Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4138

Pages:86

Published On:December 2025

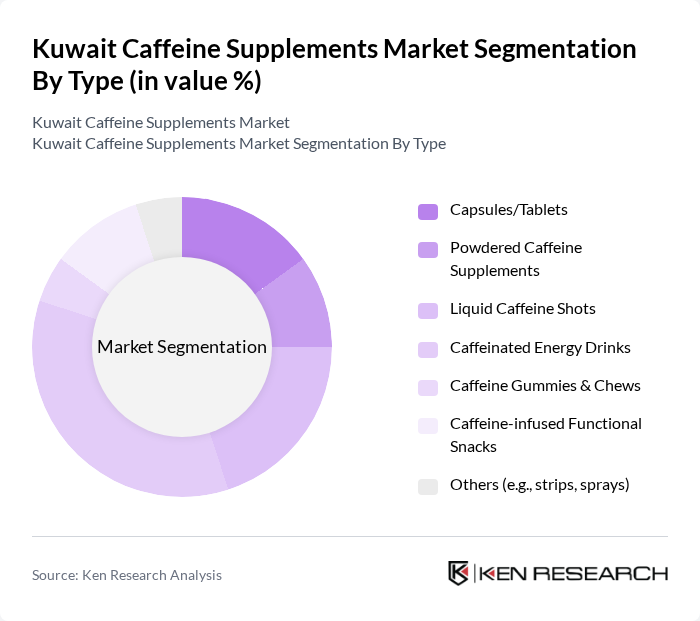

By Type:The market is segmented into various types of caffeine supplements, including Capsules/Tablets, Powdered Caffeine Supplements, Liquid Caffeine Shots, Caffeinated Energy Drinks, Caffeine Gummies & Chews, Caffeine-infused Functional Snacks, and Others (e.g., strips, sprays). Among these, Caffeinated Energy Drinks are the most popular due to their convenience and immediate energy boost, appealing to a wide range of consumers from athletes to busy professionals. The trend towards on-the-go consumption has significantly influenced the demand for this sub-segment.

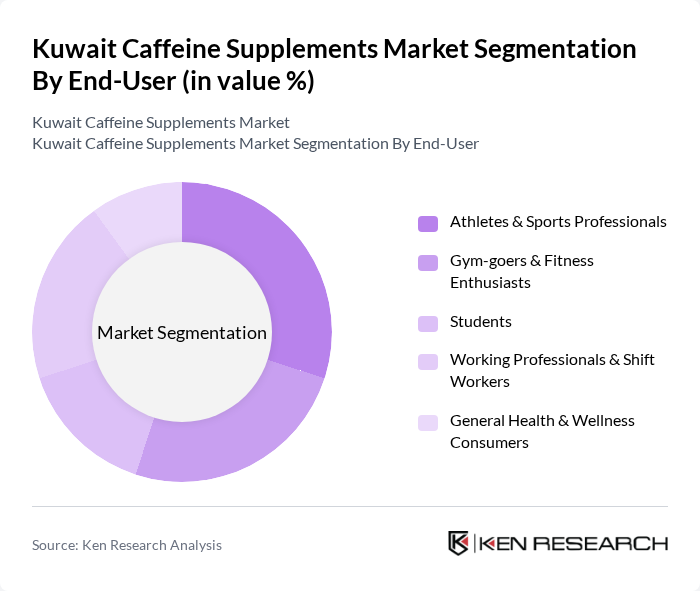

By End-User:The end-user segmentation includes Athletes & Sports Professionals, Gym-goers & Fitness Enthusiasts, Students, Working Professionals & Shift Workers, and General Health & Wellness Consumers. Athletes and sports professionals dominate the market as they seek performance enhancement and recovery benefits from caffeine supplements. The increasing participation in sports and fitness activities has led to a higher demand for these products among this demographic.

The Kuwait Caffeine Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optimum Nutrition (Glanbia Performance Nutrition), Cellucor (C4 Energy) – Nutrabolt, MuscleTech (Iovate Health Sciences), BSN – Bio-Engineered Supplements and Nutrition, Inc., GNC Holdings, LLC, Herbalife Nutrition Ltd., Red Bull GmbH, Monster Beverage Corporation, Starbucks Corporation (Ready-to-drink and functional coffee beverages), 5-hour Energy (Living Essentials LLC), Zipfizz Corporation, Al Nasser Sports Center Co. (Distributor of sports nutrition and energy products in Kuwait), Sultan Center Food Products Co. K.S.C.C. (Modern trade retailer for supplements and energy products in Kuwait), Kuwait Danish Dairy Company (KDD) – caffeinated and energy beverage offerings, Carrefour Kuwait (Majid Al Futtaim Hypermarkets – channel partner for global caffeine supplement brands) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the caffeine supplements market in Kuwait appears promising, driven by evolving consumer preferences and lifestyle changes. As health consciousness continues to rise, there is a notable shift towards natural and organic caffeine sources, aligning with global sustainability trends. Additionally, the increasing penetration of e-commerce platforms is expected to enhance product accessibility, allowing brands to reach a broader audience. These factors will likely foster innovation and diversification within the market, creating new growth avenues.

| Segment | Sub-Segments |

|---|---|

| By Type | Capsules/Tablets Powdered Caffeine Supplements Liquid Caffeine Shots Caffeinated Energy Drinks Caffeine Gummies & Chews Caffeine-infused Functional Snacks Others (e.g., strips, sprays) |

| By End-User | Athletes & Sports Professionals Gym-goers & Fitness Enthusiasts Students Working Professionals & Shift Workers General Health & Wellness Consumers |

| By Distribution Channel | Online Retail & Marketplaces Supermarkets/Hypermarkets Specialty Nutrition & Health Stores Pharmacies & Drugstores Gyms, Fitness Centers & Other |

| By Packaging Type | Bottles Blister Packs Tubs & Jars Sachets & Stick Packs Others |

| By Consumer Demographics | Age Group (18–24, 25–34, 35–44, 45+) Gender (Male, Female) Income Level (Low, Medium, High) Nationality (Kuwaiti, Expatriate) |

| By Formulation | Natural Caffeine (e.g., coffee bean, guarana, tea) Synthetic Caffeine Blended Formulations with Other Actives Sugar-free & Low-calorie Formulations |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya, Al Jahra & Mubarak Al-Kabeer |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of Caffeine Supplements | 150 | Health-conscious individuals, Fitness enthusiasts |

| Retail Insights on Caffeine Products | 100 | Store Managers, Product Buyers |

| Expert Opinions on Health Trends | 50 | Nutritionists, Dietitians, Health Coaches |

| Market Trends in Fitness Centers | 80 | Gym Owners, Personal Trainers |

| Regulatory Perspectives on Supplements | 40 | Health Policy Makers, Regulatory Officials |

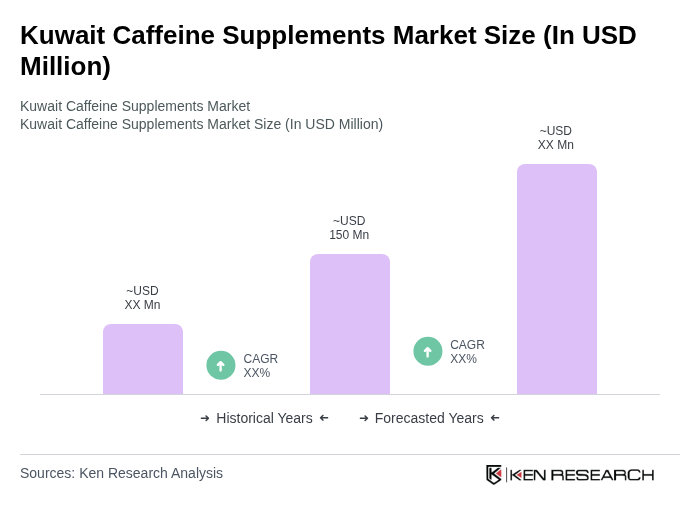

The Kuwait Caffeine Supplements Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing health consciousness and the rising popularity of energy drinks and supplements among various demographics.