Region:Middle East

Author(s):Shubham

Product Code:KRAC2813

Pages:84

Published On:October 2025

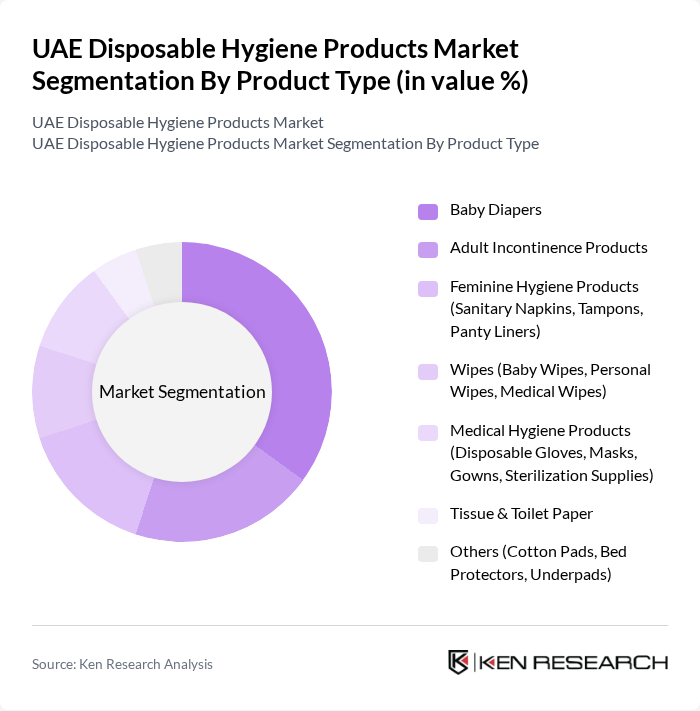

By Product Type:The product type segmentation includes Baby Diapers, Adult Incontinence Products, Feminine Hygiene Products (Sanitary Napkins, Tampons, Panty Liners), Wipes (Baby Wipes, Personal Wipes, Medical Wipes), Medical Hygiene Products (Disposable Gloves, Masks, Gowns, Sterilization Supplies), Tissue & Toilet Paper, and Others (Cotton Pads, Bed Protectors, Underpads). Among these, Baby Diapers are the leading sub-segment, driven by a high birth rate, increased awareness of child hygiene, and the growing demand for premium, skin-friendly, and eco-conscious options. The market is also witnessing rising adoption of biodegradable and plant-based diapers, reflecting a broader shift towards sustainability .

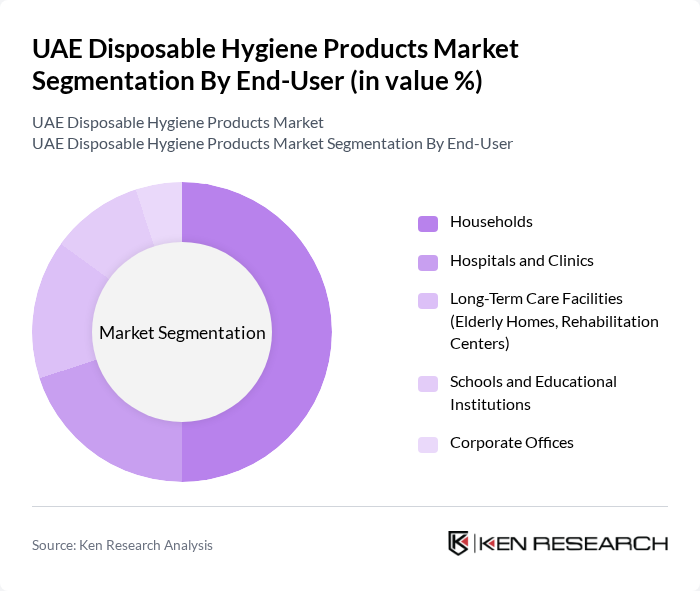

By End-User:The end-user segmentation encompasses Households, Hospitals and Clinics, Long-Term Care Facilities (Elderly Homes, Rehabilitation Centers), Schools and Educational Institutions, and Corporate Offices. Households represent the largest segment, driven by the increasing number of families, heightened hygiene awareness, and the expanding range of disposable hygiene products available through both traditional and online retail channels. The convenience and variety offered by modern retail formats further reinforce the dominance of this segment .

The UAE Disposable Hygiene Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Pampers, Always), Kimberly-Clark Corporation (Huggies, Kotex), Unicharm Corporation (MamyPoko, Sofy), Essity AB (Libero, TENA), Johnson & Johnson (Carefree, o.b.), Hengan International Group Company Limited, Fine Hygienic Holding (Fine Baby, Fine Guard), Hayat Kimya Sanayi A.?. (Molfix, Molped), Ontex Group (Canbebe, Serenity), Pigeon Corporation, Medline Industries, LP, Corman S.p.A., Abena Group, Attends Healthcare Products, Inc., Private Label Brands (Carrefour, Lulu, Union Coop) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE disposable hygiene products market appears promising, driven by ongoing trends towards sustainability and health consciousness. As consumers increasingly seek eco-friendly options, manufacturers are likely to innovate in product development, focusing on biodegradable materials. Additionally, the growth of e-commerce platforms is expected to enhance product accessibility, allowing brands to reach a broader audience. These factors will contribute to a dynamic market landscape, fostering growth and adaptation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Baby Diapers Adult Incontinence Products Feminine Hygiene Products (Sanitary Napkins, Tampons, Panty Liners) Wipes (Baby Wipes, Personal Wipes, Medical Wipes) Medical Hygiene Products (Disposable Gloves, Masks, Gowns, Sterilization Supplies) Tissue & Toilet Paper Others (Cotton Pads, Bed Protectors, Underpads) |

| By End-User | Households Hospitals and Clinics Long-Term Care Facilities (Elderly Homes, Rehabilitation Centers) Schools and Educational Institutions Corporate Offices |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Pharmacies and Drug Stores Convenience Stores Institutional Sales (B2B) |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | International Brands Local Brands Private Labels |

| By Packaging Type | Plastic Packaging Paper Packaging Eco-Friendly Packaging (Biodegradable, Compostable) |

| By Product Form | Disposable Reusable |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Disposable Hygiene Products | 120 | Store Managers, Category Buyers |

| Manufacturing Insights on Production Trends | 75 | Production Managers, Quality Control Officers |

| Consumer Preferences and Buying Behavior | 150 | General Consumers, Parents, Health-Conscious Shoppers |

| Distribution Channel Effectiveness | 60 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Future Outlook | 50 | Industry Experts, Market Analysts |

The UAE Disposable Hygiene Products Market is valued at approximately USD 1.1 billion, driven by factors such as increasing consumer awareness of hygiene, rising disposable incomes, and urbanization, along with the expansion of premium and eco-friendly product lines.