Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6055

Pages:90

Published On:December 2025

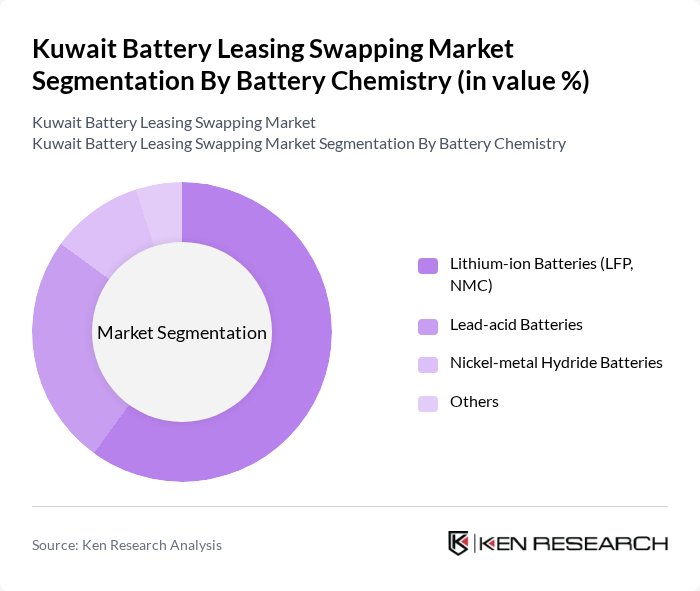

By Battery Chemistry:The battery chemistry segment includes various types of batteries used in electric vehicles and energy storage systems. The subsegments are Lithium-ion Batteries (LFP, NMC), Lead-acid Batteries, Nickel-metal Hydride Batteries, and Others. Lithium-ion batteries are leading the market for EV applications in Kuwait due to their high energy density, longer lifespan, fast-charging capability, and suitability for high ambient temperatures when combined with thermal management systems, making them the preferred choice for most modern electric passenger vehicles, buses, and commercial fleets. Lead-acid and nickel?metal hydride batteries retain a role in auxiliary systems, legacy hybrids, and certain stationary storage or backup applications but are being gradually overshadowed by lithium-ion technologies in new mobility projects.

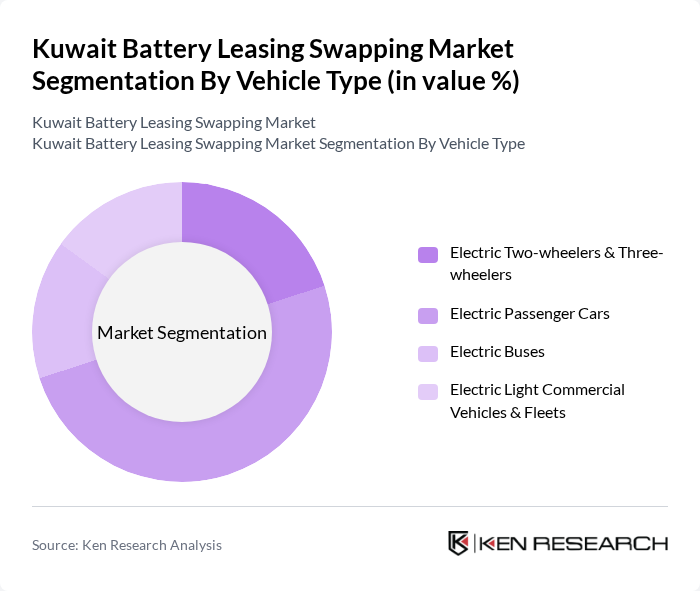

By Vehicle Type:This segment categorizes the market based on the types of electric vehicles utilizing battery leasing and swapping services. The subsegments include Electric Two-wheelers & Three-wheelers, Electric Passenger Cars, Electric Buses, and Electric Light Commercial Vehicles & Fleets. In Kuwait’s broader EV market, passenger vehicles account for the dominant share of EV adoption, supported by higher consumer awareness, home and destination charging in residential and commercial districts, and the appeal of performance and technology features. Electric buses and light commercial fleets are gaining strategic interest for future electrification of public transport and logistics, aligning with national decarbonization and air-quality objectives and providing a natural customer base for potential battery-as-a-service and swapping models. Two-wheelers and three-wheelers represent a smaller but emerging segment, particularly for last?mile delivery and service fleets, where rapid turnaround and lower operating costs make leasing and swapping concepts commercially attractive.

The Kuwait Battery Leasing Swapping Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Automotive Imports Co. (KAICO), Ali Alghanim & Sons Automotive, Al-Sayer Group Holding, Mohammed Naser Al-Sayer & Sons (Toyota Kuwait), Gulf Energy Solutions Co., National Technology Enterprises Company (NTEC), Ministry of Electricity, Water & Renewable Energy (MEWRE), Kuwait, Kuwait National Petroleum Company (KNPC), Public Transport Company of Kuwait (CityBus), Kuwait Public Transport Company (KPTC), Gulf Bank – Sustainable Mobility Financing Programs, Kuwait Finance House – Green & EV Financing Solutions, Zain Kuwait – Connected Mobility & IoT Solutions, Huawei Kuwait – EV Charging & Energy Management Solutions, ABB Kuwait – EV Charging and Power Infrastructure contribute to innovation, geographic expansion, financing mechanisms, and the deployment of charging and future battery-as-a-service infrastructure in this space.

The future of the battery leasing and swapping market in Kuwait appears promising, driven by increasing electric vehicle adoption and supportive government policies. As infrastructure expands and technology improves, the market is likely to witness significant growth. The integration of smart grid technologies and the rise of shared mobility services will further enhance operational efficiency and consumer convenience. These trends indicate a shift towards a more sustainable transportation ecosystem, positioning Kuwait as a potential leader in the region's electric mobility landscape.

| Segment | Sub-Segments |

|---|---|

| By Battery Chemistry | Lithium-ion Batteries (LFP, NMC) Lead-acid Batteries Nickel-metal Hydride Batteries Others |

| By Vehicle Type | Electric Two-wheelers & Three-wheelers Electric Passenger Cars Electric Buses Electric Light Commercial Vehicles & Fleets |

| By User Segment | Individual EV Owners Fleet Operators (Ride-hailing, Delivery, Logistics) Corporate & Industrial Campuses Government & Municipal Fleets |

| By Service Type | Battery Leasing (Battery-as-a-Service) Battery Swapping Services Integrated Charging & Swapping Packages Energy Storage & Second-life Battery Services |

| By Business Model | Subscription-based Leasing Pay-per-swap / Pay-per-use Revenue-share Partnerships with OEMs & Fleet Operators Hybrid & White-label Operator Models |

| By Station Type | Fixed Swapping Stations Mobile / Modular Swapping Units Depot-based Fleet Swapping Hubs Retail & Fuel-station Co-located Stations |

| By Charging & Power Level | Low & Medium Power Swapping (?30 kW) Fast Swapping (>30 kW) Grid-connected with Energy Management Renewable-integrated Swapping (Solar + Storage) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Leasing Companies | 60 | CEOs, Business Development Managers |

| Electric Vehicle Manufacturers | 50 | Product Managers, R&D Directors |

| Logistics Providers for Battery Swapping | 40 | Operations Managers, Supply Chain Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Consumers of Battery Leasing Services | 80 | Electric Vehicle Owners, Fleet Managers |

The Kuwait Battery Leasing Swapping Market is valued at approximately USD 55 million, reflecting the growth driven by the increasing adoption of electric vehicles and the demand for efficient energy and charging solutions.