customer-centric insurance models, positioning the market for continued growth and resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Auto Insurance Commercial Auto Insurance Motorcycle Insurance Specialty Vehicle Insurance Classic Car Insurance Non-Owner Car Insurance Others |

| By End-User | Individual Consumers Small Businesses Corporations Government Entities |

| By Coverage Type | Liability Coverage Comprehensive Coverage Collision Coverage Uninsured/Underinsured Motorist Coverage Personal Injury Protection (PIP) Usage-Based Insurance |

| By Distribution Channel | Direct Sales Insurance Brokers Online Platforms Agents |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Customer Demographics | Age Groups Income Levels Geographic Locations |

| By Claims Process | Traditional Claims Process Digital Claims Process Hybrid Claims Process |

| By Vehicle Type | Passenger Cars Motorcycles Light Commercial Vehicles Heavy Commercial Trucks Electric Vehicles (EVs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Auto Insurance | 120 | Policyholders, Insurance Agents |

| Commercial Vehicle Insurance | 90 | Fleet Managers, Business Owners |

| Claims Processing Insights | 60 | Claims Adjusters, Customer Service Representatives |

| Insurance Technology Adoption | 50 | IT Managers, Digital Transformation Officers |

| Consumer Behavior Trends | 70 | General Public, Market Researchers |

The United States Motor Insurance Market is valued at approximately USD 466 billion, reflecting significant growth driven by factors such as increasing vehicle ownership, electric vehicle adoption, and advancements in technology like telematics and AI in underwriting.