Region:Middle East

Author(s):Shubham

Product Code:KRAD7850

Pages:93

Published On:December 2025

By Type:

The segmentation by type includes various subsegments such as Customer Care & Contact Center Services, IT & Application Outsourcing, Human Resources & Talent Outsourcing, Finance, Accounting & Payroll Services, Knowledge Process Outsourcing (KPO) & Analytics, and Procurement, Facilities & Other Back-office Services. Among these, Customer Care & Contact Center Services is the leading subsegment in terms of revenue, supported by strong demand for omnichannel customer experience, inbound and outbound contact management, and government-citizen interaction services. The rise of e-commerce, digital banking, and online public services has further fueled the growth of this segment, as companies and government entities prioritize 24/7 customer engagement, Arabic–English bilingual support, and quality assurance.

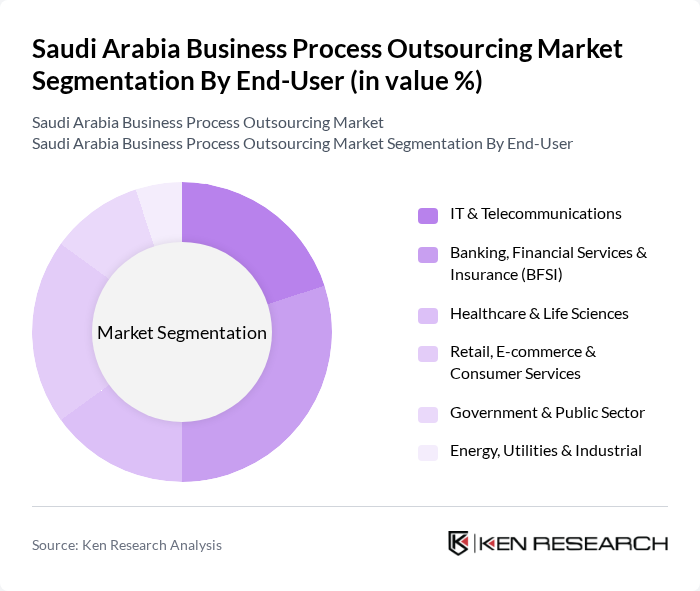

By End-User:

The end-user segmentation encompasses IT & Telecommunications, Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Retail, E-commerce & Consumer Services, Government & Public Sector, and Energy, Utilities & Industrial. IT & Telecommunications and BFSI together account for a substantial share of BPO spending in Saudi Arabia, with IT & Telecommunications emerging as the largest revenue contributor in many industry assessments due to heavy outsourcing of network operations, technical support, and application services. The BFSI sector remains a key end-user, as financial institutions increasingly outsource customer service, collections, back-office processing, and compliance-related functions to enhance operational efficiency and align with regulatory requirements issued by the Saudi Central Bank and other authorities. Growing adoption of digital banking, fintech partnerships, and data analytics further drives the demand for specialized outsourcing in this sector.

The Saudi Arabia Business Process Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Riyadh Frontline Contact Center (RFCC), Smart Link BPO Solutions, Silah Gulf (Saudi Operations), Ejada Systems Company Ltd., National Unified Contact Center (Amer 19911 & Government CX), Mobily InfoTech / Mobily Contact Center Services, STC Solutions & Contact Center Operations, Elm Company, TCS Saudi Arabia (Tata Consultancy Services Saudi Ltd.), Wipro Arabia Ltd., Accenture Saudi Arabia, IBM Saudi Arabia, Genpact (Saudi Delivery Operations), HCLTech Saudi Arabia, Capgemini Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian BPO market appears promising, driven by technological advancements and government support. As businesses increasingly recognize the value of outsourcing, particularly in enhancing operational efficiency, the market is likely to witness significant growth. The integration of AI and automation will further streamline processes, while strategic partnerships with local firms will enhance service delivery. Additionally, the rise of e-commerce and digital services will create new avenues for BPO providers, positioning them favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Customer Care & Contact Center Services IT & Application Outsourcing Human Resources & Talent Outsourcing Finance, Accounting & Payroll Services Knowledge Process Outsourcing (KPO) & Analytics Procurement, Facilities & Other Back-office Services |

| By End-User | IT & Telecommunications Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Retail, E-commerce & Consumer Services Government & Public Sector Energy, Utilities & Industrial |

| By Region | Central Region (Including Riyadh) Eastern Region (Including Dammam, Khobar & Dhahran) Western Region (Including Jeddah, Makkah & Madinah) Southern & Northern Regions |

| By Service Model | Captive (In-house Shared Services) Third-party Contract-based BPO Hybrid & Managed Services |

| By Industry Vertical | BFSI IT, Telecom & Technology Healthcare, Pharma & Medtech Retail, Travel & Hospitality Public Sector & Others |

| By Delivery Channel | Voice (Inbound & Outbound) Email & Ticket-based Support Live Chat & Messaging Support Social Media & Digital Engagement Self-service, Automation & Omnichannel Platforms |

| By Client Size | SMEs Large Enterprises Public Sector Entities Multinational Corporations (MNCs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Services Outsourcing | 120 | IT Managers, CIOs, Project Leads |

| Customer Support BPO | 100 | Customer Service Managers, Operations Directors |

| Finance and Accounting Outsourcing | 90 | Finance Directors, Accounting Managers |

| Human Resource Outsourcing | 80 | HR Managers, Talent Acquisition Specialists |

| Healthcare BPO Services | 70 | Healthcare Administrators, Compliance Officers |

The Saudi Arabia Business Process Outsourcing market is valued at approximately USD 1.4 billion, driven by the demand for cost-effective solutions, technological advancements, and digital transformation across various sectors.