Region:Asia

Author(s):Dev

Product Code:KRAA7229

Pages:81

Published On:September 2025

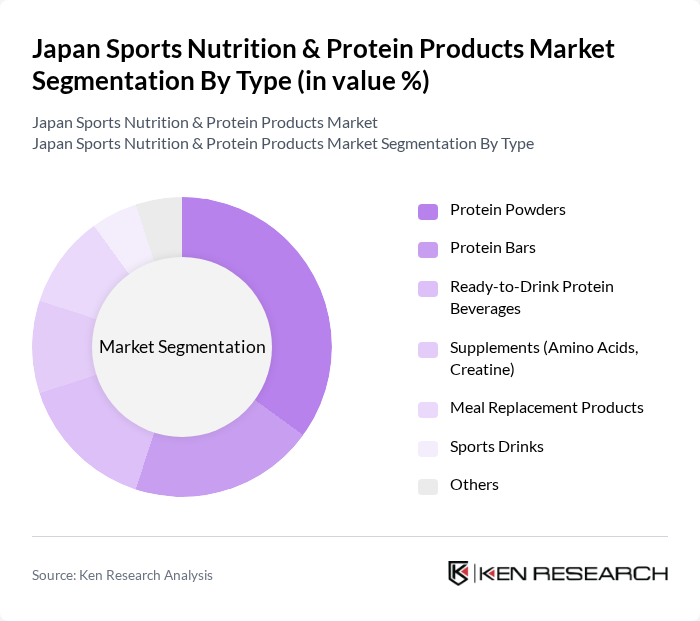

By Type:The market is segmented into various types of products, including Protein Powders, Protein Bars, Ready-to-Drink Protein Beverages, Supplements (Amino Acids, Creatine), Meal Replacement Products, Sports Drinks, and Others. Among these, Protein Powders dominate the market due to their versatility and high protein content, appealing to both athletes and casual consumers. The increasing trend of home workouts and meal replacements has further boosted the demand for these products.

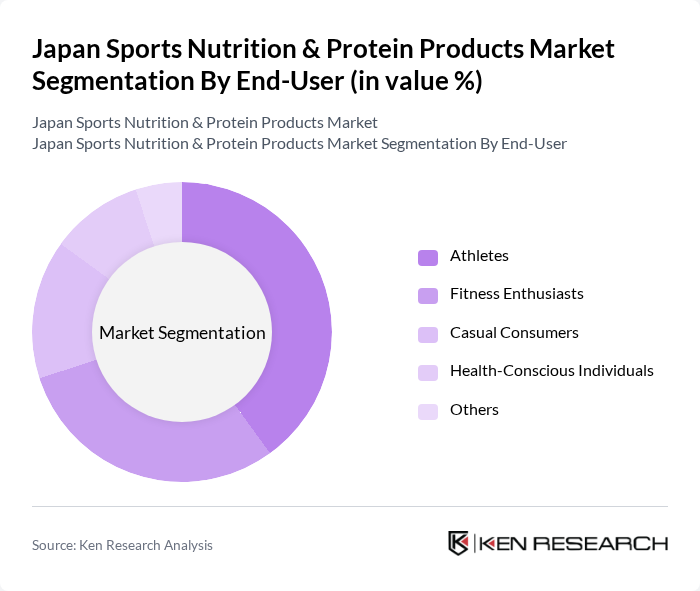

By End-User:The end-user segmentation includes Athletes, Fitness Enthusiasts, Casual Consumers, Health-Conscious Individuals, and Others. Athletes represent the largest segment, driven by their need for high-performance nutrition to enhance their training and recovery. Fitness enthusiasts also contribute significantly to the market, as they seek products that support their active lifestyles and fitness goals.

The Japan Sports Nutrition & Protein Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asahi Group Holdings, Ltd., Meiji Holdings Co., Ltd., Otsuka Pharmaceutical Co., Ltd., Kirin Holdings Company, Limited, Suntory Holdings Limited, Glico Group, Ajinomoto Co., Inc., Morinaga Milk Industry Co., Ltd., Yakult Honsha Co., Ltd., DAIWA Foods Co., Ltd., Nissin Foods Holdings Co., Ltd., Calpis Co., Ltd., Fonterra Co-operative Group Limited, Nestlé Japan Ltd., Takeda Pharmaceutical Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan sports nutrition and protein products market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to innovate with clean label products and functional foods. Additionally, the integration of technology in product development, such as personalized nutrition solutions, will cater to the growing demand for tailored health products, enhancing consumer engagement and market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Powders Protein Bars Ready-to-Drink Protein Beverages Supplements (Amino Acids, Creatine) Meal Replacement Products Sports Drinks Others |

| By End-User | Athletes Fitness Enthusiasts Casual Consumers Health-Conscious Individuals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Health and Wellness Stores Gyms and Fitness Centers Others |

| By Price Range | Low Price Mid Price Premium Price Others |

| By Packaging Type | Single-Serve Packs Bulk Packaging Ready-to-Drink Containers Others |

| By Ingredient Source | Animal-Based Plant-Based Synthetic Others |

| By Product Form | Powder Liquid Solid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Enthusiasts | 150 | Gym Members, Personal Trainers |

| Professional Athletes | 100 | Competitive Sports Coaches, Athletes |

| Health-Conscious Consumers | 120 | Nutritionists, Dietitians |

| Retailers of Sports Nutrition Products | 80 | Store Managers, Product Buyers |

| Online Shoppers of Protein Products | 90 | E-commerce Managers, Digital Marketers |

The Japan Sports Nutrition & Protein Products Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased health consciousness, fitness activities, and the popularity of sports among the youth.