Region:Middle East

Author(s):Rebecca

Product Code:KRAD7572

Pages:88

Published On:December 2025

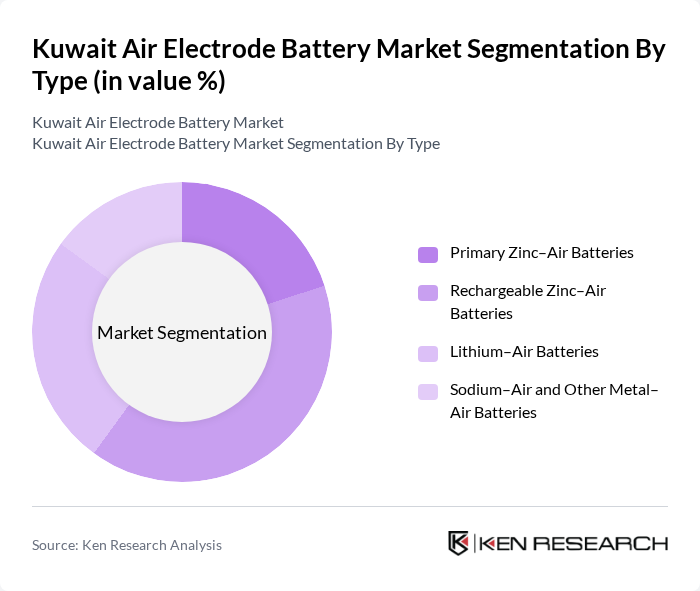

By Type:

The market is segmented into four main types: Primary Zinc–Air Batteries, Rechargeable Zinc–Air Batteries, Lithium–Air Batteries, and Sodium–Air and Other Metal–Air Batteries. Primary zinc–air batteries remain widely used in hearing aids and select consumer devices due to their high energy density and cost-effective single-use format. Rechargeable zinc–air and other rechargeable metal–air chemistries are gaining traction for stationary storage and longer-duration applications because they offer high specific energy and the potential for lower material costs compared with many conventional chemistries. Lithium–air and sodium–air batteries are at an earlier commercialization stage, with activity concentrated in pilot and R&D deployments, but they are increasingly considered for future electric mobility and grid-scale storage due to their theoretical ultra-high energy density. In Kuwait, demand is currently strongest for zinc–air and related metal–air solutions in backup power, telecom, and specialized industrial uses, with growing interest from project developers in integrating these chemistries alongside lithium-ion systems for renewable and long-duration storage.

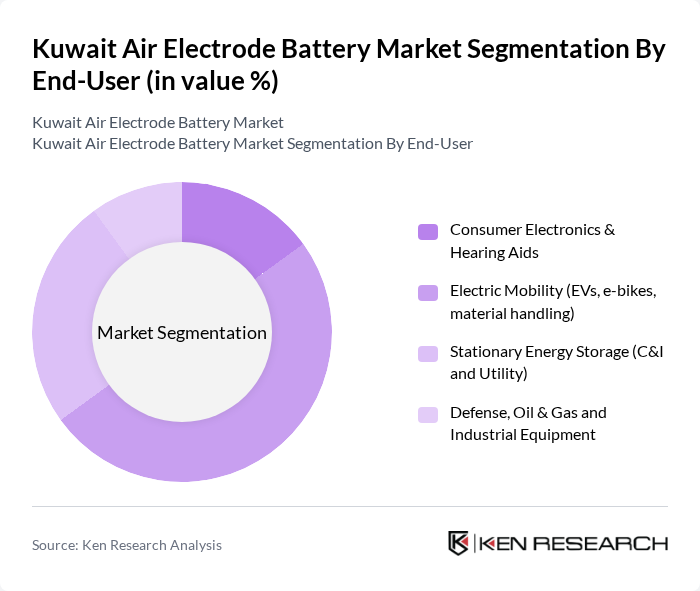

By End-User:

The end-user segmentation includes Consumer Electronics & Hearing Aids, Electric Mobility (EVs, e-bikes, material handling), Stationary Energy Storage (C&I and Utility), and Defense, Oil & Gas and Industrial Equipment. Consumer electronics and hearing aids represent a stable demand base for primary zinc–air cells, which are a standard power source in many hearing aid models due to their high energy density and steady voltage profile. Electric mobility and broader transportation uses are a key long-term opportunity for air electrode batteries globally, supported by the rapid growth of the EV and e-mobility ecosystem in GCC markets and the need for higher-range, lightweight storage solutions. Stationary energy storage for commercial, industrial, and utility applications is an increasingly important segment, where metal–air systems are being evaluated for renewable integration, backup power, and long-duration storage to complement lithium-ion installations. Defense, oil & gas, and industrial users in Kuwait are also exploring metal–air technologies for remote operations, emergency backup, and mission-critical equipment, driven by requirements for compact, high-energy solutions capable of operating in harsh environments.

The Kuwait Air Electrode Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Energy Co., Ltd., Duracell Inc., Energizer Holdings, Inc., GP Batteries International Limited, VARTA AG, Spectrum Brands Holdings, Inc. (Rayovac), LG Energy Solution Ltd., Samsung SDI Co., Ltd., Saft Groupe S.A., Zinc8 Energy Solutions Inc., NantEnergy, Inc., Phinergy Ltd., POLY PLUS Battery Company, ZAF Energy Systems, Inc., EnerVenue Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the air electrode battery market in Kuwait appears promising, driven by increasing investments in renewable energy and technological advancements. As the government continues to implement policies supporting sustainable energy, the market is expected to witness a surge in adoption rates. Additionally, the growing focus on energy efficiency and environmental sustainability will likely encourage further research and development, paving the way for innovative solutions that enhance battery performance and reduce costs.

| Segment | Sub-Segments |

|---|---|

| By Type | Primary Zinc–Air Batteries Rechargeable Zinc–Air Batteries Lithium–Air Batteries Sodium–Air and Other Metal–Air Batteries |

| By End-User | Consumer Electronics & Hearing Aids Electric Mobility (EVs, e-bikes, material handling) Stationary Energy Storage (C&I and Utility) Defense, Oil & Gas and Industrial Equipment |

| By Application | Grid-Scale and Behind-the-Meter Energy Storage Electric and Hybrid Vehicles Portable and Wearable Electronics Backup Power and Remote / Off-Grid Systems |

| By Distribution Channel | Direct OEM Supply & Project Sales Industrial Distributors & System Integrators Retail and Online Channels EPC / Turnkey Energy Solution Providers |

| By Technology | Metal–Air (Zinc–Air, Lithium–Air, Sodium–Air) Hybrid Metal–Air with Lithium-Ion Systems Advanced Air Electrode & Catalyst Technologies |

| By Market Segment | Utility-Scale Renewable Integration Commercial & Industrial Microgrids Residential & Small Commercial Storage Specialized and Niche Applications |

| By Policy Support | Renewable Energy & Storage Procurement Targets Import Duty & Tax Incentives for Advanced Batteries R&D Grants and Pilot Project Support Local Content & Industrial Diversification Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Battery Manufacturers | 45 | Production Managers, Technical Directors |

| Renewable Energy Storage Solutions | 40 | Project Managers, Energy Consultants |

| Government Energy Policy Makers | 30 | Policy Analysts, Regulatory Affairs Managers |

| Research Institutions in Battery Technology | 35 | Lead Researchers, Academic Professors |

| Battery Recycling and Disposal Companies | 40 | Operations Managers, Environmental Compliance Officers |

The Kuwait Air Electrode Battery Market is valued at approximately USD 160 million, driven by the increasing demand for energy storage solutions, electric mobility, and advancements in battery technologies that enhance energy density and cost-efficiency.