Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8182

Pages:82

Published On:December 2025

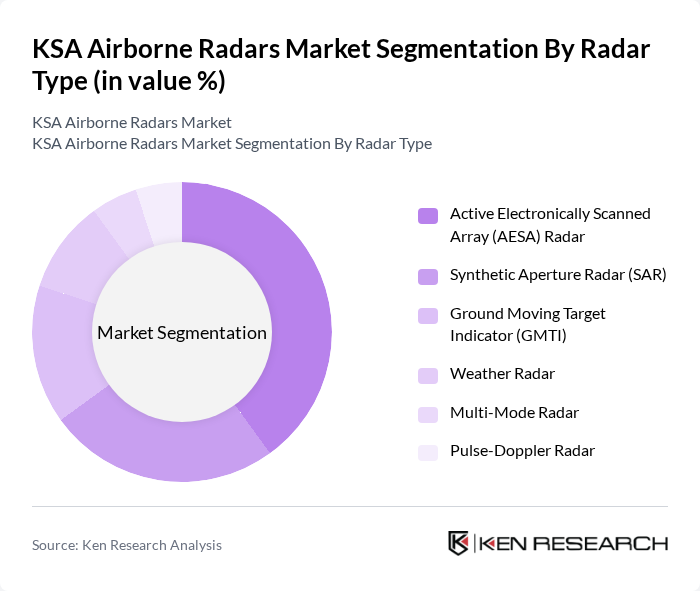

By Radar Type:

The radar type segmentation includes Active Electronically Scanned Array (AESA) Radar, Synthetic Aperture Radar (SAR), Ground Moving Target Indicator (GMTI), Weather Radar, Multi-Mode Radar, and Pulse-Doppler Radar. Among these, the Active Electronically Scanned Array (AESA) Radar is leading the market due to its advanced capabilities in target detection and tracking, which are essential for modern warfare. The increasing demand for high-resolution imaging and real-time data processing in military applications further drives the adoption of AESA technology. The versatility and efficiency of AESA systems make them a preferred choice for both air and ground platforms.

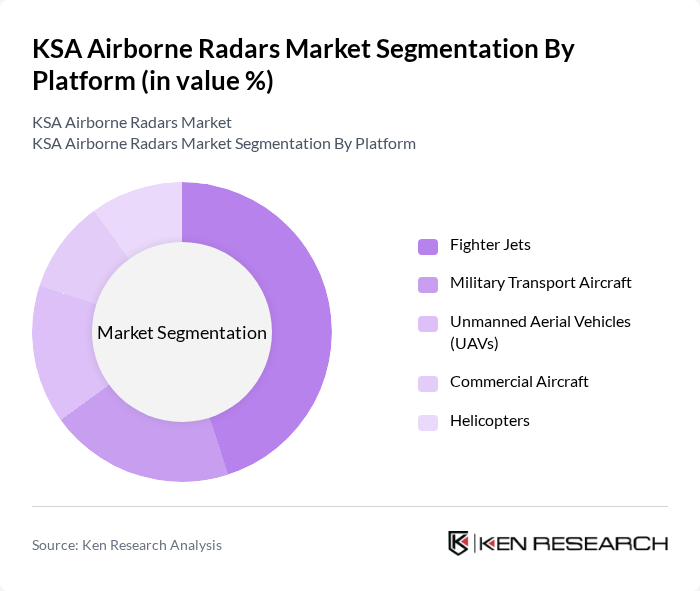

By Platform:

The platform segmentation encompasses Fighter Jets, Military Transport Aircraft, Unmanned Aerial Vehicles (UAVs), Commercial Aircraft, and Helicopters. The Fighter Jets segment is currently dominating the market, driven by the increasing need for advanced air combat capabilities and the integration of sophisticated radar systems for enhanced situational awareness. The growing focus on air superiority and the modernization of existing fleets are key factors contributing to the demand for airborne radars in fighter jets. Additionally, the rise of UAVs is also notable, as they are increasingly being equipped with advanced radar systems for surveillance and reconnaissance missions.

The KSA Airborne Radars Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raytheon Technologies Corporation, Northrop Grumman Corporation, Thales Group, Leonardo S.p.A., BAE Systems plc, Elbit Systems Ltd., Saab AB, L3Harris Technologies, Inc., General Dynamics Corporation, Israel Aerospace Industries Ltd., Indra Sistemas, S.A., Mitsubishi Electric Corporation, Honeywell International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The KSA airborne radars market is poised for significant transformation, driven by technological advancements and increasing defense budgets. As the nation seeks to enhance its military capabilities, the integration of artificial intelligence and machine learning into radar systems will become more prevalent. Additionally, the focus on multi-function radar systems will likely reshape operational strategies, enabling more efficient resource allocation and improved situational awareness. These trends will foster a more robust defense posture in the region.

| Segment | Sub-Segments |

|---|---|

| By Radar Type | Active Electronically Scanned Array (AESA) Radar Synthetic Aperture Radar (SAR) Ground Moving Target Indicator (GMTI) Weather Radar Multi-Mode Radar Pulse-Doppler Radar |

| By Platform | Fighter Jets Military Transport Aircraft Unmanned Aerial Vehicles (UAVs) Commercial Aircraft Helicopters |

| By Application | Surveillance and Airborne Early Warning (AEW) Imaging (SAR/GMTI) Weather Monitoring Navigation and Collision-Avoidance |

| By Frequency Band | L-Band (1–2 GHz) S-Band (2–4 GHz) C-Band X-Band (8–12 GHz) Ku/K/Ka-Bands (12–40 GHz) |

| By End-User | Military (Combat Aircraft, Non-Combat Aircraft, Helicopters) Commercial (Narrowbody Aircraft, Widebody Aircraft) Law Enforcement Civil Aviation Authorities |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Radar Procurement | 100 | Defense Procurement Officers, Military Strategists |

| Radar Technology Suppliers | 80 | Product Managers, Sales Directors |

| Defense Analysts | 60 | Market Analysts, Defense Policy Experts |

| Military Operations Personnel | 70 | Radar Operators, Tactical Commanders |

| Government Defense Officials | 50 | Policy Makers, Budget Analysts |

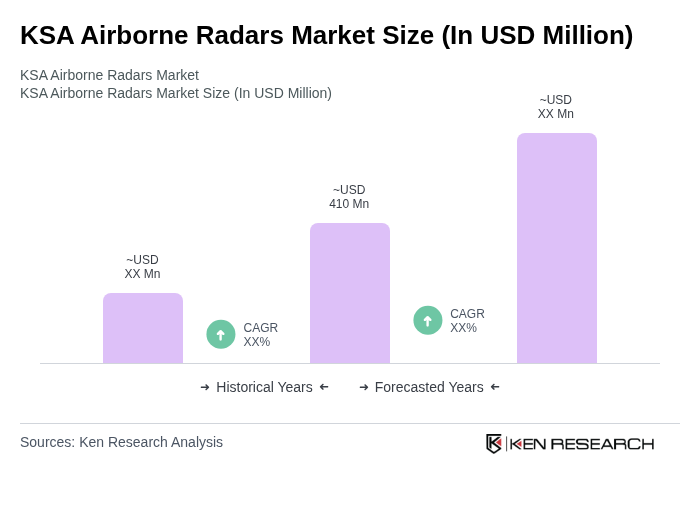

The KSA Airborne Radars Market is valued at approximately USD 410 million, reflecting a significant growth driven by increased defense budgets, modernization efforts, and rising demand for advanced surveillance systems in the region.