Region:Middle East

Author(s):Shubham

Product Code:KRAD6737

Pages:82

Published On:December 2025

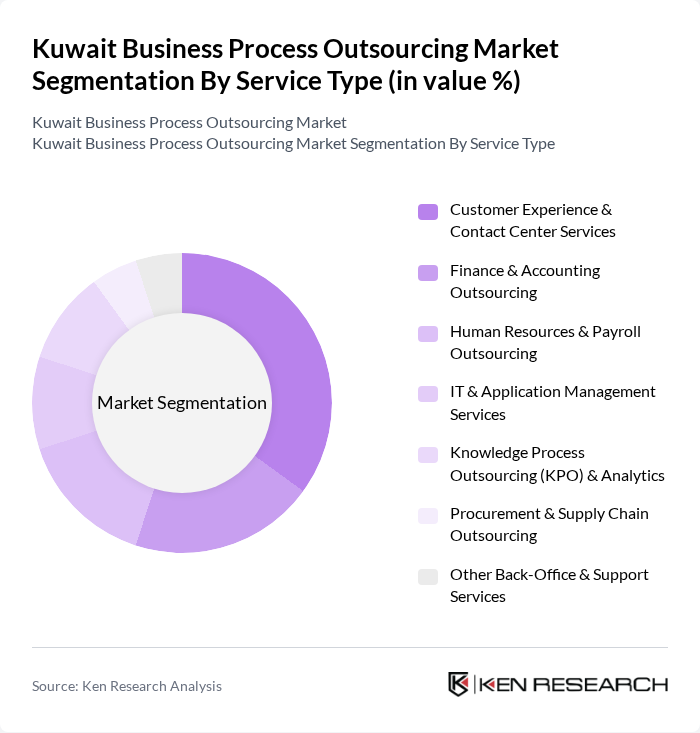

By Service Type:The service type segmentation includes various subsegments such as Customer Experience & Contact Center Services, Finance & Accounting Outsourcing, Human Resources & Payroll Outsourcing, IT & Application Management Services, Knowledge Process Outsourcing (KPO) & Analytics, Procurement & Supply Chain Outsourcing, and Other Back-Office & Support Services. Among these, Customer Experience & Contact Center Services is the leading subsegment, driven by the increasing demand for enhanced customer engagement and support solutions. Companies are increasingly investing in these services to improve customer satisfaction and retention.

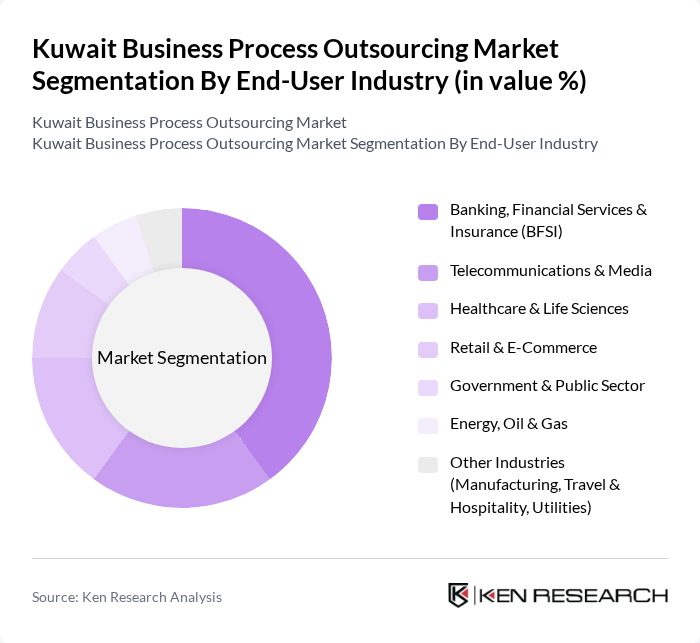

By End-User Industry:The end-user industry segmentation encompasses Banking, Financial Services & Insurance (BFSI), Telecommunications & Media, Healthcare & Life Sciences, Retail & E-Commerce, Government & Public Sector, Energy, Oil & Gas, and Other Industries. The BFSI sector is the most significant contributor to the BPO market, as financial institutions increasingly rely on outsourcing to enhance operational efficiency and comply with regulatory requirements. The growing complexity of financial services has led to a surge in demand for specialized BPO solutions.

The Kuwait Business Process Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Business Machines (GBM Kuwait), Zain Group (Zain Kuwait), Ooredoo Kuwait, VFS Global Kuwait, Agility Logistics Parks & Agility Outsourcing Services, KPMG Safi Al?Mutawa & Partners (KPMG in Kuwait), Ernst & Young Al Aiban, Al Osaimi & Partners (EY Kuwait), Deloitte & Touche (Al?Fahad, Al?Wazzan & Co.) – Deloitte Kuwait, PwC Kuwait (PricewaterhouseCoopers Kuwait), IBM Kuwait, Accenture Middle East – Kuwait Operations, Infosys – Kuwait & GCC Delivery, Wipro Limited – Kuwait & Middle East Operations, Cognizant Technology Solutions – Kuwait Clients, TATA Consultancy Services (TCS) – Kuwait & GCC Operations contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait BPO market appears promising, driven by ongoing digital transformation and the increasing adoption of remote work models. As businesses continue to prioritize customer experience and operational efficiency, the demand for innovative outsourcing solutions is expected to rise. Additionally, the integration of AI and automation technologies will likely enhance service delivery, enabling BPO providers to offer more value-added services. This evolving landscape presents opportunities for growth and expansion, particularly for firms that can adapt to changing client needs and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Customer Experience & Contact Center Services Finance & Accounting Outsourcing Human Resources & Payroll Outsourcing IT & Application Management Services Knowledge Process Outsourcing (KPO) & Analytics Procurement & Supply Chain Outsourcing Other Back?Office & Support Services |

| By End?User Industry | Banking, Financial Services & Insurance (BFSI) Telecommunications & Media Healthcare & Life Sciences Retail & E?Commerce Government & Public Sector Energy, Oil & Gas Other Industries (Manufacturing, Travel & Hospitality, Utilities) |

| By Outsourcing Type | Onshore / Domestic Outsourcing (Within Kuwait) Nearshore Outsourcing (GCC & MENA Providers) Offshore Outsourcing (Asia, Europe & Other Regions) Hybrid / Multishore Delivery |

| By Delivery Model | On?site / Dedicated Captive Centers Remote / Cloud?Enabled Delivery Hybrid Delivery (On?site + Remote) Work?From?Home / Virtual Contact Center Model |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Start?ups & Digital?Native Firms |

| By Contract Type | Long?Term Managed Services Contracts Project?Based Outsourcing Transaction?Based / Pay?Per?Use Outsourcing Outcome?Based / Gain?Sharing Contracts |

| By Service Criticality | Front?Office / Customer?Facing Processes Middle?Office Processes Back?Office Processes Mission?Critical & Regulated Processes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Services Outsourcing | 120 | IT Managers, CTOs, Business Analysts |

| Customer Support Services | 100 | Customer Service Managers, Call Center Supervisors |

| HR and Recruitment Process Outsourcing | 90 | HR Directors, Recruitment Managers |

| Finance and Accounting Outsourcing | 80 | Finance Managers, CFOs, Accountants |

| Marketing and Sales Support Services | 110 | Marketing Directors, Sales Managers, Business Development Executives |

The Kuwait Business Process Outsourcing market is valued at approximately USD 1.1 billion, reflecting a significant segment of the broader Middle East and Africa BPO market, which is valued at around USD 14.7 billion.