Region:Asia

Author(s):Geetanshi

Product Code:KRAA4017

Pages:81

Published On:January 2026

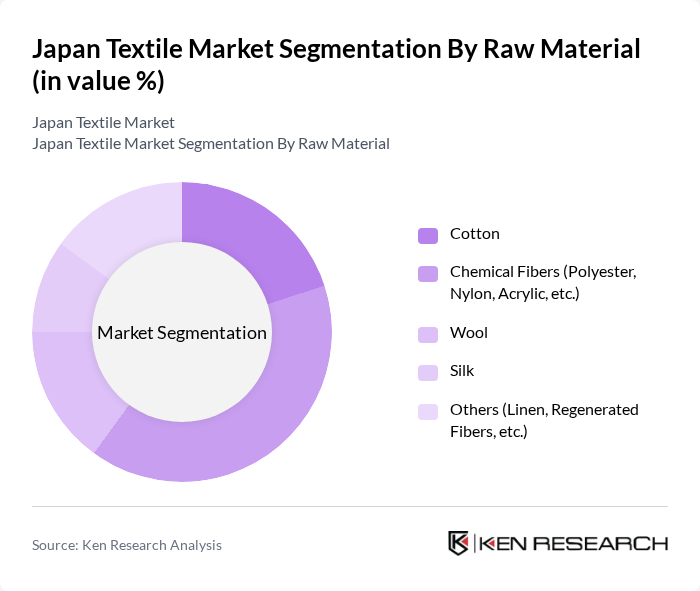

By Raw Material:The raw material segment of the Japan Textile Market includes various subsegments such as Cotton, Chemical Fibers (Polyester, Nylon, Acrylic, etc.), Wool, Silk, and Others (Linen, Regenerated Fibers, etc.). Chemical Fibers account for a substantial share of Japan’s textile fiber consumption, supported by strong domestic capabilities in synthetic fibers like polyester, nylon, and high-performance materials. Their versatility, durability, and cost-effectiveness, along with demand for performance textiles in apparel, sportswear, and industrial applications, underpin the dominance of chemical fibers in the market. At the same time, interest in eco-designed synthetics, recycled polyester, and bio-based fibers is rising as brands respond to sustainability expectations.

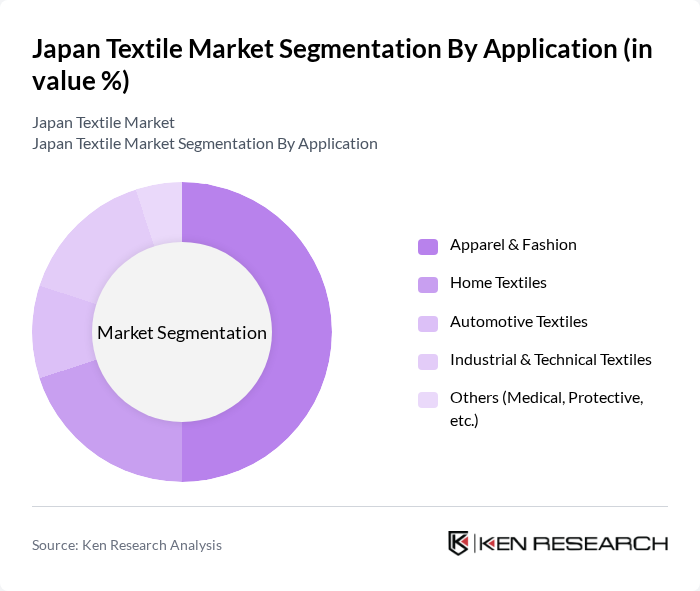

By Application:The application segment encompasses various uses of textiles, including Apparel & Fashion, Home Textiles, Automotive Textiles, Industrial & Technical Textiles, and Others (Medical, Protective, etc.). The Apparel & Fashion segment leads the market, supported by Japan’s position as a major apparel market with strong demand for both domestic and international brands and a high emphasis on quality and functionality in clothing. Growth in athleisure, functional wear, and eco-conscious fashion, combined with the expansion of e-commerce channels, has further reinforced this segment’s importance. Home textiles, automotive, and industrial and technical textiles also represent significant demand areas, driven by interior renovation trends, automotive component needs, and applications in filtration, medical, and protective uses.

The Japan Textile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toray Industries, Inc., Asahi Kasei Corporation, Teijin Limited, Kuraray Co., Ltd., Unitika Ltd., Shima Seiki Mfg., Ltd., Nitto Boseki Co., Ltd. (Nittobo), Daiwabo Holdings Co., Ltd., Japan Vilene Company, Ltd. (Freudenberg Performance Materials Japan), Toyobo Co., Ltd., Gunze Limited, Sanyo Shokai Ltd., Descente Ltd., World Co., Ltd., TSI Holdings Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japanese textile market appears promising, driven by a strong emphasis on sustainability and technological innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest more in sustainable practices. Additionally, advancements in smart textiles and digital printing technologies are expected to enhance product offerings. The integration of e-commerce will further facilitate market expansion, allowing companies to reach diverse consumer segments and adapt to changing market dynamics effectively.

| Segment | Sub-Segments |

|---|---|

| By Raw Material | Cotton Chemical Fibers (Polyester, Nylon, Acrylic, etc.) Wool Silk Others (Linen, Regenerated Fibers, etc.) |

| By Application | Apparel & Fashion Home Textiles Automotive Textiles Industrial & Technical Textiles Others (Medical, Protective, etc.) |

| By Product Category | Yarn Fabrics (Woven & Knitted) Non-woven Textiles Finished Goods (Garments, Home Textiles, etc.) Others |

| By Distribution Channel | B2B Sales (Brands, OEMs, Traders) Modern Retail (Department Stores, Specialty Chains) E-commerce Direct-to-Consumer (Brand Stores) Others |

| By Region | Kanto Kansai Chubu Kyushu Others (Hokkaido, Tohoku, Chugoku, Shikoku, Okinawa) |

| By Fabric Construction | Woven Fabrics Knitted Fabrics Non-woven Fabrics Technical & Specialty Fabrics Others |

| By Sustainability Profile | Organic & Bio-based Textiles Recycled & Circular Textiles Low-impact / Certified Textiles Conventional Textiles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Apparel Manufacturing Insights | 110 | Production Managers, Quality Control Supervisors |

| Home Textiles Market Trends | 85 | Product Managers, Retail Buyers |

| Technical Textiles Applications | 75 | R&D Managers, Industry Experts |

| Consumer Preferences in Fashion | 130 | Fashion Designers, Marketing Executives |

| Sustainability Practices in Textiles | 95 | Sustainability Officers, Corporate Social Responsibility Managers |

The Japan Textile Market is valued at approximately USD 63 billion, reflecting a robust growth trajectory driven by increasing demand for high-quality textiles, technological advancements, and a focus on sustainable practices.