Region:Middle East

Author(s):Shubham

Product Code:KRAA1146

Pages:86

Published On:August 2025

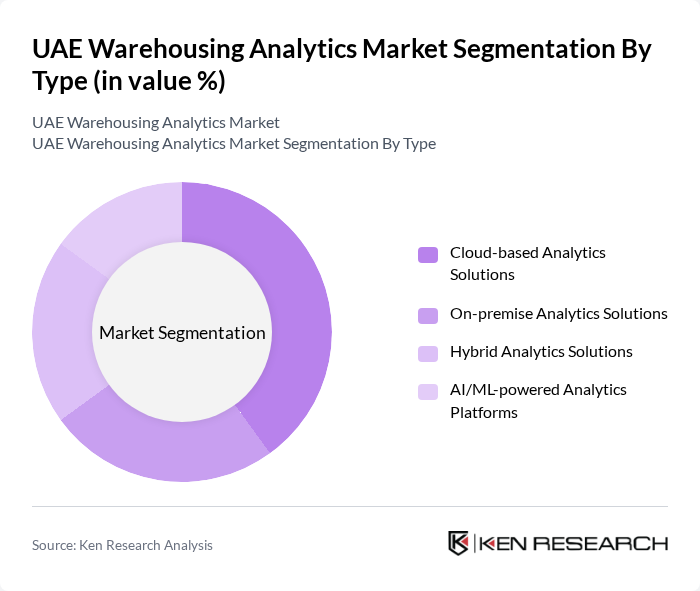

By Type:The market is segmented into various types of analytics solutions that cater to different operational needs. The subsegments include Cloud-based Analytics Solutions, On-premise Analytics Solutions, Hybrid Analytics Solutions, and AI/ML-powered Analytics Platforms. Each of these subsegments plays a crucial role in enhancing operational efficiency and decision-making processes within warehouses. Cloud-based solutions are particularly favored for their scalability, cost-effectiveness, and seamless integration with other digital platforms, while AI/ML-powered platforms are gaining traction for their ability to provide predictive and prescriptive insights .

The Cloud-based Analytics Solutions subsegment is currently dominating the market due to its scalability, cost-effectiveness, and ease of integration with existing systems. Businesses are increasingly opting for cloud solutions to leverage real-time data analytics, which enhances inventory management and operational efficiency. The flexibility offered by cloud-based platforms allows companies to adapt quickly to changing market demands, making it a preferred choice among various industries .

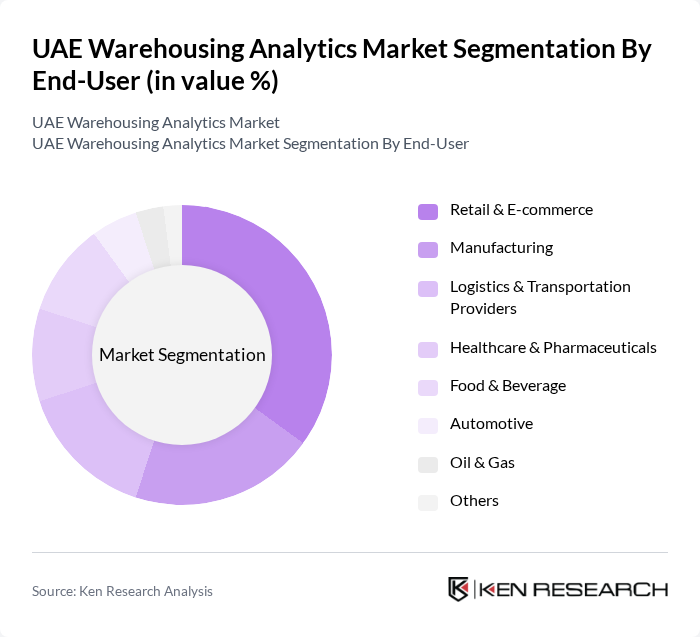

By End-User:The market is segmented based on various end-user industries, including Retail & E-commerce, Manufacturing, Logistics & Transportation Providers, Healthcare & Pharmaceuticals, Food & Beverage, Automotive, Oil & Gas, and Others. Each of these sectors utilizes warehousing analytics to improve operational efficiency and decision-making. Retail & E-commerce is the largest segment, driven by the need for real-time inventory tracking, demand forecasting, and enhanced customer fulfillment. Manufacturing and logistics providers are also significant adopters, leveraging analytics for process optimization and cost reduction .

The Retail & E-commerce sector is the leading end-user of warehousing analytics, driven by the exponential growth of online shopping and the need for efficient inventory management. Companies in this sector are leveraging analytics to optimize their supply chains, enhance customer experiences, and reduce operational costs. The increasing focus on data-driven decision-making in retail is propelling the demand for advanced analytics solutions .

The UAE Warehousing Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Infor, Blue Yonder (JDA Software), Zebra Technologies, Honeywell International Inc., SSI Schaefer, Swisslog (KUKA Group), Softeon, IBM Corporation, Microlistics (WiseTech Global), Tecsys Inc., Locus Robotics, Emirates Logistics LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE warehousing analytics market appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to embrace AI and machine learning, the ability to analyze vast amounts of data in real-time will enhance decision-making processes. Furthermore, the ongoing shift towards omnichannel fulfillment strategies will necessitate more sophisticated analytics solutions, ensuring that businesses remain competitive in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Analytics Solutions On-premise Analytics Solutions Hybrid Analytics Solutions AI/ML-powered Analytics Platforms |

| By End-User | Retail & E-commerce Manufacturing Logistics & Transportation Providers Healthcare & Pharmaceuticals Food & Beverage Automotive Oil & Gas Others |

| By Application | Inventory Optimization & Forecasting Order & Fulfillment Analytics Supply Chain Visibility & Optimization Labor & Resource Analytics Asset Tracking & Utilization Risk & Compliance Analytics Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Service Type | Consulting & Advisory Services Implementation & Integration Services Managed Analytics Services Maintenance & Support Services |

| By Pricing Model | Subscription-based Pricing Pay-per-use Pricing One-time Licensing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Supply Chain Executives |

| E-commerce Fulfillment Centers | 50 | Operations Managers, Logistics Coordinators |

| Cold Storage Facilities | 40 | Facility Managers, Quality Control Supervisors |

| Third-Party Logistics Providers | 45 | Business Development Managers, Account Executives |

| Manufacturing Warehousing Solutions | 55 | Production Managers, Inventory Control Specialists |

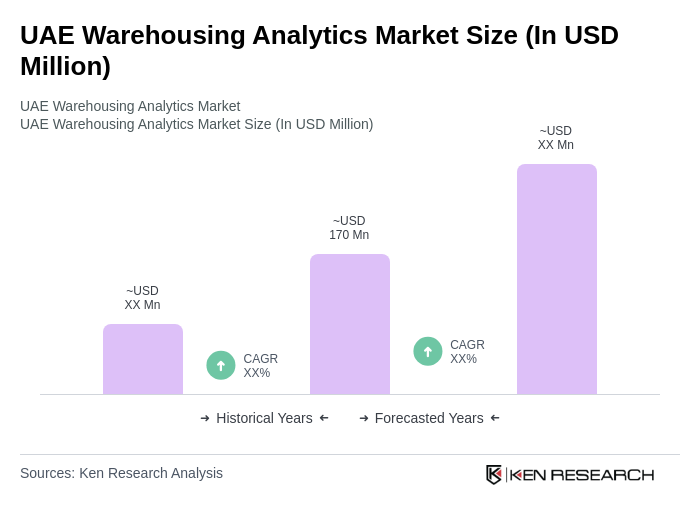

The UAE Warehousing Analytics Market is valued at approximately USD 170 million, reflecting significant growth driven by the expansion of e-commerce, demand for efficient supply chain management, and the adoption of advanced technologies like AI and machine learning.