Region:Middle East

Author(s):Dev

Product Code:KRAD7665

Pages:94

Published On:December 2025

By Type:

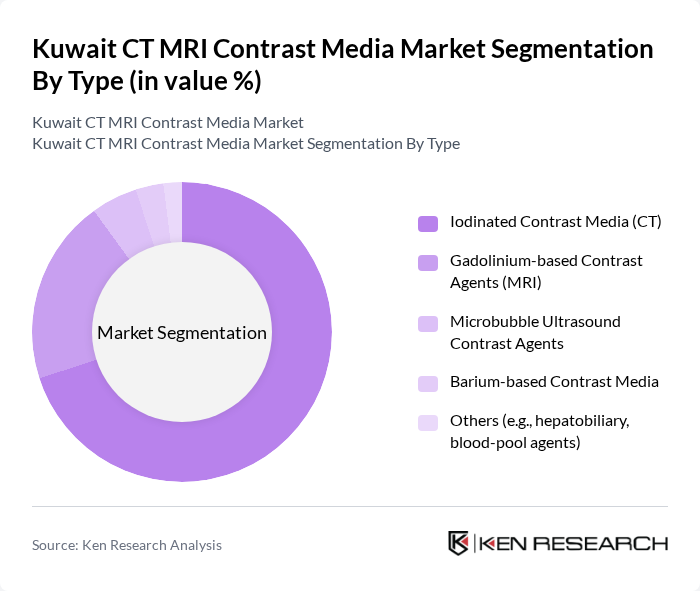

The market is segmented into various types of contrast media, including Iodinated Contrast Media (CT), Gadolinium-based Contrast Agents (MRI), Microbubble Ultrasound Contrast Agents, Barium-based Contrast Media, and Others (e.g., hepatobiliary, blood-pool agents). Among these, Iodinated Contrast Media holds a significant share due to its widespread use in CT imaging, which is commonly performed in hospitals and diagnostic centers. The increasing number of CT scans performed for various medical conditions, including trauma and cancer, drives the demand for iodinated contrast agents. Gadolinium-based agents are also gaining traction, particularly in MRI applications, as they provide high-quality imaging for neurological and vascular assessments.

By End-User:

The end-user segmentation includes Public Hospitals (MOH & Government Hospitals), Private Hospitals, Standalone Diagnostic Imaging Centers, Military & Oil-sector Medical Facilities, and Others. Public hospitals dominate the market due to their extensive patient base and the high volume of imaging procedures conducted. The government’s investment in healthcare infrastructure and the increasing number of patients seeking diagnostic services contribute to the growth of public hospitals. Private hospitals are also significant players, offering advanced imaging technologies and specialized services, which attract patients looking for quicker access to healthcare.

The Kuwait CT MRI Contrast Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, GE HealthCare Technologies Inc., Siemens Healthineers AG, Bracco Imaging S.p.A., Guerbet Group, Daiichi Sankyo Company, Limited, Lantheus Holdings, Inc., Nano Therapeutics Pvt. Ltd. (iMax Diagnostics), JB Pharmaceuticals Limited, Beijing Beilu Pharmaceutical Co., Ltd., Trivitron Healthcare Pvt. Ltd., Fresenius Kabi AG, Canon Medical Systems Corporation, Koninklijke Philips N.V. (Philips Healthcare), Fujifilm Holdings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait CT MRI contrast media market appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in imaging processes is expected to enhance diagnostic accuracy and efficiency. Additionally, the growing trend towards personalized medicine will likely lead to the development of tailored contrast agents, improving patient outcomes. As healthcare infrastructure expands, the demand for outpatient imaging services will also rise, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Iodinated Contrast Media (CT) Gadolinium-based Contrast Agents (MRI) Microbubble Ultrasound Contrast Agents Barium-based Contrast Media Others (e.g., hepatobiliary, blood-pool agents) |

| By End-User | Public Hospitals (MOH & Government Hospitals) Private Hospitals Standalone Diagnostic Imaging Centers Military & Oil-sector Medical Facilities Others |

| By Application | Oncology Imaging Neurology & Neurovascular Imaging Cardiology & Vascular Imaging Musculoskeletal Imaging Abdominal & Pelvic Imaging Others |

| By Route of Administration | Intravascular (Intravenous & Intra-arterial) Oral Intrathecal Rectal Others |

| By Distribution Channel | Direct Sales to Hospitals (Tender-based) Local Pharmaceutical & Medical Distributors Direct Import by Large Provider Groups Others |

| By Geography | Capital Region (Kuwait City) Hawalli & Farwaniya Governorates Ahmadi & Mubarak Al-Kabeer Governorates Jahra Governorate Others |

| By Patient Demographics | Pediatric Adult Geriatric High-risk / Renal-impaired Patients |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Private Clinics and Diagnostic Centers | 90 | Clinic Managers, Radiology Directors |

| Healthcare Procurement Officers | 70 | Procurement Managers, Supply Chain Coordinators |

| Medical Equipment Distributors | 60 | Sales Representatives, Product Managers |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Regulatory Experts |

The Kuwait CT MRI Contrast Media Market is valued at approximately USD 40 million, reflecting a five-year historical analysis. This valuation is influenced by the rising prevalence of chronic diseases and advancements in imaging technologies.