Oman Dental Implants Market Overview

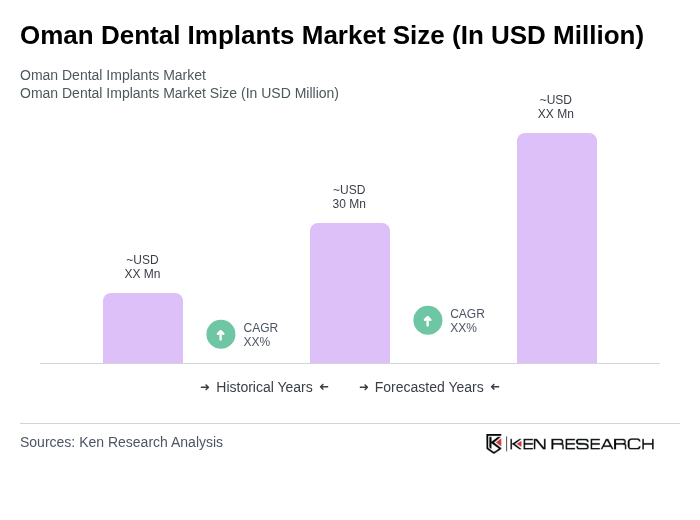

- The Oman Dental Implants Market is valued at USD 30 million, based on a five-year historical analysis. This estimate aligns with the most recent GCC dental implants market data, where Oman represents a moderate share of the region’s total value. Market growth is primarily driven by the increasing prevalence of dental diseases, rising disposable incomes, and rapid advancements in dental technology. The demand for dental implants continues to surge as more individuals seek effective solutions for tooth loss, supported by heightened awareness of oral health and the growing influence of aesthetic dentistry trends.

- Muscat, the capital city, remains the dominant market hub due to its advanced healthcare infrastructure and high concentration of dental clinics. Other significant cities include Salalah and Sohar, where ongoing urbanization and increased awareness of dental health are contributing to market expansion. The presence of skilled dental professionals and the adoption of modern implant technologies in these regions further enhance their market prominence.

- The Ministry of Health of Oman issued the “Dental Clinics and Centers Regulation, Ministerial Decision No. 24/2023,” which mandates all dental clinics to comply with strict sterilization protocols and utilize certified dental implants. This regulation requires clinics to maintain comprehensive records of sterilization procedures, ensure the traceability of implantable materials, and submit to periodic inspections to uphold patient safety and service quality standards.

Oman Dental Implants Market Segmentation

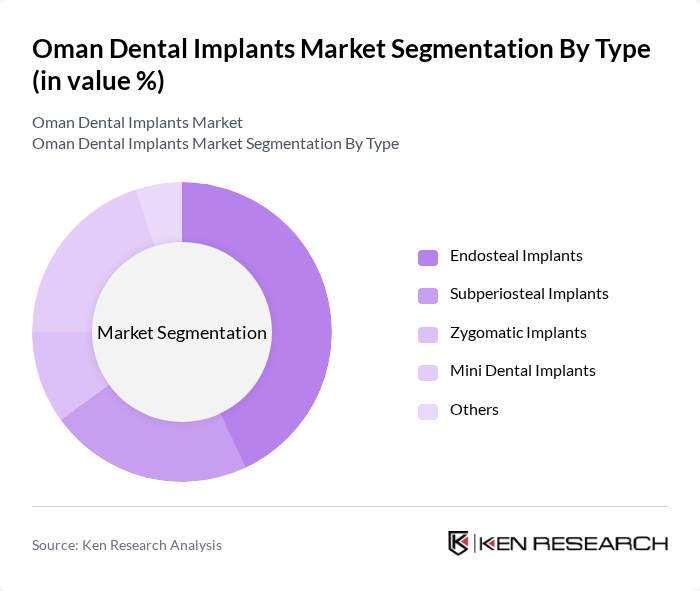

By Type:The market is segmented into various types of dental implants, including Endosteal Implants, Subperiosteal Implants, Zygomatic Implants, Mini Dental Implants, and Others.Endosteal Implantsare the most widely used, favored for their high success rates and compatibility with the jawbone. The increasing preference for these implants is driven by their durability, effectiveness in restoring dental function, and widespread adoption by dental professionals in Oman.

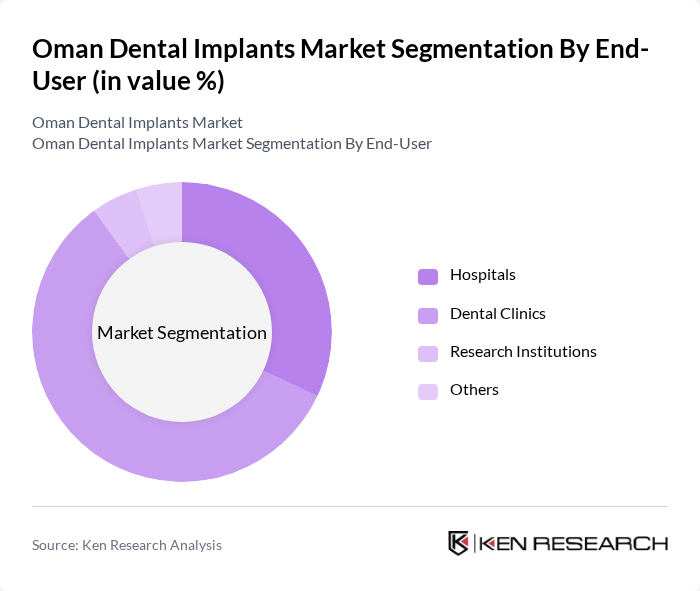

By End-User:The end-user segmentation includes Hospitals, Dental Clinics, Research Institutions, and Others.Dental Clinicsdominate the market, serving as the primary providers of dental implant procedures. The increasing number of specialized dental clinics, coupled with the expansion of private dental practices and greater patient preference for outpatient care, drives high demand for implants in this segment.

Oman Dental Implants Market Competitive Landscape

The Oman Dental Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Straumann Group, Nobel Biocare, Dentsply Sirona, Zimmer Biomet, Osstem Implant, BioHorizons, Implant Direct, Megagen, Bicon Dental Implants, Alpha-Bio Tec, Hiossen, Neodent, Dentium, 3M, Klockner, MIS Implants Technologies, Anthogyr, Camlog, and local Omani distributors contribute to innovation, geographic expansion, and service delivery in this space.

Oman Dental Implants Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Dental Disorders:The prevalence of dental disorders in Oman is significant, with approximately 65% of the population experiencing some form of dental issue. According to the World Health Organization, dental caries and periodontal diseases are among the most common conditions affecting adults. This high incidence drives demand for dental implants, as patients seek effective solutions to restore oral health and functionality, thereby boosting the market for dental implants in the region.

- Rising Awareness About Dental Aesthetics:In Oman, the growing awareness of dental aesthetics has led to an increased demand for cosmetic dental procedures, including implants. A survey by the Oman Dental Association indicated that 75% of respondents prioritize the appearance of their teeth. This trend is further supported by the rising influence of social media, where individuals showcase their smiles, prompting more people to invest in dental implants to enhance their aesthetic appeal and self-confidence.

- Advancements in Dental Implant Technology:Technological advancements in dental implants, such as the development of biocompatible materials and improved surgical techniques, have significantly enhanced the success rates of these procedures. The introduction of digital dentistry tools, including 3D imaging and computer-aided design, has streamlined the implant process. According to industry reports, these innovations have led to a 35% increase in successful implant placements, making dental implants a more attractive option for patients in Oman.

Market Challenges

- High Cost of Dental Implants:The cost of dental implants in Oman can range from OMR 900 to OMR 1,600 per implant, which poses a significant barrier for many patients. With the average monthly income in Oman being around OMR 1,300, the expense of dental implants is often prohibitive. This high cost limits access to necessary dental care, thereby hindering market growth and leading to a reliance on less effective dental solutions.

- Lack of Skilled Dental Professionals:The shortage of skilled dental professionals in Oman is a critical challenge for the dental implant market. Currently, there are only about 1,600 licensed dentists for a population of over 5 million, resulting in a dentist-to-population ratio of 1:3,125. This scarcity affects the quality of care and the availability of advanced dental procedures, including implants, ultimately limiting market expansion and patient access to necessary treatments.

Oman Dental Implants Market Future Outlook

The Oman dental implants market is poised for growth, driven by increasing consumer awareness and technological advancements. As the population ages, the demand for dental solutions will likely rise, particularly among the elderly. Additionally, the integration of digital technologies in dental practices is expected to enhance patient experiences and outcomes. With ongoing investments in healthcare infrastructure, the market is set to evolve, addressing current challenges and expanding access to dental implant procedures for a broader segment of the population.

Market Opportunities

- Expansion of Dental Tourism:Oman is emerging as a dental tourism destination, attracting international patients seeking affordable and high-quality dental care. With dental procedures costing up to 40% less than in Western countries, this trend presents a lucrative opportunity for local dental practices to cater to foreign patients, thereby boosting the overall market for dental implants.

- Increasing Investment in Dental Healthcare:The Omani government is prioritizing healthcare investments, with a projected increase of OMR 250 million in the healthcare budget for future. This funding will enhance dental facilities and training programs, creating opportunities for growth in the dental implant sector. Improved infrastructure will facilitate better access to advanced dental care, further driving market expansion.