Region:Middle East

Author(s):Dev

Product Code:KRAD4407

Pages:85

Published On:December 2025

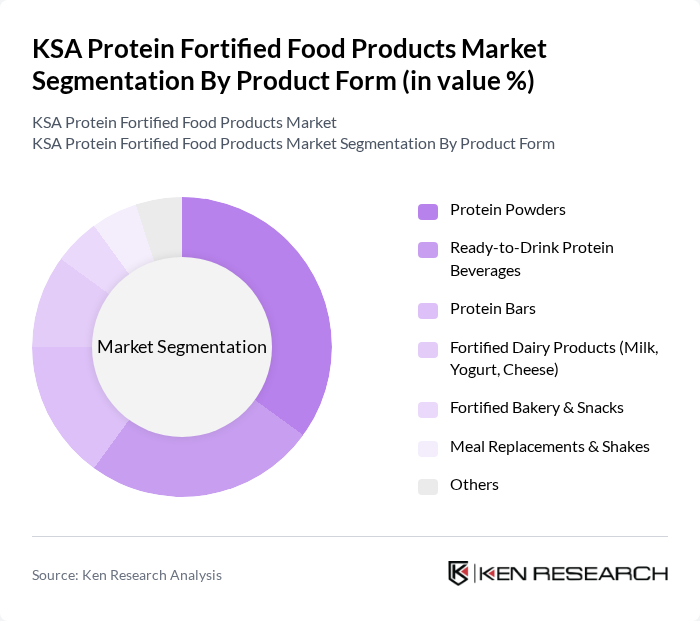

By Product Form:The market is segmented into various product forms, including Protein Powders, Ready-to-Drink Protein Beverages, Protein Bars, Fortified Dairy Products (Milk, Yogurt, Cheese), Fortified Bakery & Snacks, Meal Replacements & Shakes, and Others. Among these, Protein Powders have emerged as the leading subsegment due to their popularity among fitness enthusiasts and athletes seeking convenient protein sources. The increasing trend of home workouts and fitness regimes has further fueled the demand for protein powders, making them a staple in many households.

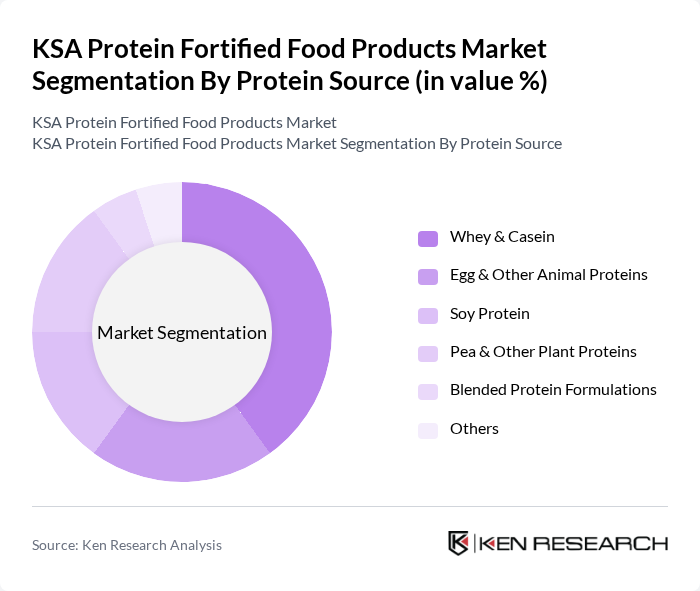

By Protein Source:The market is also segmented by protein source, including Whey & Casein, Egg & Other Animal Proteins, Soy Protein, Pea & Other Plant Proteins, Blended Protein Formulations, and Others. Whey & Casein proteins dominate this segment due to their high biological value and effectiveness in muscle recovery, making them the preferred choice among athletes and bodybuilders. The increasing awareness of the benefits of protein supplementation has led to a significant rise in the consumption of whey and casein-based products.

The KSA Protein Fortified Food Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Saudi Dairy & Foodstuff Company (SADAFCO), Nadec Foods (National Agricultural Development Company), Al Safi Danone, Nestlé Saudi Arabia, Baladna Saudi (Joint Ventures & Imports), Arla Foods Saudi Arabia, United Food Industries Corporation Ltd. (UFIC), Halwani Bros. Co., Savola Foods Company, Abdulla Al Othaim Markets Co. (Private Label Protein Products), Panda Retail Company (Private Label Protein Products), Saudia Dairy & Beverage Company (SDBC), Al Rabie Saudi Foods Co., Gulf Union Foods Co. contribute to innovation, geographic expansion, and service delivery in this space.

The KSA protein fortified food products market is poised for significant growth, driven by evolving consumer preferences and increasing health awareness. As the population becomes more health-conscious, the demand for innovative and nutritious food options will rise. Additionally, the government's support for local producers and initiatives promoting healthy eating will further enhance market dynamics. The integration of technology in product development and marketing strategies will also play a crucial role in shaping the future landscape of this market.

| Segment | Sub-Segments |

|---|---|

| By Product Form | Protein Powders Ready-to-Drink Protein Beverages Protein Bars Fortified Dairy Products (Milk, Yogurt, Cheese) Fortified Bakery & Snacks Meal Replacements & Shakes Others |

| By Protein Source | Whey & Casein Egg & Other Animal Proteins Soy Protein Pea & Other Plant Proteins Blended Protein Formulations Others |

| By Consumer Group | Sports & Fitness Enthusiasts General Health-Conscious Adults Children & Adolescents Clinical & Medical Nutrition Users Elderly Population Others |

| By Distribution Channel | Supermarkets and Hypermarkets Pharmacies & Drugstores Specialty Nutrition & Health Stores Gyms, Fitness Centers & Health Clubs Online Retail & E-commerce Platforms Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Nutritional Positioning | High Protein High Protein & Low Sugar High Protein & Low Fat High Protein & Functional (with Vitamins, Minerals, or Other Actives) Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Protein Fortified Foods | 120 | Store Managers, Category Buyers |

| Manufacturers of Fortified Food Products | 90 | Production Managers, Quality Assurance Heads |

| Health and Nutrition Experts | 60 | Registered Dietitians, Nutrition Researchers |

| Consumer Insights on Fortified Foods | 130 | Health-Conscious Consumers, Parents |

| Regulatory Bodies and Policy Makers | 40 | Food Safety Inspectors, Policy Analysts |

The KSA Protein Fortified Food Products Market is valued at approximately USD 770 million, reflecting a significant growth trend driven by increasing health consciousness and demand for high-protein foods among consumers.