Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3879

Pages:80

Published On:November 2025

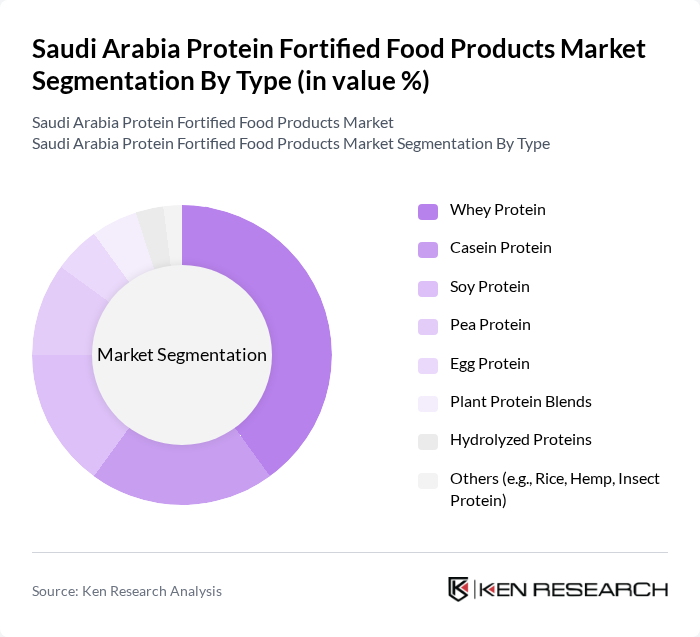

By Type:The market is segmented into various types of protein sources, including whey protein, casein protein, soy protein, pea protein, egg protein, plant protein blends, hydrolyzed proteins, and others such as rice, hemp, and insect protein. Among these, whey protein is the most dominant due to its high bioavailability and popularity in sports nutrition. The increasing trend of fitness and bodybuilding has led to a surge in demand for whey protein products, making it a preferred choice among consumers. Plant-based proteins, particularly soy and pea, are also gaining traction as consumers seek alternative protein sources for health and sustainability reasons .

By End-User:The end-user segmentation includes the food and beverage industry, nutraceuticals, sports nutrition, infant and clinical nutrition, animal feed, retail consumers, and others. The food and beverage industry is the leading segment, driven by the increasing incorporation of protein fortification in various food products, including snacks, beverages, and meal replacements. The growing trend of health and wellness among consumers has led to a significant rise in demand for protein-enriched food options. Nutraceuticals and sports nutrition are also expanding rapidly as consumers seek convenient and functional protein sources for specific health outcomes .

The Saudi Arabia Protein Fortified Food Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Nestlé Saudi Arabia LLC, Danone Saudi Arabia, Al Safi Danone Ltd., Al Ain Dairy, Al Watania Poultry, United Food Industries Corporation Ltd., Al Othaim Holding (Al Othaim Foods), Nadec Foods (National Agricultural Development Company), Al Jazeera Food Company, Al Kabeer Group, Al Faisaliah Foods, Al Muhaidib Foods, SADAFCO (Saudia Dairy & Foodstuff Company), Halwani Bros. Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the protein fortified food products market in Saudi Arabia appears promising, driven by evolving consumer preferences and government support. As health awareness continues to rise, the demand for innovative and convenient protein-rich options is expected to grow. Additionally, advancements in food technology will likely lead to the development of new protein sources, enhancing product variety and appeal. The market is poised for expansion, particularly in e-commerce, which will facilitate broader access to these products.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Casein Protein Soy Protein Pea Protein Egg Protein Plant Protein Blends Hydrolyzed Proteins Others (e.g., Rice, Hemp, Insect Protein) |

| By End-User | Food & Beverage Industry Nutraceuticals Sports Nutrition Infant & Clinical Nutrition Animal Feed Retail Consumers Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Health Food Stores Direct Sales Specialty Stores Others |

| By Product Form | Powder Ready-to-Drink Beverages Protein Bars Fortified Snacks Bakery Products Others |

| By Age Group | Children Adults Seniors/Elderly Others |

| By Packaging Type | Bags Tubs Bottles Pouches Sachets Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness of Protein Fortified Foods | 120 | Health-conscious Consumers, Families with Children |

| Retailer Insights on Product Demand | 45 | Store Managers, Category Buyers |

| Manufacturer Perspectives on Market Trends | 35 | Product Development Managers, Marketing Directors |

| Nutritionist Opinions on Fortification Benefits | 30 | Registered Dietitians, Nutrition Consultants |

| Government and Regulatory Insights | 25 | Policy Makers, Health Officials |

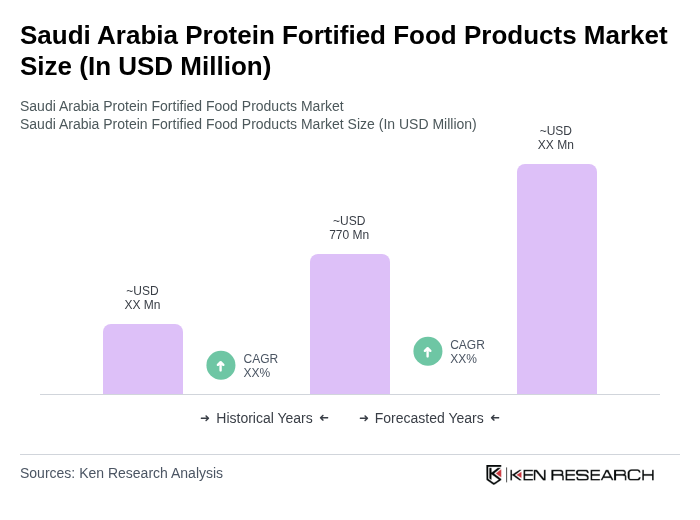

The Saudi Arabia Protein Fortified Food Products Market is valued at approximately USD 770 million, reflecting a significant growth trend driven by increasing health consciousness and demand for protein-rich diets among consumers.