Region:Middle East

Author(s):Dev

Product Code:KRAA8269

Pages:86

Published On:November 2025

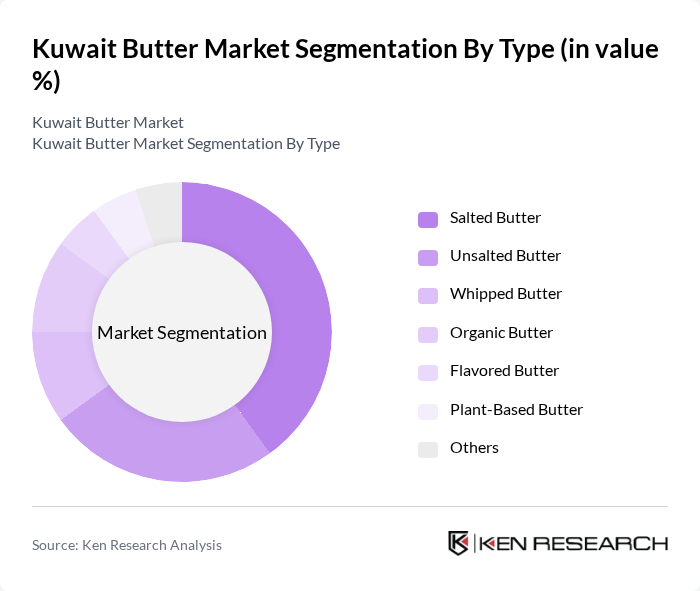

By Type:The butter market can be segmented into various types, including Salted Butter, Unsalted Butter, Whipped Butter, Organic Butter, Flavored Butter, Plant-Based Butter, and Others. Among these, Salted Butter is the most popular choice among consumers due to its flavor enhancement properties, making it a staple in many households and foodservice establishments. Unsalted Butter is also gaining traction, particularly among health-conscious consumers and bakers who prefer to control salt levels in their recipes. The demand for Organic and Plant-Based Butter is on the rise, reflecting a shift towards healthier and more sustainable options.

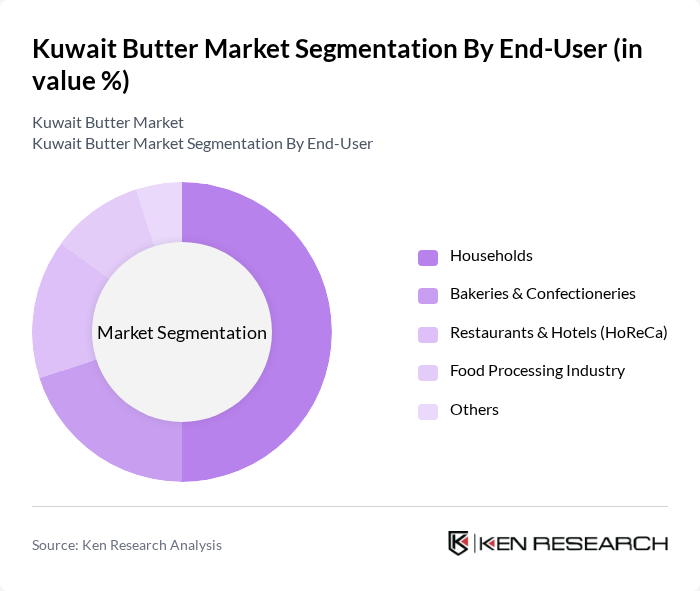

By End-User:The butter market is segmented by end-user into Households, Bakeries & Confectioneries, Restaurants & Hotels (HoReCa), Food Processing Industry, and Others. Households represent the largest segment, driven by the increasing use of butter in everyday cooking and baking. The HoReCa sector is also significant, as restaurants and hotels utilize butter extensively in their culinary offerings. The growing trend of home baking has further boosted the demand from households, while the food processing industry continues to seek high-quality butter for various products.

The Kuwait Butter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Kuwait Dairy Company (KDC/Alban Dairy), Kuwait Danish Dairy Company (KDD), SADAFCO (Saudia Dairy & Foodstuff Company), Al Safat Fresh Dairy Co., NADA Dairy (Al-Othman Group Holding Co.), Balade Farms LLC, Al Faisaliah Group (NADEC), Kuwait United Dairy Company, Al Jazeera Dairy, Al Muhalab Dairy, Al Qabas Dairy, Al Masafi Dairy, Al Sultan Dairy, Al Mahabba Dairy contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait butter market is poised for significant growth, driven by increasing health consciousness and a rising demand for dairy products. As consumers seek premium and organic options, the market is likely to see a shift towards high-quality butter offerings. Additionally, the expansion of e-commerce platforms will facilitate easier access to diverse butter products, enhancing consumer choice. The food service sector's growth will further bolster demand, creating a favorable environment for butter producers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Salted Butter Unsalted Butter Whipped Butter Organic Butter Flavored Butter Plant-Based Butter Others |

| By End-User | Households Bakeries & Confectioneries Restaurants & Hotels (HoReCa) Food Processing Industry Others |

| By Packaging Type | Tubs Sticks Pouches Bulk Packaging Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Foodservice Distributors Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Jahra Governorate Others |

| By Price Range | Premium Mid-range Economy Others |

| By Product Form | Block Butter Spreadable Butter Clarified Butter (Ghee) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Butter Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Butter | 120 | Household Consumers, Health-Conscious Shoppers |

| Dairy Product Distribution | 80 | Logistics Coordinators, Distribution Managers |

| Market Trends in Organic Butter | 60 | Health Food Store Owners, Organic Product Buyers |

| Impact of Pricing on Butter Sales | 60 | Pricing Analysts, Marketing Managers |

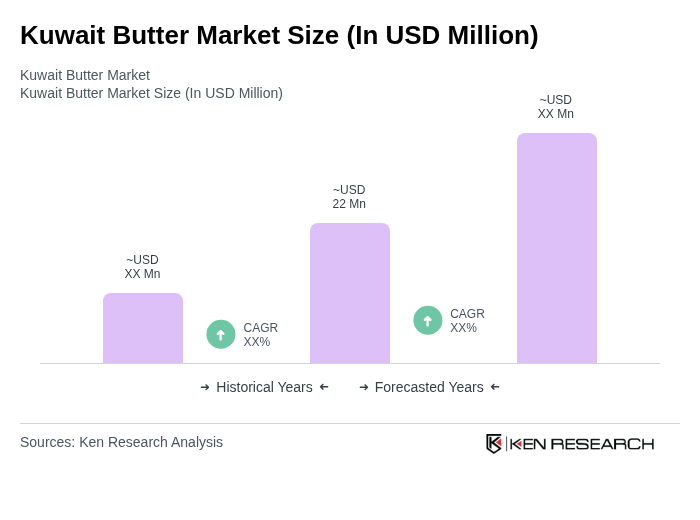

The Kuwait Butter Market is valued at approximately USD 22 million, reflecting recent declines due to changing consumer preferences and competition from plant-based alternatives. However, growth is supported by rising demand for premium dairy products.