Region:Europe

Author(s):Geetanshi

Product Code:KRAA0188

Pages:98

Published On:August 2025

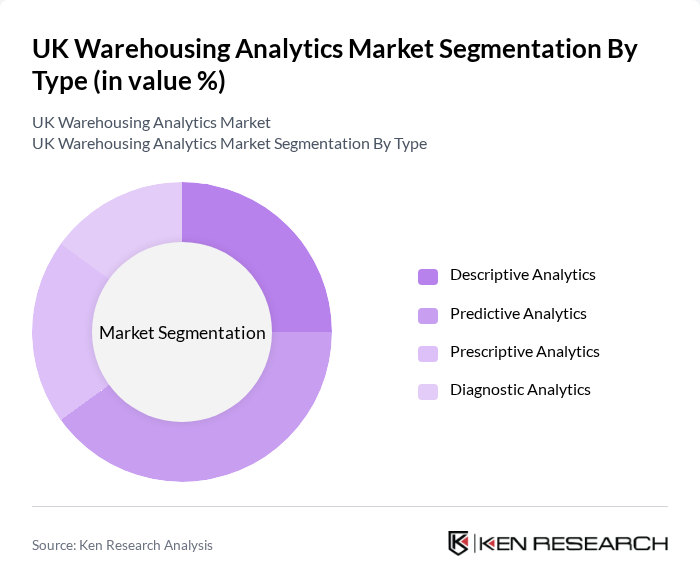

By Type:The market is segmented into four types of analytics: Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Diagnostic Analytics. Each type serves a unique purpose in enhancing warehouse operations, with Descriptive Analytics focusing on historical data analysis, Predictive Analytics forecasting future trends, Prescriptive Analytics recommending actions based on data, and Diagnostic Analytics identifying the causes of past outcomes. Among these, Predictive Analytics is currently leading the market due to its ability to provide actionable insights that help businesses anticipate demand and optimize inventory levels.

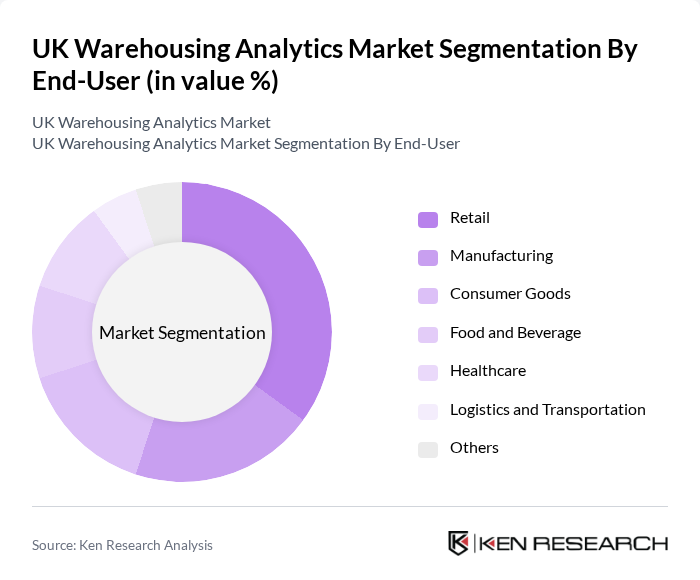

By End-User:The end-user segmentation includes Retail, Manufacturing, Consumer Goods, Food and Beverage, Healthcare, Logistics and Transportation, and Others. Each sector utilizes warehousing analytics to enhance operational efficiency and meet customer demands. The Retail sector is the dominant end-user, driven by the rapid growth of e-commerce and the need for effective inventory management. Retailers leverage analytics to optimize stock levels, improve order fulfillment, and enhance customer satisfaction.

The UK Warehousing Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Manhattan Associates, Blue Yonder (formerly JDA Software), Oracle Corporation, SAP SE, SSI SCHAEFER, Swisslog (KUKA Group), Dematic (a KION Group company), Zebra Technologies, Infor, Microlise, Synergy Logistics (SnapFulfil), WiseTech Global, Körber Supply Chain, Mintsoft (part of The Access Group), Descartes Systems Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK warehousing analytics market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize data-driven decision-making, the integration of cloud-based solutions and IoT technologies will become more prevalent. In future, the market is expected to witness a significant shift towards predictive analytics, enabling companies to anticipate demand fluctuations and optimize inventory management. This trend will be crucial for maintaining competitive advantage in a rapidly changing retail landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics |

| By End-User | Retail Manufacturing Consumer Goods Food and Beverage Healthcare Logistics and Transportation Others |

| By Warehouse Type | Public Warehouses Private Warehouses Automated Warehouses Distribution Centers Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | England Scotland Wales Northern Ireland |

| By Technology | AI and Machine Learning IoT Solutions Big Data Analytics Robotics and Automation Others |

| By Application | Inventory Management Order Fulfillment Supply Chain Optimization Demand Forecasting Labor Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Supply Chain Management | 50 | Operations Directors, Supply Chain Analysts |

| E-commerce Fulfillment Strategies | 45 | eCommerce Managers, Distribution Center Supervisors |

| Cold Chain Logistics | 40 | Cold Storage Managers, Quality Assurance Officers |

| Third-Party Logistics Providers | 50 | Business Development Managers, Account Executives |

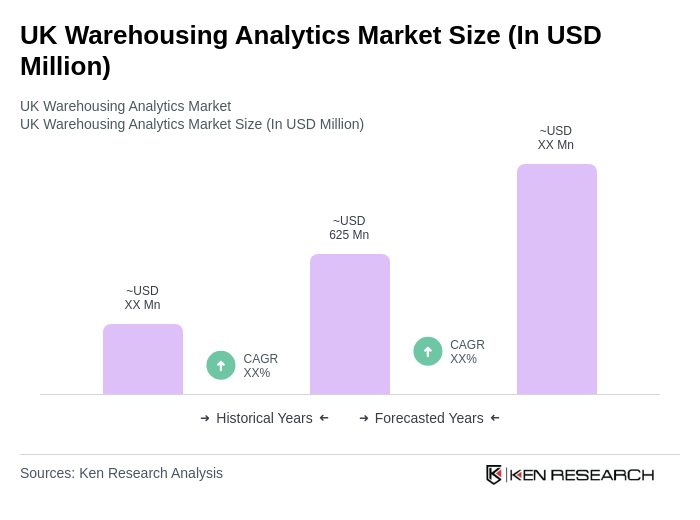

The UK Warehousing Analytics Market is valued at approximately USD 625 million, driven by the increasing demand for efficient supply chain management and real-time data analytics to optimize warehouse operations.