Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4836

Pages:98

Published On:December 2025

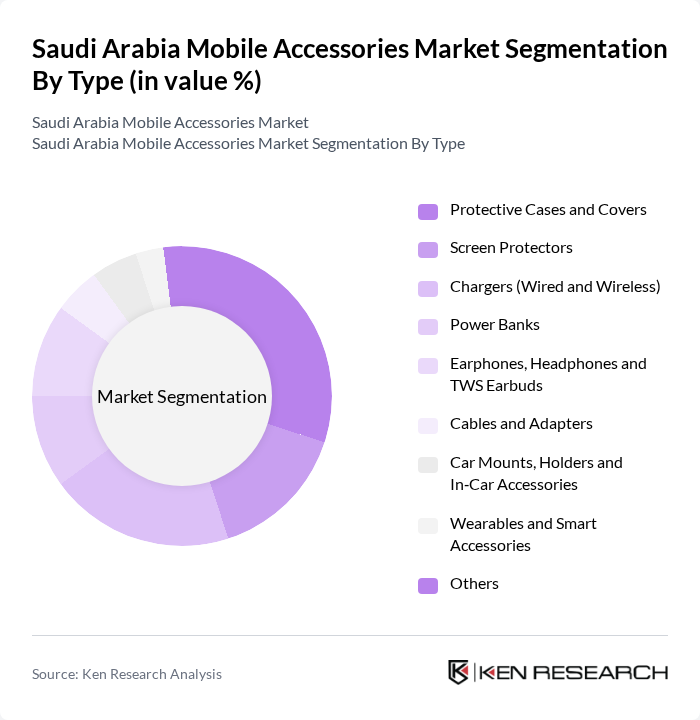

By Type:The mobile accessories market is segmented into various types, including protective cases and covers, screen protectors, chargers (wired and wireless), power banks, earphones, headphones and TWS earbuds, cables and adapters, car mounts, holders and in-car accessories, wearables and smart accessories, and others. Among these, protective cases and covers constitute one of the largest segments, supported by the widespread use of premium smartphones and increasing concern for device protection and aesthetics. Consumers are increasingly investing in high-quality cases with features such as shock absorption, MagSafe or magnetic compatibility, and transparent or designer finishes to safeguard their devices from damage while reflecting personal style, which drives sustained demand for this segment.

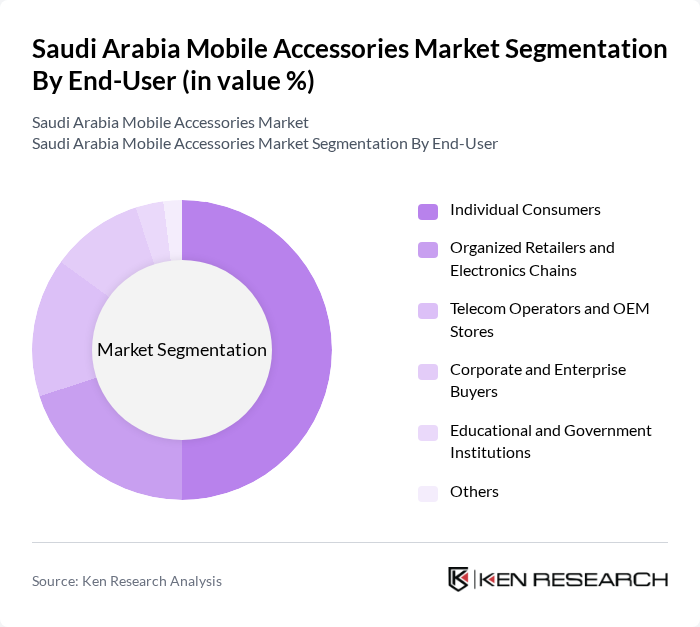

By End-User:The end-user segmentation includes individual consumers, organized retailers and electronics chains, telecom operators and OEM stores, corporate and enterprise buyers, educational and government institutions, and others. Individual consumers represent the largest segment, driven by the increasing ownership of smartphones, higher spending on premium and branded accessories, and the desire for personalized and lifestyle-oriented products such as designer cases, gaming headsets, and TWS earbuds. The rapid growth of online shopping and omnichannel retail in Saudi Arabia has also made it easier for consumers to access a wide range of products, compare prices, and benefit from same-day or next-day delivery, further boosting this segment's growth.

The Saudi Arabia Mobile Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., Apple Inc., Huawei Technologies Co., Ltd., Xiaomi Corporation, Anker Innovations Co., Ltd., Belkin International, Inc., JBL (Harman International Industries, Inc.), ZAGG Inc., Baseus (Shenzhen Baseus Technology Co., Ltd.), UGREEN Group Limited, Spigen Inc., RAVPower (Sunvalley Group), Mophie, Inc. (ZAGG Brands), Jabra (GN Audio A/S), Incase Designs Corp., Jarir Marketing Company (Jarir Bookstore), eXtra (United Electronics Company), Lulu Group International (Electronics & Mobile Accessories Division), stc Channels (Saudi Telecom Company Retail), Mobily (Etihad Etisalat Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia mobile accessories market appears promising, driven by technological advancements and evolving consumer preferences. The shift towards wireless accessories is expected to gain momentum, with sales projected to account for a substantial share of the market in future. Additionally, the integration of smart technology into accessories will likely enhance user experience, creating new avenues for growth. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Protective Cases and Covers Screen Protectors Chargers (Wired and Wireless) Power Banks Earphones, Headphones and TWS Earbuds Cables and Adapters Car Mounts, Holders and In?Car Accessories Wearables and Smart Accessories Others |

| By End-User | Individual Consumers Organized Retailers and Electronics Chains Telecom Operators and OEM Stores Corporate and Enterprise Buyers Educational and Government Institutions Others |

| By Distribution Channel | Online Marketplaces (e.g., Amazon.sa, Noon, Jarir Online) Brand and OEM E?Stores Organized Offline Retail (Jarir Bookstore, Extra, eXtra, Lulu, Carrefour, etc.) Independent Mobile Shops and Kiosks Hypermarkets & Supermarkets Wholesale and Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Positioning | Global Premium Brands Mass?Market International Brands Regional and Local Brands Private Label / Retailer Brands Unbranded / Grey Market |

| By Material Type | Plastic and Polycarbonate Silicone and TPU Leather and PU Leather Metal and Hybrid Materials Recycled and Bio?Based Materials Others |

| By Technology Integration | Standard Accessories Smart and Connected Accessories (Bluetooth, NFC, MagSafe, etc.) Fast?Charging and Wireless?Charging Accessories Gaming and Creator?Focused Accessories Eco?Friendly and Sustainable Accessories Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Mobile Accessories | 150 | Store Managers, Sales Representatives |

| Consumer Preferences for Mobile Accessories | 140 | End Users, Tech Enthusiasts |

| Distribution Channels for Mobile Accessories | 100 | Distributors, Wholesalers |

| Market Trends in Mobile Accessories | 80 | Market Analysts, Industry Experts |

| Impact of E-commerce on Mobile Accessories Sales | 120 | E-commerce Managers, Digital Marketing Specialists |

The Saudi Arabia Mobile Accessories Market is valued at approximately USD 2.3 billion, driven by factors such as increasing smartphone penetration, rising disposable incomes, and a growing trend towards mobile gaming and content creation.