Region:Middle East

Author(s):Dev

Product Code:KRAD7847

Pages:86

Published On:December 2025

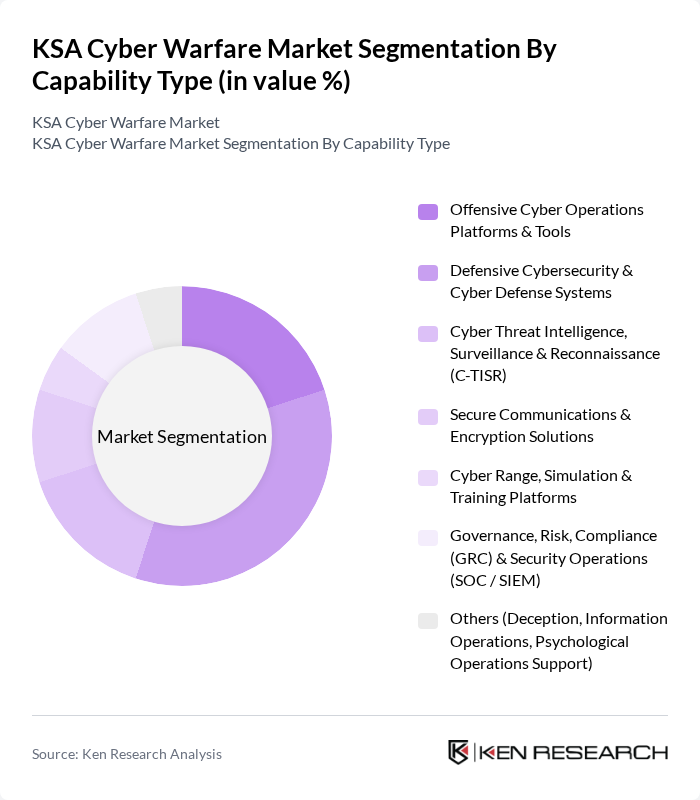

By Capability Type:The capability type segmentation includes various subsegments that cater to different aspects of cyber warfare. The dominant subsegment is Defensive Cybersecurity & Cyber Defense Systems, which is crucial for protecting national assets and infrastructure from cyber threats, in line with national priorities around critical infrastructure, government services, and financial systems. The increasing frequency and sophistication of cyberattacks, particularly targeting energy, oil and gas, and government services, has led to a surge in demand for advanced defensive solutions, including next-generation network security, identity and access management, cloud security, and industrial cyber defense platforms, making this subsegment a priority for both government and private sectors. Other notable subsegments include Offensive Cyber Operations Platforms & Tools and Cyber Threat Intelligence, Surveillance & Reconnaissance (C-TISR), which are also gaining traction as organizations seek to enhance their proactive and reactive capabilities through threat hunting, security operations centers, advanced analytics, and cyber range-based training.

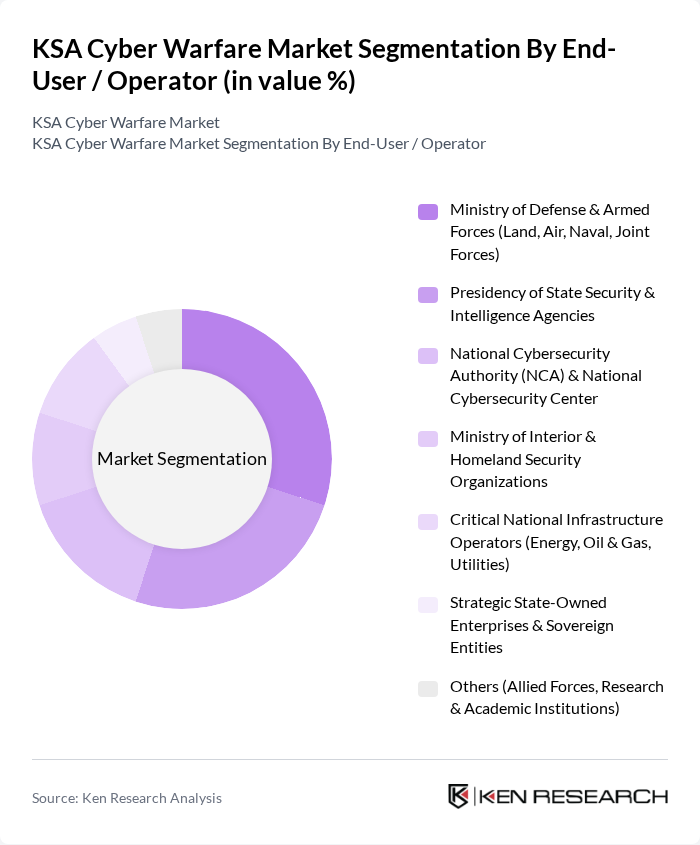

By End-User / Operator:The end-user segmentation highlights various operators involved in the KSA Cyber Warfare Market. The Ministry of Defense & Armed Forces is the leading subsegment, driven by the need for enhanced security measures in military operations, joint command-and-control systems, and protection of defense networks as Saudi Arabia scales up defense localization and advanced electronic warfare capabilities. This segment is followed by the National Cybersecurity Authority (NCA) and the Presidency of State Security, both of which play critical roles in national security, intelligence, and the implementation and supervision of national cybersecurity controls, audits, and incident response coordination. The increasing focus on protecting critical national infrastructure has also led to significant investments from organizations in the energy and utilities sectors, particularly oil and gas, power, and water, where industrial control systems and operational technology have become prime targets for advanced cyber threats.

The KSA Cyber Warfare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Information Technology Company (SITE), Saudi Arabian Military Industries (SAMI) – Cyber & Advanced Electronics Units, STC Solutions (Including Cybersecurity & Managed Security Services), Elm Company (Digital Security & Government Platforms), National Cybersecurity Authority–Affiliated Operational Entities, NEOM & Royal Commission Smart City Cyber Programs (Key Program Integrators), Saudi Aramco Cybersecurity & Industrial Cyber Defense Units, Lockheed Martin (Cyber & C4ISR Programs in KSA), Raytheon Technologies (RTX) – Intelligence & Cyber Systems, BAE Systems Saudi Arabia – Cyber & Electronic Systems, Northrop Grumman – Cyber & Networked Warfare Solutions, Booz Allen Hamilton – Cyber Warfare, Intelligence & Defense Consulting, Cisco Systems – Secure Networking for Defense & Critical Infrastructure, IBM Security & IBM Consulting – Defense, Government & Critical Infrastructure Cyber, Palo Alto Networks & Managed Security Partners in KSA contribute to innovation, geographic expansion, and service delivery in this space.

The KSA Cyber Warfare Market is poised for significant evolution, driven by technological advancements and increasing awareness of cybersecurity's importance. As organizations embrace digital transformation, the integration of AI and machine learning into cybersecurity practices will enhance threat detection and response capabilities. Additionally, the shift towards zero trust security models will redefine security frameworks, ensuring robust protection against evolving threats. The focus on cyber resilience will further shape strategies, emphasizing the need for continuous improvement and adaptation in cybersecurity measures.

| Segment | Sub-Segments |

|---|---|

| By Capability Type | Offensive Cyber Operations Platforms & Tools Defensive Cybersecurity & Cyber Defense Systems Cyber Threat Intelligence, Surveillance & Reconnaissance (C-TISR) Secure Communications & Encryption Solutions Cyber Range, Simulation & Training Platforms Governance, Risk, Compliance (GRC) & Security Operations (SOC / SIEM) Others (Deception, Information Operations, Psychological Operations Support) |

| By End-User / Operator | Ministry of Defense & Armed Forces (Land, Air, Naval, Joint Forces) Presidency of State Security & Intelligence Agencies National Cybersecurity Authority (NCA) & National Cybersecurity Center Ministry of Interior & Homeland Security Organizations Critical National Infrastructure Operators (Energy, Oil & Gas, Utilities) Strategic State-Owned Enterprises & Sovereign Entities Others (Allied Forces, Research & Academic Institutions) |

| By Targeted Domain | Command, Control, Communications, Computers, Intelligence, Surveillance & Reconnaissance (C4ISR) Critical Infrastructure & Industrial Control Systems (OT / ICS) Government & Defense Networks (IT) Space, Satellite & Strategic Communications Financial & Strategic Economic Systems Others (Civilian Networks Supporting Military Operations) |

| By Deployment Mode | On-Premises / Air-Gapped Defense Networks Sovereign / Private Cloud for Defense & Government Hybrid Architectures Others (Forward-Deployed & Tactical Environments) |

| By Service Type | Managed Security & Managed Detection and Response (MSS/MDR) Cyber Warfare Consulting, Design & Systems Integration Threat Hunting, Incident Response & Digital Forensics Training, Doctrine Development & Red/Blue Team Services |

| By Region in KSA | Central Region (Including Riyadh) Eastern Region (Including Dammam, Dhahran, Aramco Hubs) Western Region (Including Jeddah, Makkah, Madinah) Southern Region Northern & Border Regions |

| By Funding & Policy Support | Vision 2030 Defense & Cybersecurity Programs Government Procurement & Offset / Localization (GAMI, SAMI, Local Content) Public-Private Partnerships & Joint Ventures International Cooperation, Alliances & Capacity-Building Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity Strategies | 120 | CIOs, IT Security Managers |

| Healthcare Cyber Defense Mechanisms | 90 | Compliance Officers, IT Directors |

| Government Cybersecurity Initiatives | 80 | Policy Makers, Cybersecurity Analysts |

| Telecommunications Security Protocols | 70 | Network Security Engineers, Operations Managers |

| SME Cybersecurity Adoption Trends | 100 | Business Owners, IT Consultants |

The KSA Cyber Warfare Market is valued at approximately USD 4.7 billion, driven by increased investments in cybersecurity infrastructure and heightened awareness of cyber threats, alongside government initiatives to enhance national security through advanced technological solutions.