Region:Middle East

Author(s):Shubham

Product Code:KRAA1093

Pages:94

Published On:August 2025

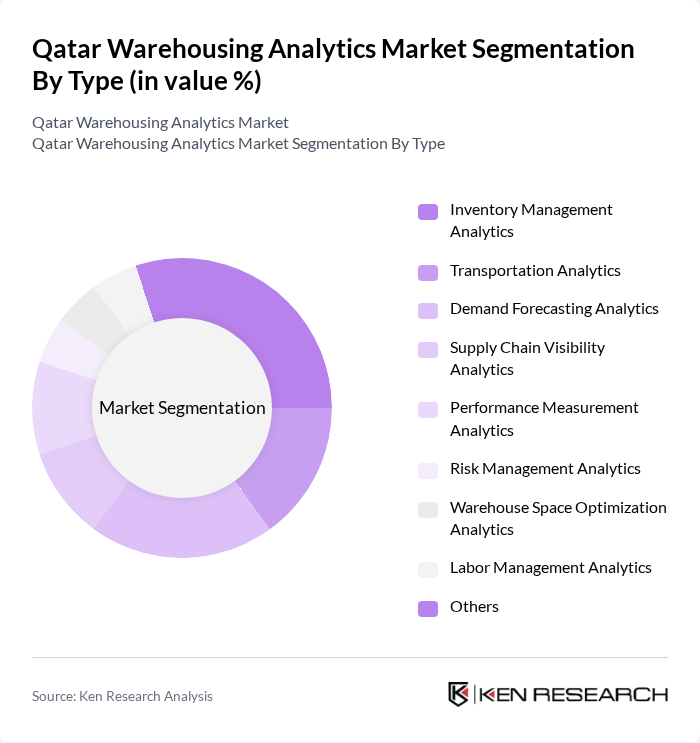

By Type:The market is segmented into various types of analytics that address different operational needs within warehousing. The subsegments include Inventory Management Analytics, Transportation Analytics, Demand Forecasting Analytics, Supply Chain Visibility Analytics, Performance Measurement Analytics, Risk Management Analytics, Warehouse Space Optimization Analytics, Labor Management Analytics, and Others. Each subsegment is integral to enhancing operational efficiency, driving data-driven decision-making, and supporting the digital transformation of warehousing operations .

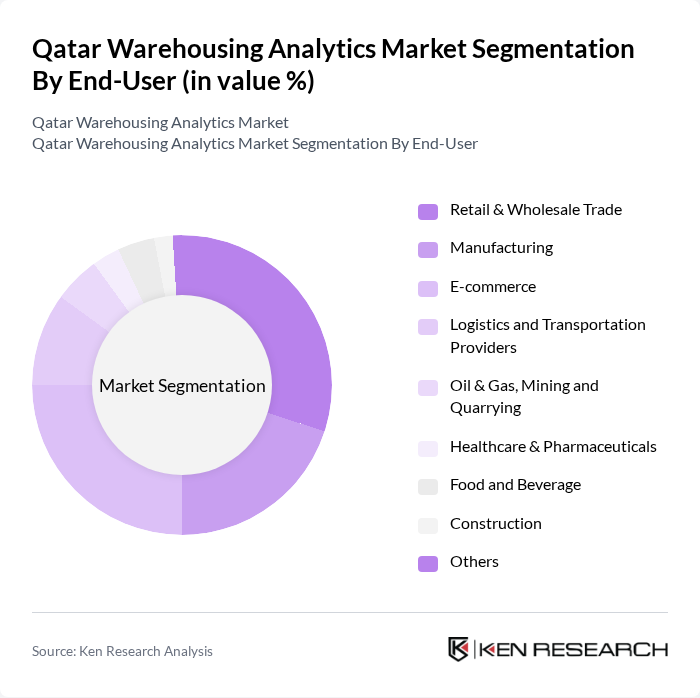

By End-User:The end-user segmentation encompasses industries that leverage warehousing analytics to enhance operational performance. The subsegments include Retail & Wholesale Trade, Manufacturing, E-commerce, Logistics and Transportation Providers, Oil & Gas, Mining and Quarrying, Healthcare & Pharmaceuticals, Food and Beverage, Construction, and Others. Each sector utilizes analytics to address unique supply chain challenges, improve resource allocation, and reduce costs through data-driven insights .

The Qatar Warehousing Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Warehousing Company (GWC), DHL Supply Chain, Kuehne + Nagel, Agility Logistics, DB Schenker, CEVA Logistics, Aramex, FedEx Logistics, UPS Supply Chain Solutions, Yusen Logistics, Expeditors International, JAS Forwarding, Maersk Logistics, Qatar Logistics (Qatar Logistics & Freight Services WLL), Panalpina (now part of DSV) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar warehousing analytics market appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to embrace AI and machine learning, the integration of predictive analytics will become more prevalent, enhancing decision-making processes. Furthermore, the shift towards cloud-based solutions will facilitate easier access to data and analytics tools, enabling businesses to respond swiftly to market changes. This evolution will likely lead to a more agile and responsive logistics sector, positioning Qatar as a leader in warehousing innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Analytics Transportation Analytics Demand Forecasting Analytics Supply Chain Visibility Analytics Performance Measurement Analytics Risk Management Analytics Warehouse Space Optimization Analytics Labor Management Analytics Others |

| By End-User | Retail & Wholesale Trade Manufacturing E-commerce Logistics and Transportation Providers Oil & Gas, Mining and Quarrying Healthcare & Pharmaceuticals Food and Beverage Construction Others |

| By Application | Warehouse Operations Optimization Inventory Control Order Fulfillment Supply Chain Management Asset Tracking Temperature-Controlled Warehousing Analytics Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | B2B B2C C2C |

| By Pricing Strategy | Cost-Plus Pricing Value-Based Pricing Competitive Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Supply Chain Logistics | 50 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 40 | eCommerce Operations Managers, Inventory Control Specialists |

| Cold Storage Facilities | 40 | Facility Managers, Quality Assurance Officers |

| Third-Party Logistics Providers | 40 | Business Development Managers, Client Relationship Managers |

The Qatar Warehousing Analytics Market is valued at approximately USD 1.1 billion, driven by the growth of e-commerce, investments in logistics infrastructure, and the adoption of advanced technologies like AI and IoT in warehousing operations.