Region:Middle East

Author(s):Dev

Product Code:KRAC8667

Pages:93

Published On:November 2025

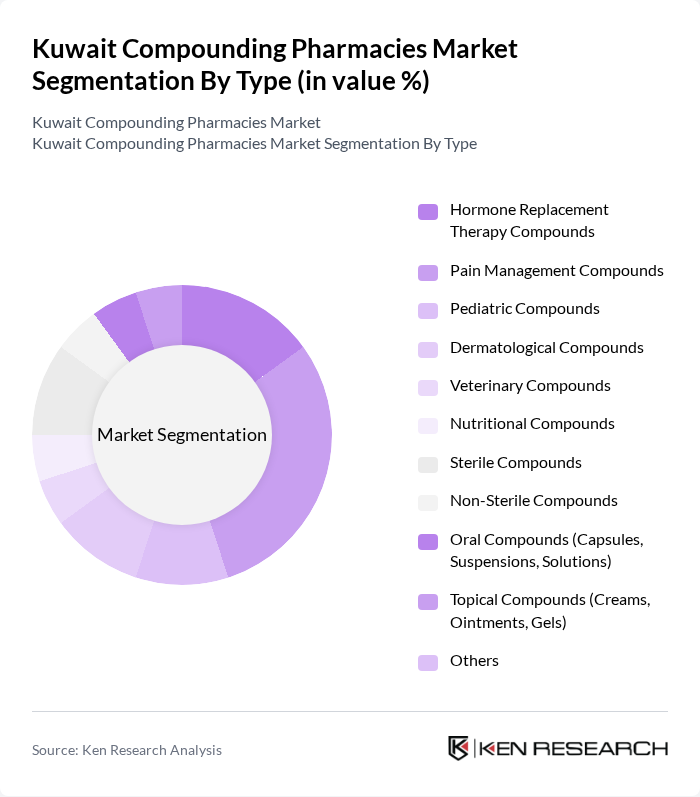

By Type:The compounding pharmacy market is segmented into various types, including Hormone Replacement Therapy Compounds, Pain Management Compounds, Pediatric Compounds, Dermatological Compounds, Veterinary Compounds, Nutritional Compounds, Sterile Compounds, Non-Sterile Compounds, Oral Compounds (Capsules, Suspensions, Solutions), Topical Compounds (Creams, Ointments, Gels), and Others. Among these, Pain Management Compounds are currently leading the market due to the rising prevalence of chronic pain conditions and the increasing demand for customized pain relief solutions. The growing awareness of the benefits of personalized medicine is also contributing to the expansion of this segment.

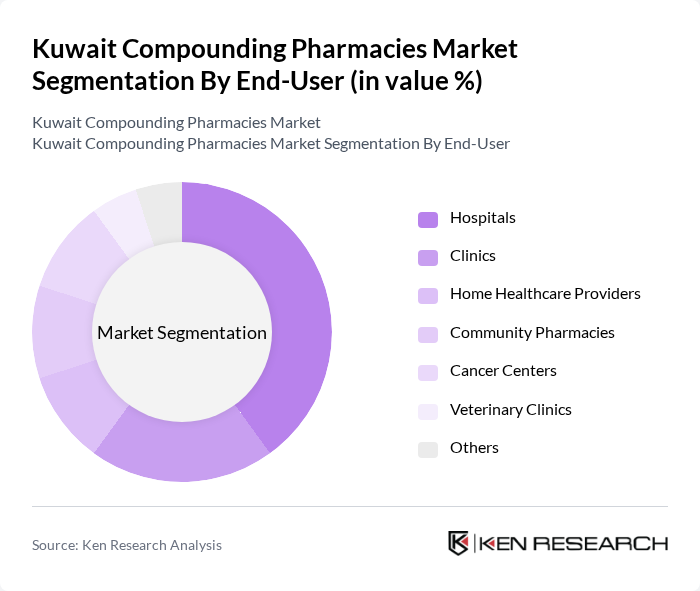

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare Providers, Community Pharmacies, Cancer Centers, Veterinary Clinics, and Others. Hospitals are the leading end-user segment, driven by the increasing number of surgical procedures and the need for customized medications for patients with specific health conditions. The demand for compounded medications in hospitals is further fueled by the growing trend of personalized medicine and the need for tailored therapeutic solutions.

The Kuwait Compounding Pharmacies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Pharmacy, Al-Diwan Pharmacy, Al-Mohalab Pharmacy, Al-Salam Pharmacy, Al-Bahar Pharmacy, Al-Mansour Pharmacy, Al-Jazeera Pharmacy, Al-Faisal Pharmacy, Al-Hadi Pharmacy, Al-Nasr Pharmacy, Al-Razi Pharmacy, Al-Safa Pharmacy, Al-Majed Pharmacy, Al-Qabas Pharmacy, Al-Muheet Pharmacy, YIACO Medical Company, Pharmazone Pharmacy, City Pharmacy Co., Al-Mutawa Pharmacy, Al-Hikma Pharmacy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait compounding pharmacies market appears promising, driven by the increasing integration of technology and a growing focus on personalized healthcare solutions. As telehealth services expand, compounded medications can be more readily prescribed, enhancing patient access. Additionally, collaborations with healthcare institutions are likely to foster innovation in compounded products, addressing specific patient needs and improving overall healthcare outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Hormone Replacement Therapy Compounds Pain Management Compounds Pediatric Compounds Dermatological Compounds Veterinary Compounds Nutritional Compounds Sterile Compounds Non-Sterile Compounds Oral Compounds (Capsules, Suspensions, Solutions) Topical Compounds (Creams, Ointments, Gels) Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Community Pharmacies Cancer Centers Veterinary Clinics Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Therapeutic Area | Oncology Cardiology Neurology Endocrinology Pain Management Dermatology Others |

| By Distribution Channel | Direct Sales Online Sales Third-Party Distributors Hospital Pharmacies Others |

| By Geographic Distribution | Urban Areas Rural Areas Others |

| By Policy Support | Subsidies for Compounding Pharmacies Tax Incentives Regulatory Support Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacists in Compounding Pharmacies | 100 | Pharmacy Owners, Lead Pharmacists |

| Healthcare Professionals Prescribing Compounded Medications | 80 | General Practitioners, Specialists |

| Patients Using Compounded Medications | 75 | Chronic Illness Patients, Pediatric Patients |

| Regulatory Experts in Pharmacy Practice | 50 | Compliance Officers, Regulatory Affairs Managers |

| Industry Experts and Analysts | 60 | Market Analysts, Healthcare Consultants |

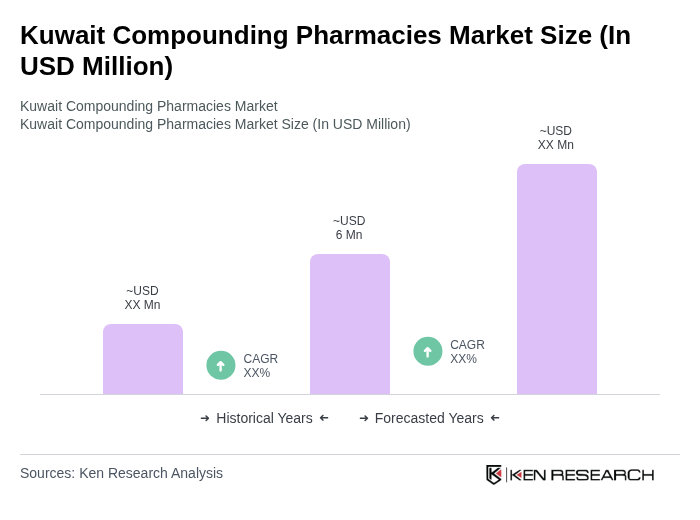

The Kuwait Compounding Pharmacies Market is valued at approximately USD 6 million, reflecting a growing demand for personalized medications and advancements in pharmaceutical technology, alongside an increasing awareness of compounded medications among healthcare providers and patients.