Region:Middle East

Author(s):Dev

Product Code:KRAD4496

Pages:86

Published On:December 2025

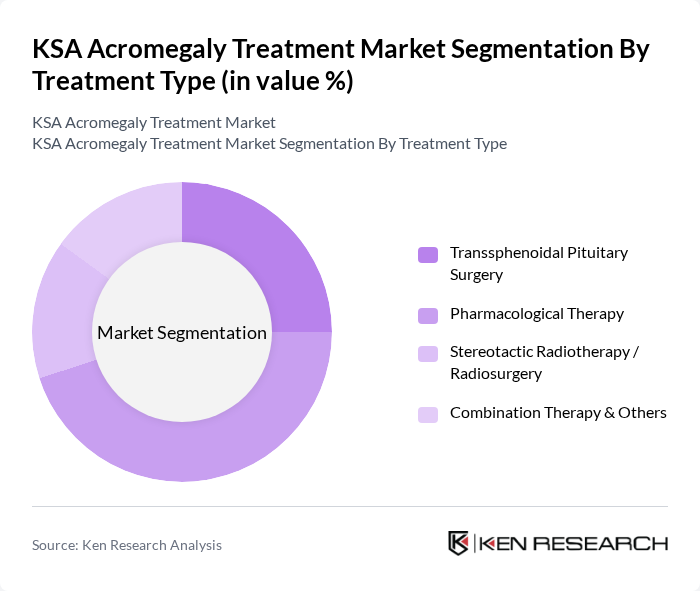

By Treatment Type:The treatment type segmentation includes various methods employed to manage acromegaly, each catering to different patient needs and clinical scenarios. The primary treatment types are Transsphenoidal Pituitary Surgery, Pharmacological Therapy, Stereotactic Radiotherapy / Radiosurgery, and Combination Therapy & Others. Contemporary regional and international practice guidelines position transsphenoidal pituitary surgery as the preferred first-line therapy for eligible patients, with strong expert consensus, while pharmacological therapy with somatostatin analogues, growth hormone receptor antagonists, and dopamine agonists is widely used as second-line therapy or when surgery is contraindicated or insufficient. In routine practice, a substantial proportion of patients receive long-term pharmacological therapy, either as monotherapy or in combination with surgery and/or radiotherapy, reflecting its central role in maintaining biochemical control of growth hormone and insulin-like growth factor-1 levels.

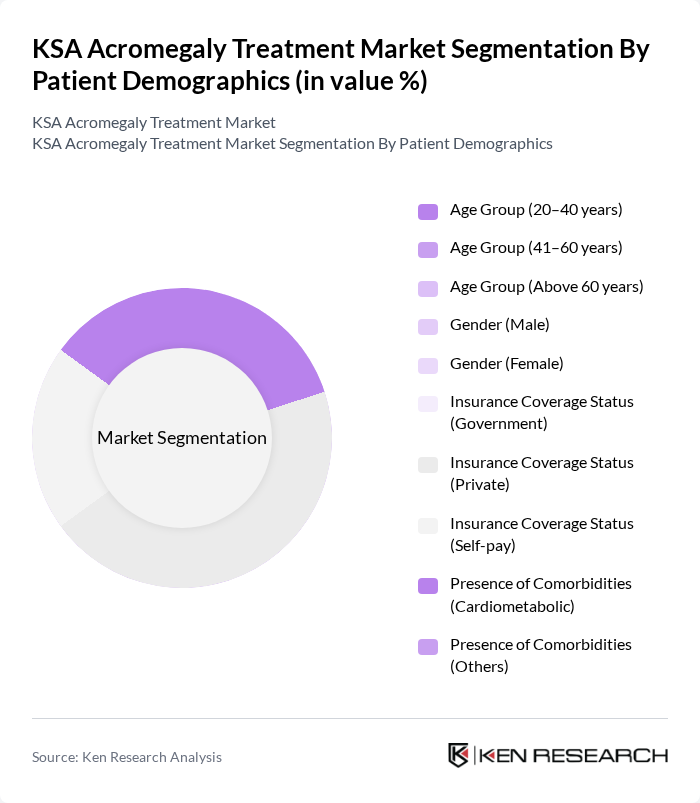

By Patient Demographics:This segmentation focuses on the characteristics of patients receiving treatment for acromegaly, including age, gender, insurance coverage, and presence of comorbidities. Acromegaly most commonly presents in middle age, and international and regional data show mean ages at diagnosis around the fifth decade of life, which is consistent with the age group of 41–60 years being the most significant demographic for diagnosed and treated patients. Additionally, the presence of comorbidities such as cardiometabolic disorders and thyroid disease is frequent in Saudi patients with acromegaly and strongly influences treatment choices, follow-up intensity, and overall outcomes, making this segment crucial for market dynamics.

The KSA Acromegaly Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis AG, Pfizer Inc., Ipsen Pharma, Recordati Rare Diseases, Teva Pharmaceutical Industries Ltd., HRA Pharma Rare Diseases, Amgen Inc., Sanofi, Merck & Co., Inc. (MSD), Eli Lilly and Company, Æterna Zentaris Inc., Sandoz Group AG, Genentech, Inc. (a member of the Roche Group), Bayer AG, Crinetics Pharmaceuticals, Inc. contribute to innovation, geographic expansion, and service delivery in this space. Key branded agents commonly used in acromegaly management globally and available in Gulf markets include somatostatin analogues (e.g., octreotide and lanreotide) and growth hormone receptor antagonists (e.g., pegvisomant), with formulary and tender decisions in KSA shaping the competitive positioning of these companies.

The KSA acromegaly treatment market is poised for significant growth driven by advancements in medical technology and increasing healthcare investments. The integration of telemedicine and digital health solutions is expected to enhance patient access to specialized care, particularly in underserved regions. Furthermore, ongoing collaborations between pharmaceutical companies and research institutions will likely lead to the development of innovative therapies, improving treatment efficacy and patient outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Transsphenoidal Pituitary Surgery Pharmacological Therapy Stereotactic Radiotherapy / Radiosurgery Combination Therapy & Others |

| By Patient Demographics | Age Group (20–40 years, 41–60 years, Above 60 years) Gender (Male, Female) Insurance Coverage Status (Government, Private, Self?pay) Presence of Comorbidities (Cardiometabolic, Others) |

| By Treatment Setting | Tertiary Care / Specialist Hospitals Secondary / General Hospitals Specialized Endocrinology & Neurosurgery Clinics Others |

| By Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam, Al?Khobar) Western Region (incl. Jeddah, Makkah, Madinah) Southern & Northern Regions |

| By Drug Class | Somatostatin Analogues (SSAs) Growth Hormone Receptor Antagonists (GHRAs) Dopamine Agonists Emerging / Investigational Therapies |

| By Distribution Channel | Hospital Pharmacies Retail / Community Pharmacies Online & Mail?Order Pharmacies Others |

| By Clinical Trial Phases (Pipeline in KSA / GCC) | Phase I Phase II Phase III Phase IV / Post?marketing Studies & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists in KSA | 60 | Endocrinologists, Medical Directors |

| Patients with Acromegaly | 120 | Acromegaly Patients, Patient Advocacy Group Members |

| Healthcare Administrators | 60 | Hospital Administrators, Health Policy Makers |

| Pharmaceutical Representatives | 50 | Sales Representatives, Product Managers |

| Clinical Researchers | 40 | Clinical Researchers, Academic Physicians |

The KSA Acromegaly Treatment Market is valued at approximately USD 140 million, reflecting a five-year historical analysis that highlights the increasing recognition of acromegaly as a rare endocrine disorder and the expansion of specialized treatment services in the Kingdom.