Region:Middle East

Author(s):Dev

Product Code:KRAB7259

Pages:92

Published On:October 2025

By Type:The bancassurance market can be segmented into various types of insurance products. The primary segments include Life Insurance, Health Insurance, Property Insurance, Liability Insurance, Travel Insurance, Investment-linked Insurance, and Others. Each of these segments caters to different consumer needs and preferences, with Life Insurance being the most sought-after due to its long-term benefits and investment potential.

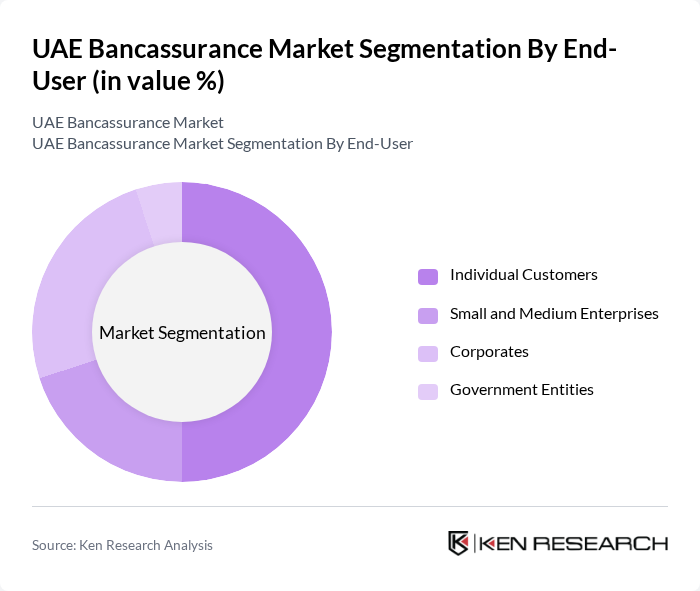

By End-User:The end-user segmentation includes Individual Customers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Customers dominate the market due to the increasing awareness of personal financial planning and the need for life and health insurance products. SMEs and Corporates also contribute significantly, as they seek comprehensive insurance solutions to protect their assets and employees.

The UAE Bancassurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank, First Abu Dhabi Bank, Mashreq Bank, Noor Bank, RAK Bank, Union Insurance, Oman Insurance Company, AXA Gulf, MetLife UAE, Zurich Insurance, Allianz, Daman, Abu Dhabi National Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE bancassurance market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms become more prevalent, banks are likely to enhance their online offerings, making insurance products more accessible. Additionally, the growing expatriate population, projected to reach 8 million in future, will further fuel demand for tailored insurance solutions. This demographic shift, combined with increased financial literacy, positions the bancassurance sector for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Liability Insurance Travel Insurance Investment-linked Insurance Others |

| By End-User | Individual Customers Small and Medium Enterprises Corporates Government Entities |

| By Distribution Channel | Bank Branches Online Platforms Financial Advisors Direct Sales |

| By Product Complexity | Simple Products Complex Products |

| By Customer Demographics | Age Group Income Level Employment Status |

| By Policy Duration | Short-term Policies Long-term Policies |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Coverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bancassurance Product Awareness | 150 | Bank Customers, Financial Advisors |

| Consumer Preferences in Insurance | 100 | Insurance Policyholders, Prospective Buyers |

| Sales Strategies of Banks | 80 | Bancassurance Managers, Sales Executives |

| Market Trends and Challenges | 70 | Industry Analysts, Regulatory Officials |

| Customer Satisfaction with Bancassurance | 90 | Existing Policyholders, Customer Service Representatives |

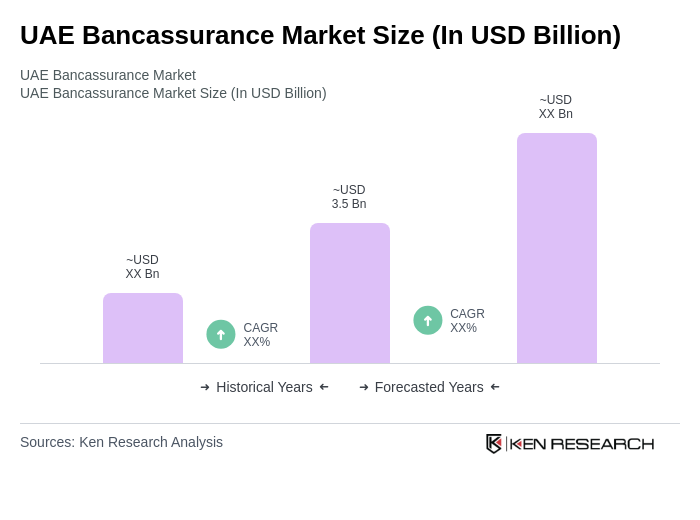

The UAE Bancassurance Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by the increasing demand for integrated financial services and rising consumer awareness of insurance benefits.