Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4186

Pages:94

Published On:December 2025

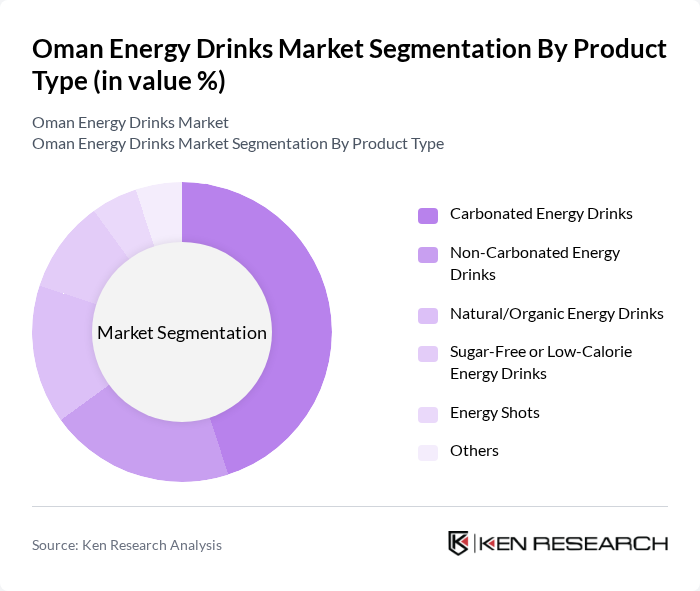

By Product Type:The energy drinks market can be segmented into various product types, including Carbonated Energy Drinks, Non-Carbonated Energy Drinks, Natural/Organic Energy Drinks, Sugar-Free or Low-Calorie Energy Drinks, Energy Shots, and Others. This structure is consistent with regional and global energy drink categorizations. Among these, Carbonated Energy Drinks are currently leading the market due to their popularity among consumers seeking refreshing and energizing beverages and the strong brand equity of leading global brands. The trend towards healthier options has also led to a rise in demand for Natural/Organic and Sugar-Free variants, appealing to health-conscious consumers who are increasingly looking for reduced-sugar, organic, and functional formulations.

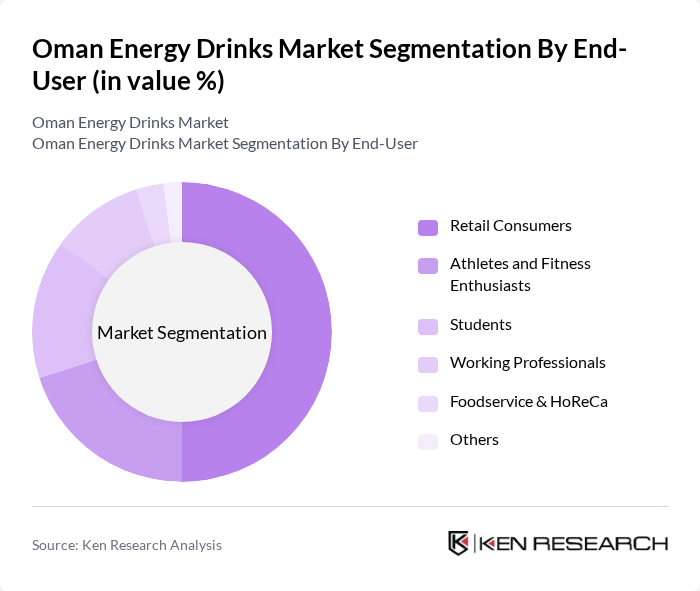

By End-User:The end-user segmentation includes Retail Consumers, Athletes and Fitness Enthusiasts, Students, Working Professionals, Foodservice & HoReCa, and Others. Retail Consumers dominate the market, driven by the increasing availability of energy drinks in supermarkets, hypermarkets, convenience stores, and online retail, which account for a substantial share of distribution across the Middle East and GCC. Athletes and Fitness Enthusiasts are also significant consumers, as they seek energy drinks to enhance performance, endurance, and post-workout recovery, supported by the growing fitness culture, gym memberships, and participation in sports activities in Oman and the wider GCC. The growing trend of fitness and wellness among the youth, combined with demanding academic and work schedules for students and working professionals, further supports this segment's growth as they turn to energy drinks for convenient energy and focus.

The Oman Energy Drinks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc. (Rockstar Energy, Sting), The Coca-Cola Company (Monster distribution, Burn), Hype Energy Drinks, Osra Drinks LLC (XL Energy Drink – regional licensee/distributor), Al Seer Group (Regional Distributor – Red Bull, Monster and others), Aujan Group Holding (Rani Refreshments – regional beverages portfolio), National Mineral Water Co. (Local beverage player – Oman), Oman Refreshment Company SAOG (PepsiCo franchisee – Oman), Celsius Holdings, Inc., Reign Total Body Fuel (Monster Beverage Corporation), 5-hour Energy (Living Essentials LLC), Lucozade Ribena Suntory Limited (Lucozade Energy), Other Emerging GCC & Local Energy Drink Brands contribute to innovation, geographic expansion, and service delivery in this space.

The Oman energy drinks market is poised for dynamic growth, driven by evolving consumer preferences and innovative product offerings. As health consciousness continues to rise, brands that prioritize natural ingredients and functional benefits are likely to gain traction. Additionally, the increasing penetration of e-commerce platforms will facilitate broader access to energy drinks, catering to the tech-savvy youth demographic. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to thrive in this competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Carbonated Energy Drinks Non-Carbonated Energy Drinks Natural/Organic Energy Drinks Sugar-Free or Low-Calorie Energy Drinks Energy Shots Others |

| By End-User | Retail Consumers Athletes and Fitness Enthusiasts Students Working Professionals Foodservice & HoReCa Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty & Health/Fitness Stores Petrol Stations & Forecourt Retail HoReCa and Foodservice Outlets Others |

| By Flavor Profile | Citrus Berry Tropical & Exotic Fruits Mixed Fruit Herbal & Functional Blends Others |

| By Packaging Type | Metal Cans PET Bottles Glass Bottles Multi-pack Formats Others |

| By Price Range | Economy Mid-Range Premium/Imported Others |

| By Consumer Demographics | Age Group Gender Income Level Nationality (Omani vs Expatriate) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Energy Drinks | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Distribution Insights | 80 | Retail Managers, Beverage Distributors |

| Market Trends and Innovations | 60 | Product Development Managers, Marketing Executives |

| Impact of Health Regulations | 50 | Regulatory Affairs Specialists, Industry Analysts |

| Brand Loyalty and Consumer Behavior | 100 | Brand Managers, Consumer Insights Analysts |

The Oman Energy Drinks Market is valued at approximately USD 15 million, reflecting a growing demand for functional beverages, particularly among the youth and working professionals seeking energy boosts and health benefits.