Region:Global

Author(s):Geetanshi

Product Code:KRAD1239

Pages:90

Published On:November 2025

By Type:The cheese market is segmented into various types, including Cheddar, Mozzarella, Parmesan, Feta, Blue Cheese, Cream Cheese, Processed Cheese, Goat Cheese, Ricotta, and Others (e.g., Gouda, Swiss, Paneer, Roquefort). Among these, Cheddar and Mozzarella are the most popular due to their versatility in cooking, snacking, and use in fast-food and quick-service restaurant menus. Cheddar is favored for its sharp flavor and broad utility in both home and food service, while Mozzarella is a staple in Italian cuisine and global pizza consumption. Premium and specialty cheeses, including artisanal varieties, are also seeing increased demand due to consumer interest in unique flavors and health-oriented options.

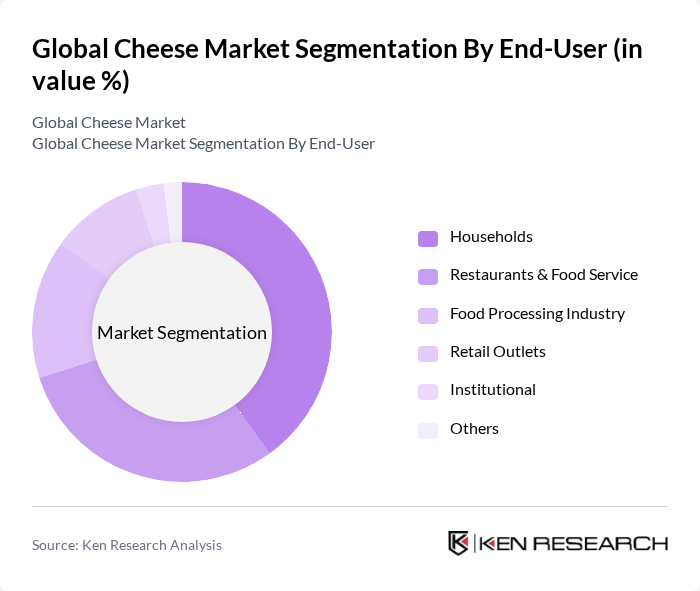

By End-User:The cheese market is segmented by end-user into Households, Restaurants & Food Service, Food Processing Industry, Retail Outlets, Institutional (e.g., Schools, Hospitals), and Others. Households represent the largest segment, driven by the increasing popularity of cheese in everyday cooking, snacking, and health-oriented diets. The food service sector is also significant, as restaurants, cafes, and quick-service outlets continue to incorporate cheese into their menus, driving overall demand. The food processing industry is expanding its use of cheese in ready-to-eat meals, snacks, and convenience foods, reflecting broader consumer trends toward convenience and premiumization.

The Global Cheese Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lactalis Group, Dairy Farmers of America, Fonterra Co-operative Group, Arla Foods, The Kraft Heinz Company, Bel Group, Saputo Inc., FrieslandCampina, Parmalat S.p.A. (Lactalis Group), Schreiber Foods, Agropur Cooperative, Murray Goulburn Co-operative Co. Limited, Emmi Group, TINE SA, Savencia Fromage & Dairy, Sargento Foods Inc., Meiji Holdings Co., Ltd., Bongrain S.A. (Savencia), Land O'Lakes, Inc., Hochland SE contribute to innovation, geographic expansion, and service delivery in this space.

The cheese market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. Innovations in cheese production, such as the development of plant-based and functional cheese products, are expected to gain traction. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to diverse cheese varieties. As health-conscious consumers continue to seek nutritious options, the demand for organic and specialty cheeses is likely to rise, shaping the future landscape of the cheese industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Cheddar Mozzarella Parmesan Feta Blue Cheese Cream Cheese Processed Cheese Goat Cheese Ricotta Others (e.g., Gouda, Swiss, Paneer, Roquefort) |

| By End-User | Households Restaurants & Food Service Food Processing Industry Retail Outlets Institutional (e.g., Schools, Hospitals) Others |

| By Packaging Type | Blocks Slices Shredded Spreadable Cubes Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Foodservice/HoReCa Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, Italy, UK, Netherlands, Others) Asia-Pacific (China, Japan, India, Australia, Others) Latin America (Brazil, Argentina, Others) Middle East & Africa (South Africa, GCC, Others) |

| By Flavor | Mild Sharp Spicy Herb-Infused Smoked Others |

| By Price Range | Economy Mid-Range Premium Luxury Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cheese Production Insights | 60 | Dairy Farmers, Cheese Producers |

| Retail Cheese Sales Analysis | 50 | Retail Managers, Category Buyers |

| Consumer Cheese Preferences | 100 | Cheese Consumers, Food Enthusiasts |

| Distribution Channel Effectiveness | 40 | Logistics Managers, Supply Chain Analysts |

| Market Trends and Innovations | 45 | Food Industry Experts, Market Analysts |

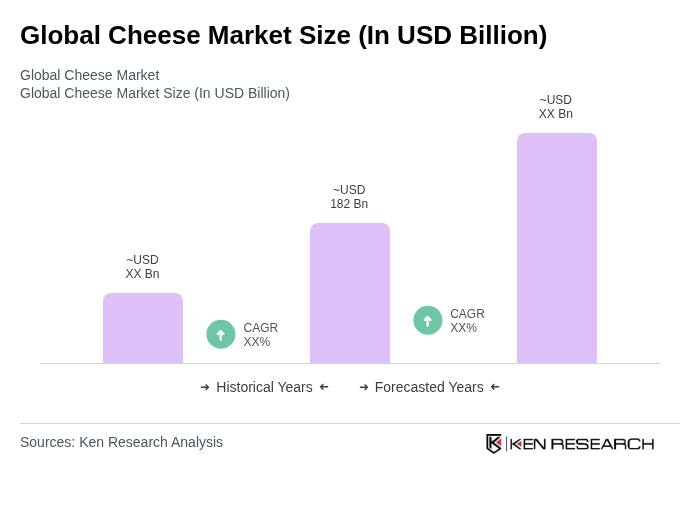

The Global Cheese Market is valued at approximately USD 182 billion, reflecting significant growth driven by increasing consumer demand for diverse cheese varieties and the expansion of the food service industry.