Region:Middle East

Author(s):Geetanshi

Product Code:KRAE1222

Pages:99

Published On:December 2025

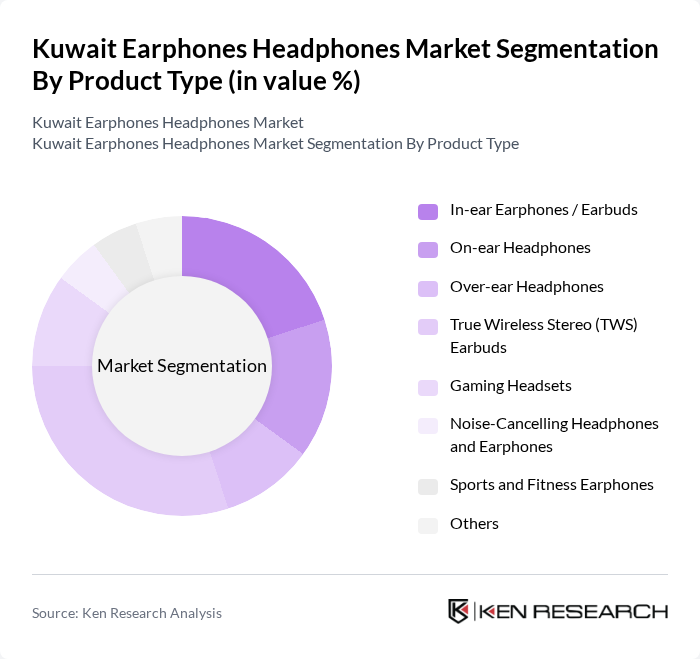

By Product Type:The product type segmentation includes various categories such as In-ear Earphones / Earbuds, On-ear Headphones, Over-ear Headphones, True Wireless Stereo (TWS) Earbuds, Gaming Headsets, Noise-Cancelling Headphones and Earphones, Sports and Fitness Earphones, and Others. Among these, True Wireless Stereo (TWS) Earbuds have emerged as the leading sub-segment due to their convenience, portability, and advancements in battery life and sound quality. The growing trend of wireless audio solutions has significantly influenced consumer preferences, making TWS earbuds a popular choice for daily use.

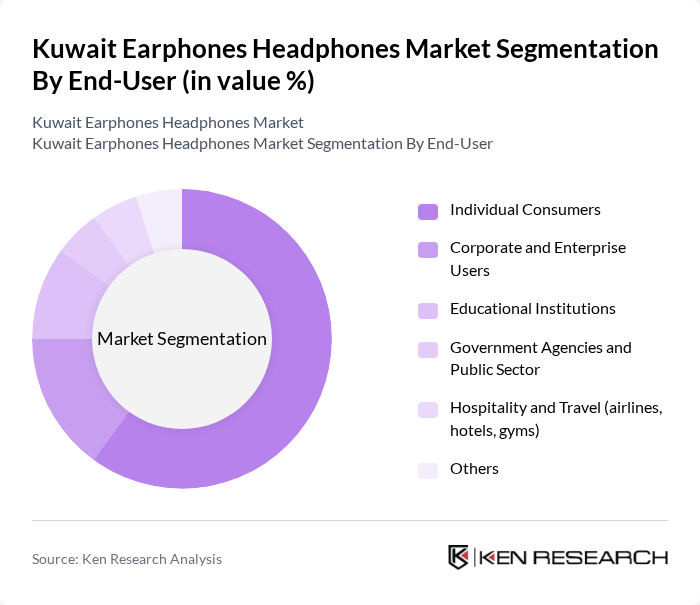

By End-User:The end-user segmentation encompasses Individual Consumers, Corporate and Enterprise Users, Educational Institutions, Government Agencies and Public Sector, Hospitality and Travel (airlines, hotels, gyms), and Others. Individual Consumers dominate the market, driven by the increasing demand for personal audio devices for entertainment and communication. The rise of remote work and online learning has further fueled the need for quality audio solutions among individual users, making this segment the largest contributor to market growth.

The Kuwait Earphones Headphones Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc. (AirPods), Samsung Electronics Co., Ltd. (Galaxy Buds), Sony Group Corporation, Bose Corporation, Sennheiser electronic GmbH & Co. KG, JBL (Harman International Industries, Inc.), Huawei Technologies Co., Ltd., Xiaomi Corporation, Anker Innovations Limited (Soundcore), Skullcandy Inc., Razer Inc., Logitech International S.A. (Logitech, Astro), Philips (TP Vision / Koninklijke Philips N.V.), Jabra (GN Audio A/S), Lenovo Group Limited (including Motorola-branded audio) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait earphones and headphones market appears promising, driven by technological advancements and changing consumer preferences. As the market shifts towards sustainable products, brands are likely to invest in eco-friendly materials and manufacturing processes. Additionally, the integration of artificial intelligence in audio devices is expected to enhance user experience, making products more appealing. The rise of subscription-based audio services will also create new revenue streams, further stimulating market growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Product Type | In-ear Earphones / Earbuds On-ear Headphones Over-ear Headphones True Wireless Stereo (TWS) Earbuds Gaming Headsets Noise-Cancelling Headphones and Earphones Sports and Fitness Earphones Others |

| By End-User | Individual Consumers Corporate and Enterprise Users Educational Institutions Government Agencies and Public Sector Hospitality and Travel (airlines, hotels, gyms) Others |

| By Distribution Channel | E-commerce Marketplaces Brand Online Stores Consumer Electronics Retailers Hypermarkets and Supermarkets Mobile Operator & Telecom Retail Stores Specialty Audio Stores Others |

| By Price Range | Entry-level (Mass Market) Mid-range Premium Luxury Others |

| By Connectivity | Wired Wireless (Bluetooth) True Wireless (TWS) Others |

| By Usage Occasion | Daily Commute and Travel Sports and Fitness Home Entertainment and Music Gaming and Esports Professional and Office Use Others |

| By Technology Features | Active Noise Cancellation (ANC) Passive Noise Isolation Voice Assistant Integration Water and Sweat Resistance Low-latency / Gaming Mode Fast Charging & Long Battery Life Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 60 | Store Managers, Sales Associates |

| Audio Equipment Distributors | 50 | Distribution Managers, Product Managers |

| End-User Consumers | 120 | General Consumers, Audiophiles |

| Market Analysts and Experts | 40 | Industry Analysts, Market Researchers |

| Online Retail Platforms | 50 | E-commerce Managers, Digital Marketing Specialists |

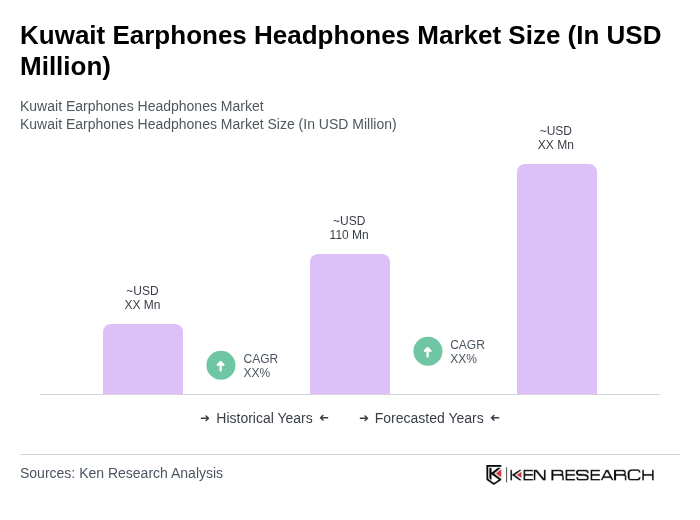

The Kuwait Earphones Headphones Market is valued at approximately USD 110 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of wireless audio devices and the demand for portable audio solutions among consumers.