Region:Middle East

Author(s):Rebecca

Product Code:KRAD6271

Pages:84

Published On:December 2025

By Workflow Type:The workflow type segmentation includes various subsegments that cater to different operational needs within organizations. The dominant subsegment in this category is Document and Content Workflow Management, which is increasingly favored due to the growing need for efficient document handling and collaboration in a digital-first environment. Organizations are investing in solutions that enhance productivity and streamline processes, making this subsegment a key player in the market.

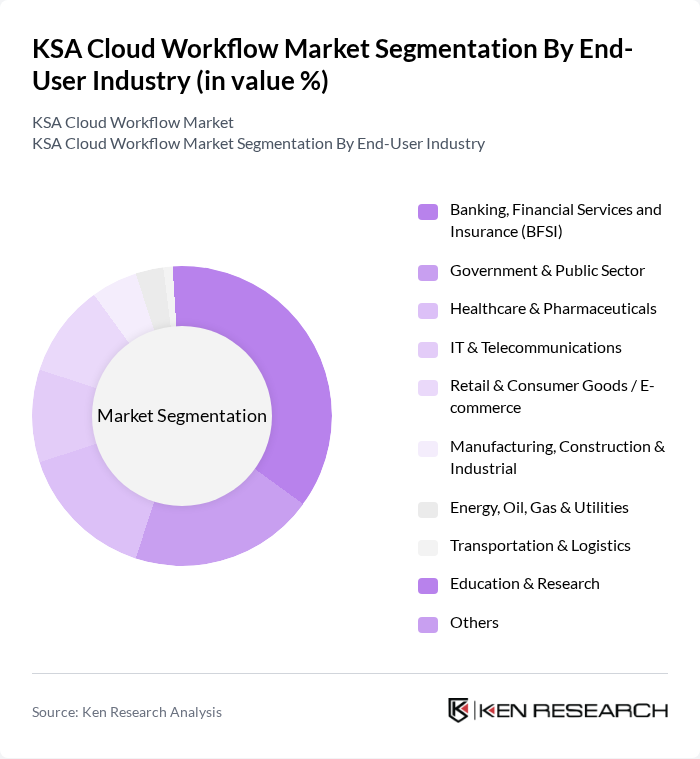

By End-User Industry:The end-user industry segmentation highlights the diverse applications of cloud workflow solutions across various sectors. The Banking, Financial Services, and Insurance (BFSI) sector is the leading subsegment, driven by stringent regulatory requirements and the need for enhanced operational efficiency. Financial institutions are increasingly adopting cloud-based workflows to streamline processes, improve customer service, and ensure compliance with evolving regulations.

The KSA Cloud Workflow Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), Oracle Cloud Infrastructure (OCI), IBM Cloud, Salesforce (Sales Cloud, Service Cloud, Salesforce Platform), ServiceNow, SAP (SAP Business Technology Platform, SAP Build Process Automation), Zoho (Zoho Creator, Zoho Flow), Nintex, Kissflow, Pegasystems, Appian, STC Cloud (Saudi Telecom Company), Saudi Data & AI Authority (SDAIA) / Tawuniya Cloud & Digital Platforms contribute to innovation, geographic expansion, and service delivery in this space.

The KSA Cloud Workflow Market is poised for significant evolution, driven by technological advancements and changing business needs. As organizations increasingly embrace hybrid cloud solutions, the integration of AI and machine learning will enhance workflow efficiency. Additionally, the emphasis on user-friendly interfaces will facilitate broader adoption across various sectors. The market is expected to witness a surge in demand for analytics tools, enabling businesses to derive actionable insights from their operations, ultimately fostering a data-driven culture.

| Segment | Sub-Segments |

|---|---|

| By Workflow Type | Document and Content Workflow Management Business Process Workflow Automation IT Service & Operations Workflow (ITSM, DevOps) Case Management & Ticketing Workflows HR & Employee Onboarding Workflows Finance & Procurement Workflows (P2P, O2C, Approvals) Industry-Specific Workflow Applications |

| By End-User Industry | Banking, Financial Services and Insurance (BFSI) Government & Public Sector Healthcare & Pharmaceuticals IT & Telecommunications Retail & Consumer Goods / E?commerce Manufacturing, Construction & Industrial Energy, Oil, Gas & Utilities Transportation & Logistics Education & Research Others |

| By Deployment Model | Public Cloud SaaS Private Cloud / Dedicated SaaS Hybrid Cloud Multi-Cloud |

| By Region | Northern & Central Region (incl. Riyadh) Western Region (incl. Jeddah, Makkah, Madinah) Eastern Region (incl. Dammam, Dhahran) Southern Region |

| By Organization Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Service Type | Software Subscription (SaaS Licenses) Implementation & Integration Services Managed Services (Administration, Monitoring) Training, Support & Consulting |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Cloud Workflow Solutions | 100 | IT Managers, Healthcare Administrators |

| Financial Services Automation | 80 | Chief Technology Officers, Compliance Officers |

| Education Sector Digital Transformation | 70 | IT Directors, Academic Administrators |

| Manufacturing Workflow Optimization | 60 | Operations Managers, Production Supervisors |

| Retail Cloud Solutions Adoption | 90 | Supply Chain Managers, E-commerce Directors |

The KSA Cloud Workflow Market is valued at approximately USD 1.1 billion, driven by the Kingdom's Cloud First Policy and the increasing demand for efficient workflow automation solutions across both public and private sectors.