Region:Middle East

Author(s):Shubham

Product Code:KRAD5366

Pages:92

Published On:December 2025

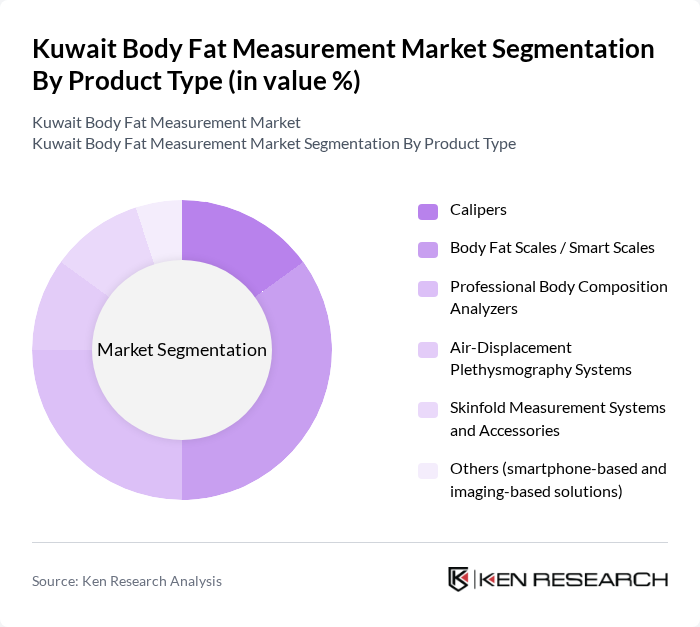

By Product Type:The product type segmentation includes various tools and devices used for measuring body fat. The subsegments are Calipers, Body Fat Scales / Smart Scales, Professional Body Composition Analyzers, Air-Displacement Plethysmography Systems, Skinfold Measurement Systems and Accessories, and Others (smartphone-based and imaging-based solutions). This structure is consistent with the major global product categories for body fat measurement devices, which typically include calipers, bioimpedance-based scales and analyzers, air displacement plethysmography, and imaging-based solutions. Among these, Body Fat Scales / Smart Scales are leading the market due to their accessibility, integration with mobile applications, and user-friendly features, appealing to both fitness enthusiasts and casual users in home and gym environments.

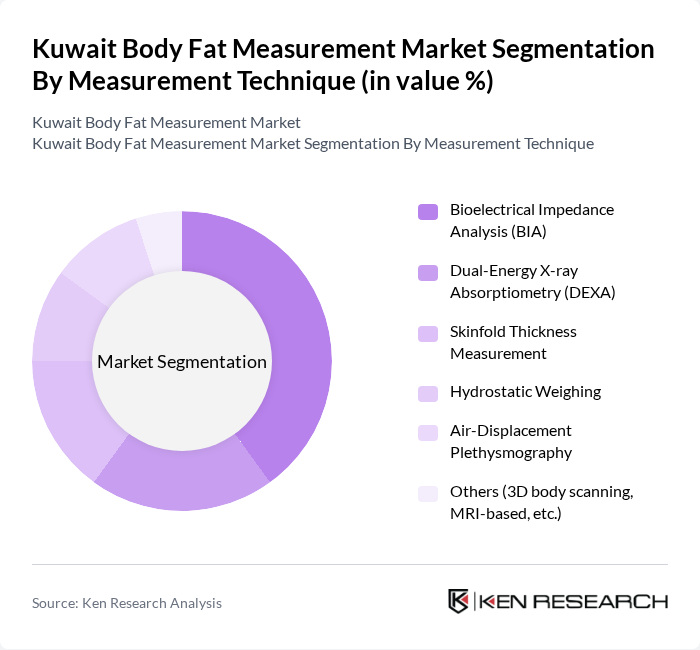

By Measurement Technique:This segmentation focuses on the various techniques employed to measure body fat. The subsegments include Bioelectrical Impedance Analysis (BIA), Dual-Energy X-ray Absorptiometry (DEXA), Skinfold Thickness Measurement, Hydrostatic Weighing, Air-Displacement Plethysmography, and Others (3D body scanning, MRI-based, etc.). These categories align with standard clinical and commercial techniques recognized in the global body fat measurement market. Bioelectrical Impedance Analysis (BIA) is the most widely used technique due to its non-invasive nature, relatively low cost, and ease of use, making it popular in both clinical and home settings and reflected in global reports that identify BIA-based devices as the largest and fastest-growing segment.

The Kuwait Body Fat Measurement Market is characterized by a dynamic mix of regional and international players. Leading participants such as InBody Co., Ltd., Tanita Corporation, Omron Healthcare, Inc., Seca GmbH & Co. KG, Bodystat Limited, Xiaomi Corporation, Withings SA, Garmin Ltd., Fitbit LLC (Google LLC), iHealth Labs, Inc., Polar Electro Oy, Schiller AG, ACCUFITNESS, LLC, Boditrak / BodyMetrix (IntelaMetrix, Inc.), Local and Regional Distributors (e.g., Gulf Medical Co. Kuwait, Al Shamel Medical & Lab Equipment Co.) contribute to innovation, geographic expansion, and service delivery in this space, consistent with the list of prominent global body fat measurement and body composition device manufacturers identified in international market reports.

The future of the Kuwait body fat measurement market appears promising, driven by increasing health consciousness and technological advancements. As the population becomes more aware of obesity-related health risks, demand for accurate body fat measurement solutions is expected to rise. Additionally, the integration of these devices with mobile health applications will enhance user engagement and monitoring capabilities, fostering a more health-oriented culture in Kuwait. The market is poised for growth as these trends continue to evolve.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Calipers Body Fat Scales / Smart Scales Professional Body Composition Analyzers Air-Displacement Plethysmography Systems Skinfold Measurement Systems and Accessories Others (smartphone?based and imaging?based solutions) |

| By Measurement Technique | Bioelectrical Impedance Analysis (BIA) Dual-Energy X-ray Absorptiometry (DEXA) Skinfold Thickness Measurement Hydrostatic Weighing Air-Displacement Plethysmography Others (3D body scanning, MRI-based, etc.) |

| By End-User | Fitness Centers and Gymnasiums Hospitals and Specialist Clinics Diagnostic and Body Composition Centers Home Users Corporate and Institutional Wellness Programs Others |

| By Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Fitness Level (Beginner, Intermediate, Advanced) BMI / Risk Category (Normal, Overweight, Obese) Others |

| By Distribution Channel | Online Retail and E-commerce Platforms Offline Retail (Pharmacies, Health & Electronics Stores) Direct Institutional / B2B Sales Distributor and Dealer Network Others |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Al Jahra Governorate Mubarak Al-Kabeer Governorate |

| By Application | Preventive Health Monitoring Fitness and Weight Management Tracking Clinical and Diagnostic Assessment Sports Performance and Athlete Monitoring Research and Academic Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Center User Insights | 150 | Gym Members, Personal Trainers |

| Healthcare Professional Feedback | 100 | Doctors, Nutritionists |

| Consumer Attitudes Towards Body Fat Measurement | 120 | Health-Conscious Individuals, Fitness Enthusiasts |

| Retailer Sales Data Collection | 80 | Store Managers, Sales Representatives |

| Market Trend Analysis | 90 | Industry Analysts, Market Researchers |

The Kuwait Body Fat Measurement Market is valued at approximately USD 8 million, reflecting a growing demand for body composition and fat measurement devices driven by health awareness and rising obesity rates among the population.