Region:Asia

Author(s):Shubham

Product Code:KRAA1114

Pages:86

Published On:August 2025

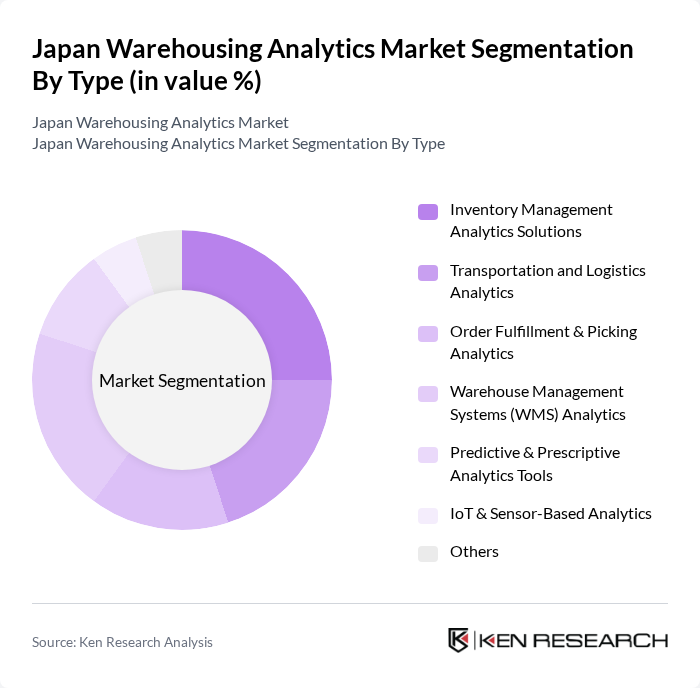

By Type:The market is segmented into various types of analytics solutions that address different aspects of warehousing operations. The subsegments include Inventory Management Analytics Solutions, which focus on optimizing stock levels and reducing holding costs; Transportation and Logistics Analytics, which enhance route planning and delivery efficiency; Order Fulfillment & Picking Analytics, which streamline picking processes and improve order accuracy; Warehouse Management Systems (WMS) Analytics, which provide comprehensive insights into warehouse performance; Predictive & Prescriptive Analytics Tools, which enable data-driven forecasting and decision-making; IoT & Sensor-Based Analytics, which offer real-time monitoring of assets and environmental conditions; and Others, covering emerging and niche analytics applications .

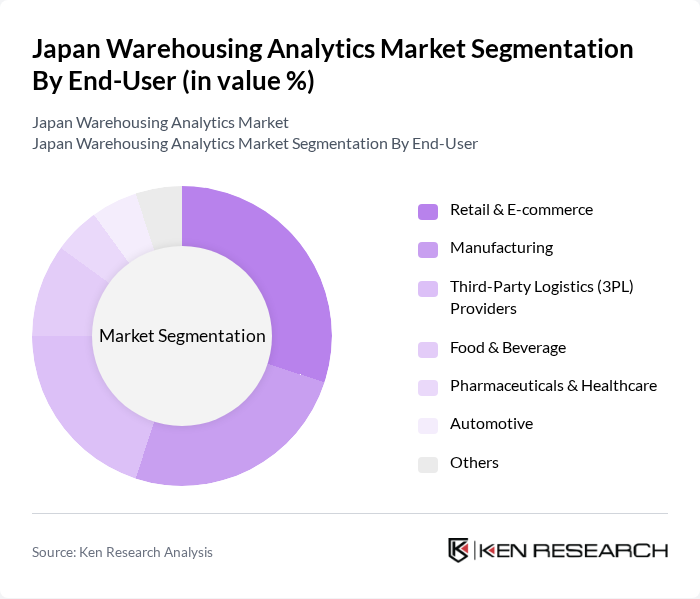

By End-User:The end-user segmentation encompasses industries leveraging warehousing analytics to improve operational efficiency and cost-effectiveness. The subsegments are Retail & E-commerce, which utilize analytics for demand forecasting and inventory optimization; Manufacturing, which benefits from process automation and supply chain visibility; Third-Party Logistics (3PL) Providers, which use analytics for resource allocation and service optimization; Food & Beverage, which require analytics for compliance and perishables management; Pharmaceuticals & Healthcare, which focus on regulatory compliance and cold chain monitoring; Automotive, which leverage analytics for parts inventory and distribution; and Others, representing additional sectors adopting analytics for specialized needs .

The Japan Warehousing Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daifuku Co., Ltd., Murata Machinery, Ltd. (Muratec), Toyota Industries Corporation, Fujitsu Limited, Hitachi Transport System, Ltd., Panasonic Connect Co., Ltd., NEC Corporation, Blue Yonder (formerly JDA Software), Manhattan Associates, Inc., Oracle Corporation, SAP SE, Zebra Technologies Corporation, Infor, Cognex Corporation, YE DIGITAL CORPORATION contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan warehousing analytics market appears promising, driven by technological advancements and evolving consumer demands. As companies increasingly prioritize efficiency and transparency, the integration of AI and machine learning into warehousing operations is expected to enhance decision-making processes. Additionally, the shift towards sustainable practices will likely influence investment strategies, encouraging firms to adopt eco-friendly technologies that align with global sustainability goals, thereby fostering long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Analytics Solutions Transportation and Logistics Analytics Order Fulfillment & Picking Analytics Warehouse Management Systems (WMS) Analytics Predictive & Prescriptive Analytics Tools IoT & Sensor-Based Analytics Others |

| By End-User | Retail & E-commerce Manufacturing Third-Party Logistics (3PL) Providers Food & Beverage Pharmaceuticals & Healthcare Automotive Others |

| By Application | Supply Chain Optimization Inventory Forecasting & Demand Planning Performance Monitoring & KPI Tracking Risk & Compliance Management Energy & Space Utilization Analytics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido Others |

| By Business Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Logistics Coordinators |

| Automotive Supply Chain Management | 50 | Operations Directors, Procurement Managers |

| Pharmaceutical Distribution Centers | 40 | Compliance Officers, Warehouse Supervisors |

| E-commerce Fulfillment Centers | 55 | eCommerce Operations Managers, Inventory Analysts |

| Cold Chain Logistics | 45 | Temperature Control Specialists, Supply Chain Analysts |

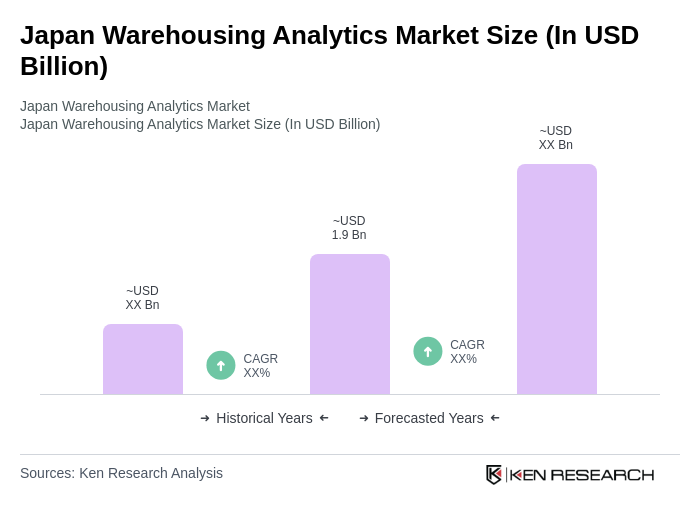

The Japan Warehousing Analytics Market is valued at approximately USD 1.9 billion, reflecting a significant growth driven by the demand for efficient supply chain management and real-time data analytics to optimize warehouse operations.