Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7317

Pages:91

Published On:October 2025

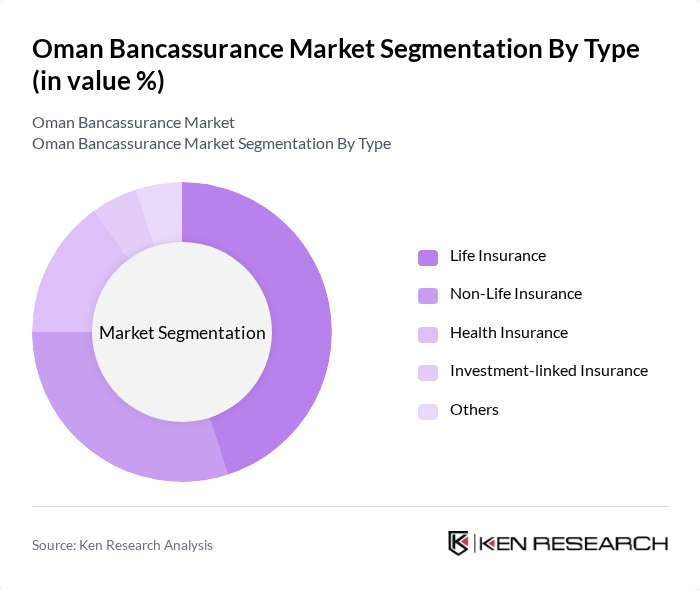

By Type:The market is segmented into various types of insurance products, including Life Insurance, Non-Life Insurance, Health Insurance, Investment-linked Insurance, and Others. Life Insurance is currently the leading segment, driven by increasing awareness of the importance of life coverage among consumers. Non-Life Insurance follows closely, supported by the growing demand for property and casualty coverage. Health Insurance is also gaining traction due to rising healthcare costs and the need for comprehensive health coverage.

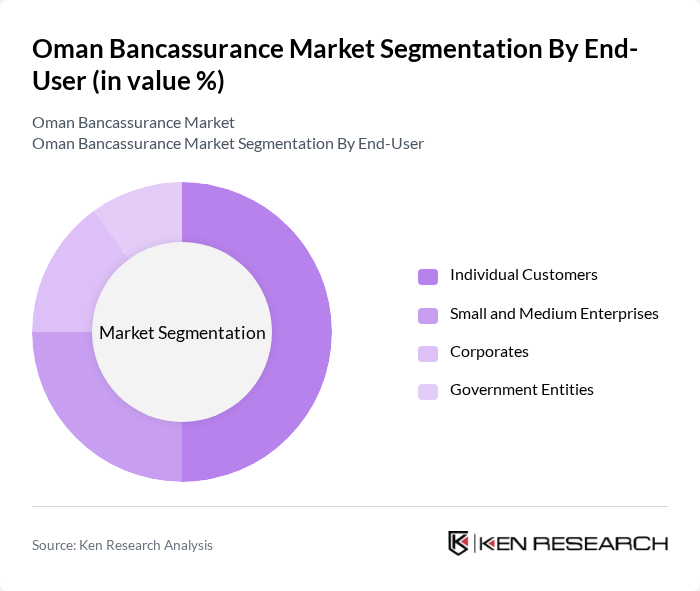

By End-User:The end-user segmentation includes Individual Customers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Customers dominate the market, driven by the increasing need for personal financial security and investment products. SMEs are also a significant segment, as they seek insurance solutions to protect their businesses and assets. Corporates and Government Entities contribute to the market through group insurance policies and employee benefits.

The Oman Bancassurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Insurance Company, Dhofar Insurance Company, Muscat Insurance Company, Al Madina Insurance Company, National Life & General Insurance Company, Oman United Insurance Company, Takaful Oman Insurance, Al Ahlia Insurance Company, Al Izz Takaful Insurance, Oman Reinsurance Company, Muscat Capital, Bank Muscat, Oman Arab Bank, HSBC Oman, Bank Dhofar contribute to innovation, geographic expansion, and service delivery in this space.

The Oman bancassurance market is poised for significant growth, driven by increasing digitalization and a focus on customer-centric services. As banks invest in technology to enhance customer experience, the integration of digital platforms will facilitate easier access to insurance products. Additionally, the collaboration between banks and fintech companies is expected to create innovative solutions that cater to the evolving needs of consumers, further propelling market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Non-Life Insurance Health Insurance Investment-linked Insurance Others |

| By End-User | Individual Customers Small and Medium Enterprises Corporates Government Entities |

| By Distribution Channel | Banks Online Platforms Insurance Agents Brokers |

| By Product Offering | Standard Insurance Products Customized Insurance Solutions Bundled Financial Services |

| By Customer Segment | Retail Customers High Net-Worth Individuals Institutional Clients |

| By Policy Duration | Short-term Policies Long-term Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bancassurance Product Awareness | 150 | Bank Customers, Insurance Policyholders |

| Consumer Preferences in Insurance | 100 | Potential Insurance Buyers, Financial Advisors |

| Sales Channel Effectiveness | 80 | Bancassurance Sales Agents, Bank Branch Managers |

| Market Trends and Insights | 70 | Insurance Executives, Financial Analysts |

| Regulatory Impact Assessment | 60 | Regulatory Officials, Compliance Officers |

The Oman Bancassurance Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the integration of banking and insurance services and increased consumer awareness of financial products.