Region:Middle East

Author(s):Dev

Product Code:KRAD5098

Pages:91

Published On:December 2025

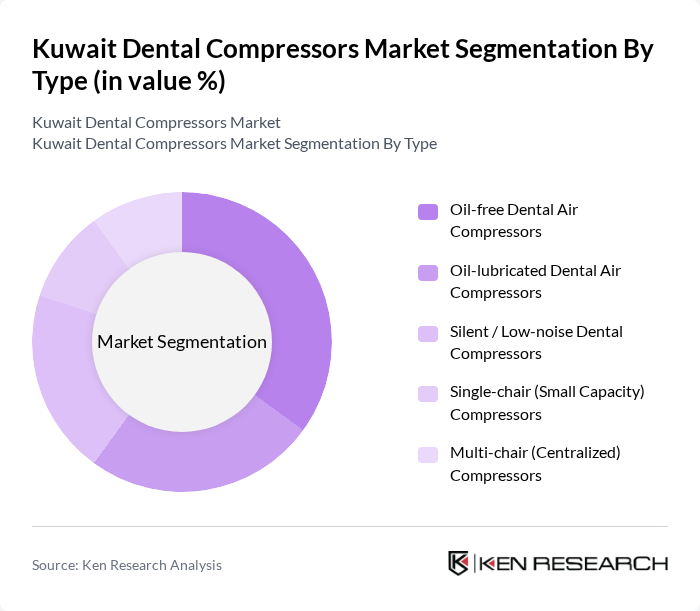

By Type:The market is segmented into various types of dental compressors, including oil-free, oil-lubricated, silent/low-noise, single-chair, and multi-chair compressors. Each type serves different needs based on the operational requirements of dental practices, with oil-free and low-noise units increasingly preferred due to infection-control, maintenance, and patient comfort considerations in modern dental clinics.

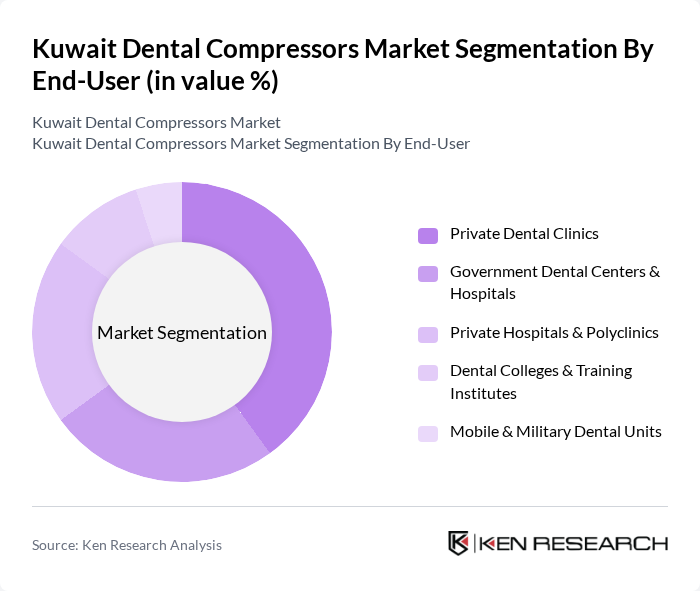

By End-User:The end-user segmentation includes private dental clinics, government dental centers and hospitals, private hospitals and polyclinics, dental colleges and training institutes, and mobile and military dental units. Each segment has unique requirements and preferences for dental compressors, with private clinics and hospitals focusing on low-noise, compact and oil-free systems, and government centers and teaching institutions emphasizing reliability, multi-chair capacity, and compliance with hygiene and energy-efficiency standards.

The Kuwait Dental Compressors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dürr Dental SE, Air Techniques Inc., Cattani S.p.A., Midmark Corporation, Kaeser Kompressoren SE (Kaeser Dental), DentalEZ Integrated Solutions, Gnatus Equipamentos Médico-Odontológicos Ltda., Aixin Medical Equipment Co., Ltd., Foshan Core Deep Medical Apparatus Co., Ltd., General Air Products, Inc., Tech West Inc., Quincy Compressor LLC, Diplomat Dental Solutions, Planmeca Oy, Local & Regional Dental Equipment Distributors in Kuwait (Al Bahar Medical, Gulf Medical, Others) contribute to innovation, geographic expansion, and service delivery in this space, in line with their global positioning in the dental compressors segment.

The future of the Kuwait dental compressors market appears promising, driven by ongoing advancements in dental technology and increasing public awareness of oral health. As the government continues to promote dental health initiatives, the demand for modern dental equipment is expected to rise. Additionally, the trend towards eco-friendly solutions and digital integration in dental practices will likely shape the market landscape, encouraging innovation and investment in sustainable dental compressors.

| Segment | Sub-Segments |

|---|---|

| By Type | Oil-free Dental Air Compressors Oil-lubricated Dental Air Compressors Silent / Low-noise Dental Compressors Single-chair (Small Capacity) Compressors Multi-chair (Centralized) Compressors |

| By End-User | Private Dental Clinics Government Dental Centers & Hospitals Private Hospitals & Polyclinics Dental Colleges & Training Institutes Mobile & Military Dental Units |

| By Application | General & Preventive Dentistry Restorative & Prosthodontic Procedures Cosmetic & Aesthetic Dentistry Orthodontics & Pediatric Dentistry Oral & Maxillofacial Surgery |

| By Distribution Channel | Direct Sales by Manufacturers Authorized Local Distributors Online B2B Platforms Regional Dental Equipment Dealers Others |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Al Ahmadi Governorate Al Farwaniya Governorate Al Jahra & Mubarak Al-Kabeer Governorates |

| By Brand Positioning | Global Premium Brands Global Value Brands Regional & Local Brands OEM / Private Label Economy Segment |

| By Technology | Desiccant-based Drying Dental Compressors Membrane-based Drying Dental Compressors Integrated Air-dryer Systems Oil-free Scroll & Rotary Technology |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private Dental Clinics | 120 | Clinic Owners, Dental Practitioners |

| Public Hospitals | 90 | Hospital Administrators, Dental Department Heads |

| Dental Equipment Suppliers | 70 | Sales Managers, Product Specialists |

| Dental Schools and Training Institutions | 60 | Program Directors, Faculty Members |

| Dental Health Regulatory Bodies | 40 | Policy Makers, Health Inspectors |

The Kuwait Dental Compressors Market is valued at approximately USD 48 million, reflecting its share within the global dental air compressors market, which is valued at around USD 396.66 million. This growth is driven by increasing dental clinics and awareness of oral health.